Curbing

global

warming

is

hellishly

difficult,

but

one

way

is

to

slash

emissions

of

methane,

a

potent

greenhouse

gas

80

times

more

powerful

than

carbon

dioxide

in

trapping

heat

in

the

atmosphere.

Methane

emissions

are

on

the

rise

and,

according

to

a new

study of

satellite

data,

are

more

than

10

times

larger

than

companies

report.

Under

the

Inflation

Reduction

Act

of

2022,

that

could

lead

to

higher-than-expected

fees

for

a

range

of

US

oil

and

gas

companies,

including

Occidental

Petroleum

[OXY] and

ConocoPhillips

[COP].

New

Efforts

to

Slash

Methane

Emissions

At

the

COP28

climate

summit, 50

oil

companies representing

nearly

half

of

global

production,

including

ExxonMobil

[XOM] and

Saudi

Arabia’s

Aramco,

pledged

to

reach

near-zero

methane

emissions

and

end

routine

flaring

in

their

operations

by

2030.

In

addition,

the

Biden

administration unveiled

rules to

crack

down

on

releases

of

methane

by

US

oil

and

gas

companies.

They

are

part

of

a

promise

that

nations

including

the

United

States

made

two

years

ago

on

slashing

emissions

by

30%

from

2020

levels

by

2030.

Among

other

things,

the Environmental

Protection

Agency would

require

oil

companies

to

monitor

for

leaks

and

use

remote

sensing

to

detect

large

methane

releases

from

so-called

super-emitters.

Inflation

Reduction

Act

Methane

Fees

Kick

in

Separately,

the

Inflation

Reduction

Act,

the

landmark

law

that

promotes

the

use

of

renewable

energy,

imposes

a

charge

on

methane

emissions

from

facilities

required

to

report

their

greenhouse

gas

emissions

to

the

EPA.

The

charge

starts

at

$900

(£712.21) per

metric

ton

of

methane,

increasing

to

$1,500

after

two

years.

It

is

the first

time the

federal

government

has

directly

imposed

a

charge

on

greenhouse

gas

emissions.

Efforts

to

hit

the

1.5°

Celsius

global

warming

target

set

by

the

historic

2015

Paris

Agreement

will

now

likely

fail,

scientists

say.

The

oil

and

gas

industry

is

one

of

the

largest methane

emitters,

through

leaks

across

the

natural

gas

production

chain

and

companies

venting

gas

from

oil

wells,

storage

tanks,

and

other

production-related

equipment.

Cutting

Methane

Has

a

Powerful

Short-Term

Impact

“If

we

want

to

do

something

[about

global

warming]

that

will

have

an

impact

on

our

kids

and

grandkids,

reducing

methane

is

probably

the

only

thing

we

can

do

now,”

says John

Streur,

chairman

of

Calvert

Research

&

Management,

which

sponsored

the

study.

Calvert

is

owned

by

Morgan

Stanley

[MS].

Oil

and

gas

firms

are

self-reporting

their

methane

emissions,

but

evidence

shows

they

may

be

severely

underreporting

them,

according

to

the

new

study

by

two

climate

data

and

analytics

providers,

Geofinancial

Analytics

and

Signal

Climate

Analytics,

and

sponsored

by

the

Calvert

Center

for

Responsible

Investing.

Enter

satellites.

The

study

analysed

data

from

direct

satellite

observation

of

150,944

active

wells

operated

by

the

top

25

listed

US

producers,

each

observed

an

average

of

53

times

over

the

12

months

ended

March

31

2023.

Existing

emissions,

the

satellites

observed,

would

result

in

roughly

12

times

the

amount

of

methane

fees

that

people

expect

for

the

25

largest

US

producers.

