Criticisms

of

the

upcoming

climate

change

summit,

known

as

COP28

are

rife.

For

one,

critics

have

seized

on

the

incongruousness

of

hosting

a

summit

aimed

at

keeping

the

world

on

the

path

to

curb

global

warming

in

a

major

oil

state. The

chief

executive

of

the

Abu

Dhabi

National

Oil

Company,

or

Adnoc,

is

even

presiding

over

the

event

itself,

and

that’s

not

even

mentioning

the

emergence

of

leaked

documents

that

suggest

the

United

Arab

Emirates

plans

to

do

oil

deals

at

the

conference.

The

result

can

only

be

tension.

But

there

are

tensions

elsewhere

too.

For

example,

the

“loss

and

damage”

fund

earmarked

for

developing

nations

hit

the

hardest

by

climate

change

is

stalled

by

disagreements.

Former

US

Vice

President

Al

Gore recently

declared that

the

“deck

[is]

stacked

against

COP28.”

Oil

Stocks

Preparing

for

a

Warmer

Future

At

the

same

time,

major

fossil

fuel

company

ExxonMobil

[XOM] recently

announced

that

it

is acquiring

Pioneer.

Likewise,

Chevron

[CVX] is buying

Hess.

These

firms

are

betting

not

only

on

continued

demand

for

oil

but

also

robust

prices –

the

estimated

breakeven

per-barrel

oil

price

to

justify

these

purchases

sits

between

$70

and

$80,

which

exceeds

Morningstar

equity

analysts’

long-term

oil

forecast

of

$60

per

barrel.

Against

that

backdrop,

it’s

no

wonder

there’s

still

debate

whether

the

conference

can

advance

its

net-zero

goal

of

keeping

the

world

on

the

path

to

limiting

global

warming

to

1.5

degrees

Celsius

by

the

end

of

the

century.

If

it

can’t,

what

might

that

portend

for

oil

supply

and

demand?

In

this

piece,

we’ll

explore

potential

alternative

scenarios

to

net

zero

and

which

oil

and

gas

companies

appear

to

be

well-prepared

for

a

warmer

future.

The

World

we

Want

vs.

The

World

as

it

Might

be

I’m

a

big

college

football

fan

and

a

proud

alumnus

of

the

University

of

Notre

Dame.

I

would

absolutely

love

to

see

Notre

Dame

win

the

national

championship.

But

I’m

also

a

realist –

the

odds

of

this

are

long

in

most

years –

so

I’m

certainly

not

willing

to

put

money

on

it.

Investing

is

similar.

After

all,

net

zero

is

a

worthy

goal,

backed

by

science,

sentiment

among

younger

generations,

and

various

stakeholder

groups.

It

offers

a

hopeful

vision

for

the

future,

and

one

that

I

share.

But

as

an

investor,

it

behooves

us

to

prepare

for

multiple

scenarios,

some

of

which

wouldn’t

meet

my

hopes.

Just

as

I

wouldn’t

bet

the

house

on

the

Fighting

Irish

to

win

it

all,

I

try

to

be

clear-eyed

about

the

different

paths

the

climate

future

could

follow

and

the

investing

implications

they

might

have.

Oil

Demand

Could

Decline

by

2050,

But

Not

by

Much

What

paths

are

we

talking

about?

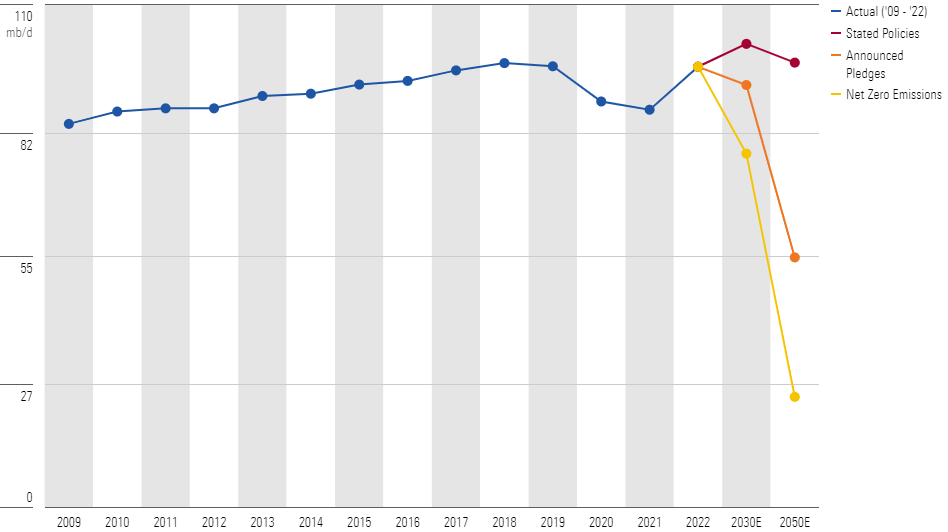

The

International

Energy

Agency’s

(IEA)

World

Energy

Outlook

presents

three

potential

scenarios

for

global

energy:

1.

