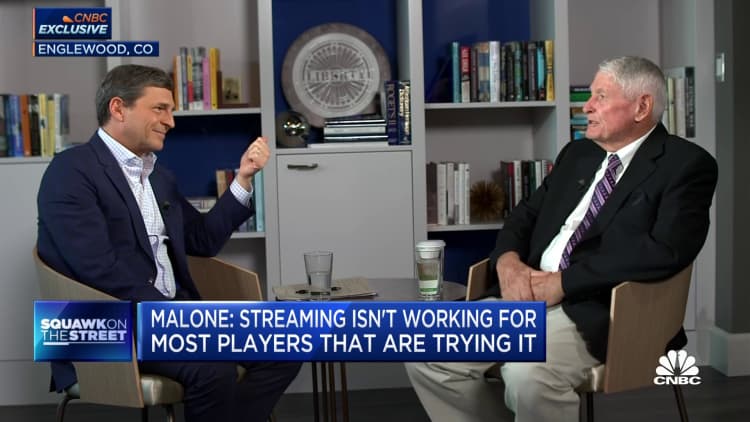

David

Zaslav,

CEO

and

president

of

Warner

Bros.

Discovery

(L),

and

John

Malone,

chairman

of

Liberty

Media,

Liberty

Global,

and

Qurate

Retail

Group.

CNBC

|

Reuters

Warner

Bros.

Discovery‘s

next

step

to

gain

scale

may

be

looking

at

distressed

assets.

Chief

Executive

David

Zaslav

and

board

member

John

Malone

both

made

comments

this

week

suggesting

the

company

is

paying

down

debt

and

building

up

free

cash

flow

to

set

up

acquisitions

in

the

next

two

years

of

media

businesses

suffering

from

diminished

valuations.

The

targets

could

be

companies

flirting

with

or

filing

for

bankruptcy,

Malone

said

in

an

exclusive

interview

with

CNBC

on

Thursday.

While

U.S.

regulators

may

frown

at

large

media

companies

coming

together

because

of

overlaps

with

studio,

cable

or

broadcasting

assets,

they’ll

be

much

more

forgiving

if

the

companies

are

struggling

to

survive,

Malone

told

David

Faber.

“I

think

we’re

going

to

see

very

serious

distress

in

our

industry,”

Malone

said.

“There

is

an

exemption

to

the

antitrust

laws

on

a

failing

business.

At

some

point

of

distress,

right,

then

some

of

the

restrictions,

they

look

the

other

way.”

Media

company

valuations

have

been

plummeting

amid

streaming

video

losses,

traditional

TV

subscriber

defections,

and

a

down

advertising

market.

This

has

affected

Warner

Bros.

Discovery

as

much

as

its

peers.

The

company’s

market

valuation

recently

fell

below

$23

billion,

its

lowest

point

since

WarnerMedia

and

Discovery

merged

last

year.

The

company

ended

the

third

quarter

with

about

$43

billion

in

net

debt.

Warner

Bros.

Discovery

is

trying

to

position

itself

to

be

an

acquirer,

rather

than

a

distressed

asset,

itself,

by

paying

down

debt

and

increasing

cash

flow,

Zaslav

said

during

his

company’s

earnings

conference

call

this

week.

Warner

Bros.

Discovery

has

paid

down

$12

billion

and

expects

to

generate

at

least

$5

billion

in

free

cash

flow

this

year,

the

company

said.

watch

now

“We’re

surrounded

by

a

lot

of

companies

that

are

–

don’t

have

the

geographic

diversity

that

we

have,

aren’t

generating

real

free

cash

flow,

have

debt

that

are

presenting

issues,”

Zaslav

said

Thursday.

“We’re

de-levering

at

a

time

when

our

peers

are

levering

up,

at

a

time

when

our

peers

are

unstable,

and

there

is

a

lot

of

excess

competitive

–

excess

players

in

the

market.

So,

this

will

give

us

a

chance

not

only

to

fight

to

grow

in

the

next

year,

but

to

have

the

kind

of

balance

sheet

and

the

kind

of

stability

…

that

we

could

be

really

opportunistic

over

the

next

12

to

24

months.”

Still,

Warner

Bros.

Discovery

also

acknowledged

it

will

miss

its

own

year-end

leverage

target

of

2.5

to

3

times

adjusted

earnings

as

the

TV

ad

market

struggles

and

linear

TV

subscription

revenue

declines.