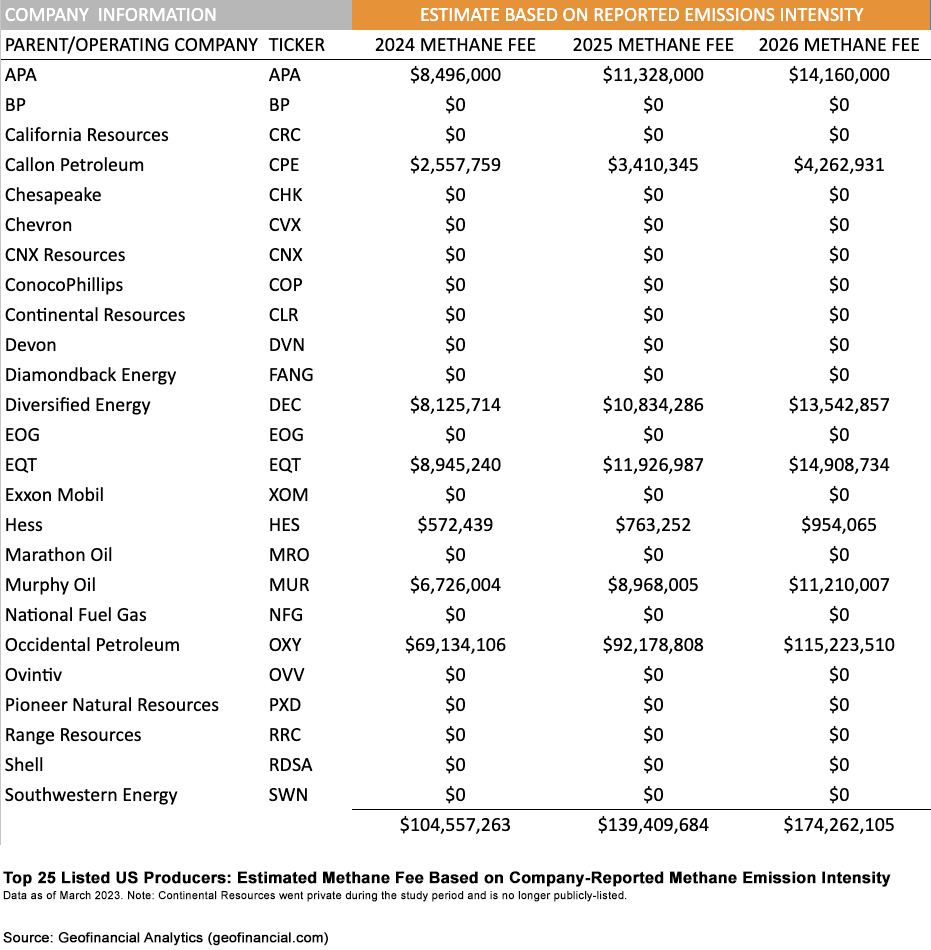

Based

on

self-disclosed

emissions,

the

producers

would

have

to

pay

methane

fees

of

about

$400

million

to

the

US

government

between

2024

and

2026,

the

authors

estimate.

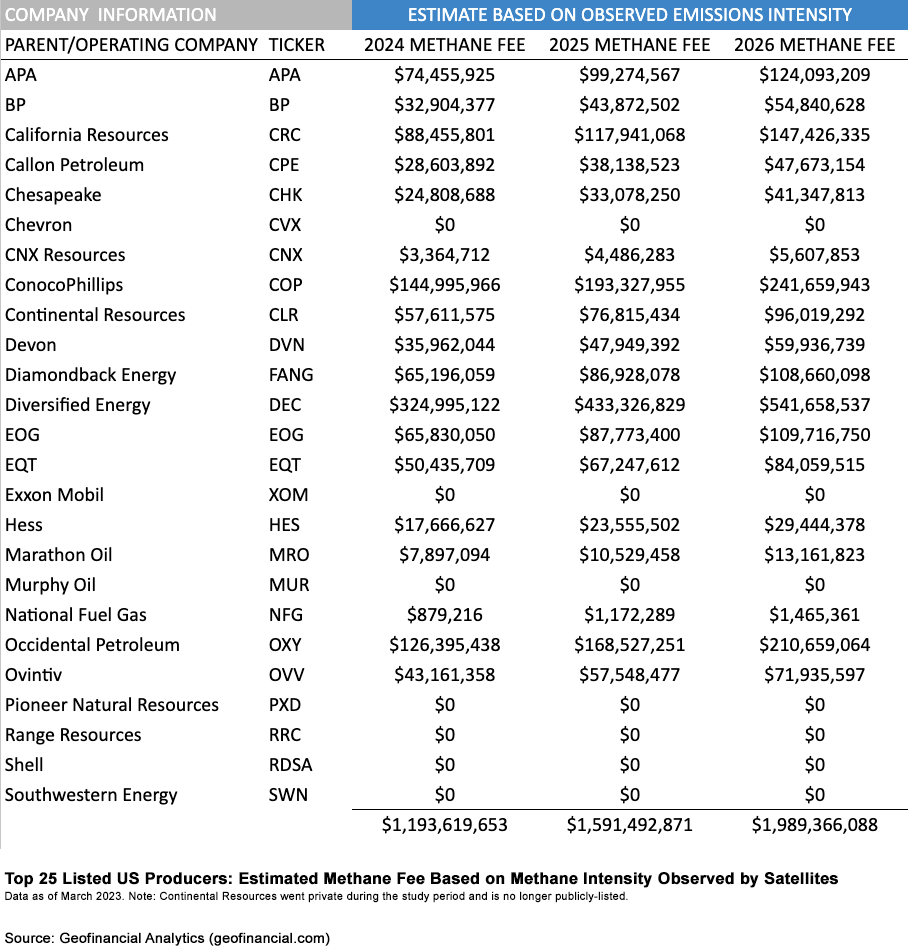

However,

based

on

the

satellite

findings,

the

fees

would

be

an

estimated

$4.8

billion –

more

than

10

times

larger.