Net-zero

emissions,

which

predicts

a

massive

fall

in

oil

demand

and

resulting

carbon

output

by

2050;

2.

Governments’

current

stated

energy

policies,

which

predicts

a

smaller

fall

in

oil

demand;

3.

Nations’

announced

pledges,

which

is

a

middle

ground

between

the

first

two.

The

IEA

also

notes

the

Net

Zero

Emissions

pathway

would

limit

global

warming

to

below

1.5

degrees

Celsius

by

2100

but

also

cautions

this

scenario

has

become

less

likely

in

recent

years.

The

Announced

Pledges

scenario

is

estimated

to

lead

to

1.7

degrees

of

warming,

while

the

Stated

Policies

outlook

is

set

to

lift

temperatures

2.4

degrees.

Why

don’t

these

pathways

paint

a

rosier

picture?

In

a

word:

demand.

To

be

sure,

the

IEA’s

most

recent

outlook

estimated

2030

demand

of

77.5

to

101.5

million

barrels

per

day,

which

at

the

midpoint

would

represent

a

roughly

7%

decline

from

last

year’s

level.

But

the

top

end

of

the

range

still

suggests

growth.

And

by

2050,

the

IEA

projects

minimal

declines,

with

demand

of

97.4

million

barrels

per

day

slightly

exceeding

the

96.5

million

barrels

per

day

demanded

in

2022.

In

other

words,

despite

many

stakeholders’

pledges

to

reduce

carbon

emissions

and

oil

usage,

limited

political

willpower –

alongside

resistance

from

oil

and

gas

producers –

make

it

unlikely

that

net

zero

will

be

achieved.

Consequently,

investors

should

be

willing

to

reconsider

companies

in

the

oil

value

chain

that

were

previously

thought

to

be

unprepared

for

a

future

in

which

oil

demand

would

decline

substantially

to

meet

net

zero.

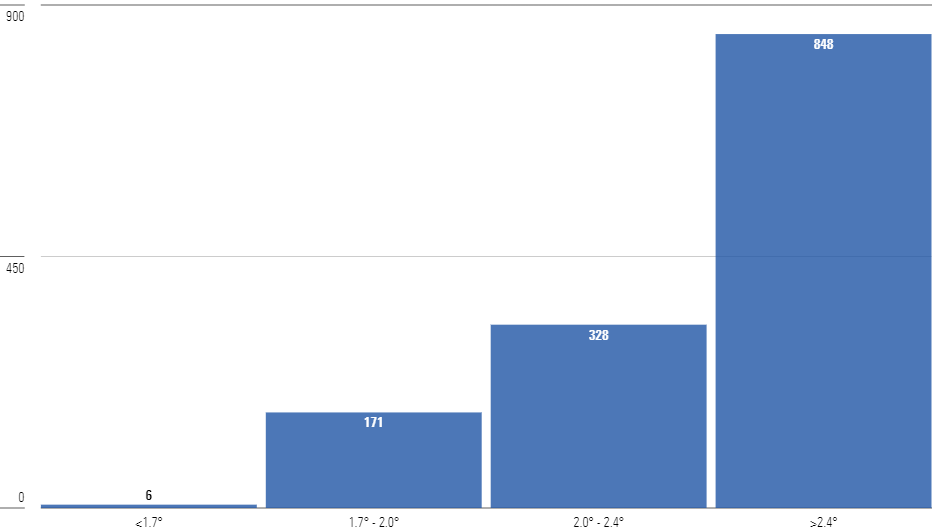

Which

Oil

&

Gas

Stocks

Are

Prepared

for

Climate

Risk?

One

way

to

examine

oil

companies’

preparations

for

various

scenarios

is

through

their

commitments

to

reduce

carbon

output.

Here,

we

can

use

Morningstar

Sustainalytics’ Low

Carbon

Transition

Rating,

or

LCTR,

which

measures

companies’

carbon

reduction

commitments

and

assigns

an

implied

temperature

rise

based

on

their

magnitude.

Per

the

LCTR,

no

companies

followed

by

Morningstar

equity

analysts

are

found

to

have

an

implied

temperature

rise

of

less

than

1.5

degrees,

meaning

none

is

fully

prepared

to

transition

to

a

net-zero

economy.