Buying

from

distress

Malone

has

some

experience

with

profiting

from

times

of

distress.

His

Liberty

Media

acquired

a

40%

stake

in

Sirius

XM

over

several

years

more

than

a

decade

ago,

saving

it

from

bankruptcy.

Since

then,

the

equity

value

of

the

satellite

radio

company

has

bounced

back

from

nearly

zero

to

about

$5

per

share.

Sirius

XM

currently

has

a

market

capitalization

of

about

$18

billion.

“It

made

us

a

lot

of

money

with

Sirius,”

Malone

told

Faber.

While

Malone

didn’t

name

a

specific

company

as

a

target

for

Warner

Bros.

Discovery,

he

discussed

Paramount

Global

as

an

example

of

a

company

whose

prospects

seem

shaky.

Paramount

Global’s

market

valuation

has

slumped

below

$8

billion

while

carrying

about

$16

billion

in

debt.

Malone

noted

that

Paramount’s

debt

was

recently

downgraded.

“I

think

that

they’re

running

probably

negative

free

cash

flow,”

he

said.

While

Paramount

Global

shares

have

fallen

precipitously

since

Viacom

and

CBS

merged

in

2019,

there

are

signs

the

company

is

shoring

up

its

balance

sheet.

CEO

Bob

Bakish

said

earlier

this

month

Paramount

Global’s

streaming

losses

will

be

lower

in

2023

than

2022,

and

the

company

expects

further

improvement

to

losses

in

2024.

The

company

closed

a

sale

for

book

publisher

Simon

&

Schuster

for

$1.6

billion

and

will

use

the

proceeds

to

pay

down

debt.

Paramount

Global’s

fate

Shari

Redstone,

chair

of

Paramount

Global,

attends

the

Allen

&

Co.

Media

and

Technology

Conference

in

Sun

Valley,

Idaho,

on

Tuesday,

July

11,

2023.

David

A.

Grogan

|

CNBC

Paramount

Global

is

one

of

the

few

assets

that

logically

fits

Malone’s

vision

of

a

media

asset

that

would

have

regulatory

issues

as

an

acquisition

with

potential

distress

concerns.

Comcast‘s

NBCUniversal,

another

potential

merger

partner,

will

lose

more

than

$2

billion

this

year

on

its

streaming

service,

Peacock,

but

the

media

giant

is

shielded

by

its

parent

company,

the

largest

U.S.

broadband

provider.

“Warner

Bros.

[Discovery]

now

is

making

money.

Not

a

lot,

but

they’re

making

money,”

Malone

said.

“Peacock

is

losing

a

lot

of

money.

Paramount

is

losing

a

ton

of

money

that

they

can’t

afford.

At

least

[Comcast

CEO]

Brian

[Roberts]

can

afford

to

lose

the

money.”

Paramount

Global’s

controlling

shareholder

Shari

Redstone

is

open

to

a

transformative

transaction,

CNBC

reported

last

month.

Puck’s

Dylan

Byers

recently

reported

that

industry

insiders

have

speculated

Warner

Bros.

Discovery

might

pursue

an

acquisition

of

Paramount

Global

after

the

2024

U.S.

presidential

election.

A

combination

of

NBCUniversal

and

Paramount

Global

also

has

strategic

logic,

but

the

combination

of

two

national

broadcast

networks

—

Comcast’s

NBC

and

Paramount

Global’s

CBS

—

would

present

a

significant

regulatory

hurdle.

Warner

Bros.

Discovery

doesn’t

own

a

broadcast

network,

making

an

acquisition

of

CBS

easier.

Spokespeople

for

Paramount

Global

and

Warner

Bros.

Discovery

declined

to

comment.

While

Malone

said

all

legacy

media

companies

should

be

talking

to

each

other

about

merger

synergies,

he

acknowledged

valuations

may

have

to

fall

farther

to

get

regulators

on

board

with

further

consolidation.

Malone

predicted

that

could

happen

in

the

same

timeline

Zaslav

gave

—

within

the

next

two

years.

“Eventually

maybe

there’ll

be

regulatory

relief,”

Malone

said.

“Out

of

distress

usually

comes

the

reduction

in

competition,

increased

pricing

power,

and

the

opportunity

to

buy

assets

at

a

deep

discount.”

Disclosure:

Comcast

owns

NBCUniversal,

the

parent

company

of

CNBC.

Tune

in:

CNBC’s

full

interview

with

John

Malone

will

air

8

p.m.

ET

Thursday.

watch

now