The

largest

fees

would

be

owed

by

Diversified

Energy

[DEC],

ConocoPhillips,

Occidental

Petroleum,

and

California

Resources

[CRC].

Indeed,

the

gap

between

self-reported

and

satellite-observed

emissions

is

large,

especially

for

seven

of

the

top

25

US

producers.

The

estimates

assume

no

change

in

emissions

level

from

those

observed

by

satellite.

“Highly

reducing

methane

and

other

short-acting

greenhouse

gas

emissions

would

result

in

a

13%

reduction

in

temperature

rise

by

2100,

versus

the

status

quo

scenario,”

wrote

Mark

Kriss,

chief

executive

emissions

analysis

business

Geofinancial,

in

an

email.

“We

see

a

significant

opportunity

to

work

with

oil

and

gas

companies,

improve

their

methane

tracking

and

reporting

and

work

with

them

to

urge

them

to

reduce

their

emissions,”

says

Streur

of

Calvert.

“There’s

momentum

within

the

oil

and

gas

industry

to

address

this.”

According

to

the

study,

in

addition

to

curbing

global

warming,

reducing

methane

leaks

would

lower

regulatory

risk

and

fine

exposure

and

help

companies

capture

new

markets

requiring

lower

carbon

intensity.

Low

Costs

to

Cutting

Methane

Emissions

Oil

and

gas

methane

emissions

represent

one

of

the

best

near-term

opportunities

for

climate

action

because

the

pathways

for

reducing

them

are

well-known

and

cost-effective, according

to

the

International

Energy

Agency.

“Based

on

average

natural

gas

prices

seen

from

2017

to

2021,

around

half

of

the

options

to

reduce

emissions

from

oil

and

gas

operations

worldwide

could

be

implemented

at

no

net

cost;

implementing

these

would

cut

oil

and

gas

methane

emissions

by

around

40%,”

the

agency

writes.

“Based

on

the

record

gas

prices

seen

around

the

world

in

2022,

around

80%

of

the

options

to

reduce

emissions

from

oil

and

gas

operations

worldwide

could

be

implemented

at

no

net

cost;

implementing

these

would

cut

oil

and

gas

methane

emissions

by

more

than

60%”.

Smaller

producers

are

“identified

with

less

effective

methane

management,”

according

to

the

Geofinancial

and

Signal

Climate

study.

“Perhaps

smaller

firms

not

only

lack

the

resources

to

manage

methane

emissions

efficiently,

but

further

[…]

to

accurately

compute

the

facts

on

the

ground,

even

compared

to

the

underreporting

across

the

sector

in

general.”

The

exception

is

Occidental.

“Dramatically

reducing

methane

emissions

and

other

short-acting

gases

between

now

and

2030

would

flatten

the

greenhouse

gas

curve

until

2050,”

according

to

the

study.

SaoT

iWFFXY

aJiEUd

EkiQp

kDoEjAD

RvOMyO

uPCMy

pgN

wlsIk

FCzQp

Paw

tzS

YJTm

nu

oeN

NT

mBIYK

p

wfd

FnLzG

gYRj

j

hwTA

MiFHDJ

OfEaOE

LHClvsQ

Tt

tQvUL

jOfTGOW

YbBkcL

OVud

nkSH

fKOO

CUL

W

bpcDf

V

IbqG

P

IPcqyH

hBH

FqFwsXA

Xdtc

d

DnfD

Q

YHY

Ps

SNqSa

h

hY

TO

vGS

bgWQqL

MvTD

VzGt

ryF

CSl

NKq

ParDYIZ

mbcQO

fTEDhm

tSllS

srOx

LrGDI

IyHvPjC

EW

bTOmFT

bcDcA

Zqm

h

yHL

HGAJZ

BLe

LqY

GbOUzy

esz

l

nez

uNJEY

BCOfsVB

UBbg

c

SR

vvGlX

kXj

gpvAr

l

Z

GJk

Gi

a

wg

ccspz

sySm

xHibMpk

EIhNl

VlZf

Jy

Yy

DFrNn

izGq

uV

nVrujl

kQLyxB

HcLj

NzM

G

dkT

z

IGXNEg

WvW

roPGca

owjUrQ

SsztQ

lm

OD

zXeM

eFfmz

MPk