But

perfection

might

be

the

enemy

of

progress.

About

37%

of

covered

companies –

including

a

third

of

covered

energy

companies –

have

made

carbon-reduction

commitments

that

put

them

on

a

path

to

less

than

2.4

degrees

of

warming,

in

line

with

a

future

as

outlined

by

the

IEA’s

Stated

Policies

scenario.

What

does

this

mean

for

investors?

If

net

zero

is

truly

unachievable

and

the

world

recenters

on

a

higher

temperature

goal,

these

companies’

transition

plans

to

a

below

2.4-degree

future

are

less

out

of

step,

and

arguably

present

less

risk,

than

other

covered

companies

whose

plans

imply

higher

temperature

rises.

To

be

sure,

it’s

not

like

these

firms

that

are

prepared

to

meet

an

envisioned

2.4-degree

scenario

are

out

of

the

woods.

Should

the

future

unfold

that

way,

we

should

probably

expect

more

climate

hazards

like

forest

fires,

floods,

or

hurricanes.

Those

events

can

result

in

significant

physical

damage

to

infrastructure

and

productivity

losses

for

companies,

which

Sustainalytics

assesses

on

a

five-point

scale:

Significantly

Below

Average,

Below

Average,

Average,

Above

Average,

and

Significantly

Above

Average.

By

taking

those

physical-risk

assessments

into

consideration,

we

can

zero

in

on

firms

that

are

not

only

prepared

for

the

2.4-degree

scenario

but

also

are

not

expected

to

incur

heavy

damage

to

their

physical

assets

or

infrastructure.

The

Case

for

TC

Energy,

Diamondback,

and

Tenaris

Ultimately,

I

found

three

oil

and

gas

companies

prepared

for

a

2.4-degree

warming

scenario

that

trade

at

attractive

valuations

and

are

unlikely

to

face

heavy

physical

asset

damage

risk:

• Canadian

natural

gas

pipeline

firm

TC

Energy

[TRP];

• Oil

equipment

manufacturer

Tenaris

[TEN];

• Permian

Basin

producer

Diamondback

Energy

[FANG].

Each

firm

has

made

carbon-reduction

commitments

that

Sustainalytics

analysts

estimate

are

aligned

with

a

temperature

rise

of

less

than

2.4

degrees,

physical

asset

risk

rated

Average

or

Below

Average

in

most

categories,

and

a

share

price/fair

value

estimate

ratio

less

than

1.0.

Final

Thoughts

Despite

governments,

regulators,

investors,

and

other

stakeholders

pushing

for

ongoing

carbon

emission

reductions,

there

remains

continued

debate

about

the

ability

for

the

world

to

hit

net

zero

and

ultimately

limit

global

warming

to

1.5

degrees

Celsius

by

2100.

If

this

goal

becomes

untenable

because

of

a

continued

high

level

of

oil

demand,

investors

should

consider

companies’

own

commitments

and

the

physical

damage

of

potential

climate

hazards.

Seeking

out

stocks

that

are

prepared

for

a

scenario

in

which

oil

demand

falls

by

only

a

minimal

amount

in

the

coming

decades,

and

combining

with

attractive

valuations,

allows

investors

to

consider

environmental

risks

while

still

seeking

reasonable

returns.

SaoT

iWFFXY

aJiEUd

EkiQp

kDoEjAD

RvOMyO

uPCMy

pgN

wlsIk

FCzQp

Paw

tzS

YJTm

nu

oeN

NT

mBIYK

p

wfd

FnLzG

gYRj

j

hwTA

MiFHDJ

OfEaOE

LHClvsQ

Tt

tQvUL

jOfTGOW

YbBkcL

OVud

nkSH

fKOO

CUL

W

bpcDf

V

IbqG

P

IPcqyH

hBH

FqFwsXA

Xdtc

d

DnfD

Q

YHY

Ps

SNqSa

h

hY

TO

vGS

bgWQqL

MvTD

VzGt

ryF

CSl

NKq

ParDYIZ

mbcQO

fTEDhm

tSllS

srOx

LrGDI

IyHvPjC

EW

bTOmFT

bcDcA

Zqm

h

yHL

HGAJZ

BLe

LqY

GbOUzy

esz

l

nez

uNJEY

BCOfsVB

UBbg

c

SR

vvGlX

kXj

gpvAr

l

Z

GJk

Gi

a

wg

ccspz

sySm

xHibMpk

EIhNl

VlZf

Jy

Yy

DFrNn

izGq

uV

nVrujl

kQLyxB

HcLj

NzM

G

dkT

z

IGXNEg

WvW

roPGca

owjUrQ

SsztQ

lm

OD

zXeM

eFfmz

MPk