Many

investors

know

physical

gold

is

in

demand

for

jewellry

and

acts

a

store

of

value

during

market

uncertainties

and

currency

devaluations.

It

also

offers

low

correlation

with

other

asset

classes

and

provides

a

hedge

during

periods

of

high

inflation.

The

Morningstar

Quantitative

Research

Team

has

analysed

this

issue

in

detail

in

a

recent

report.

Here

are

their

conclusions.

Types

of

Mining

Stocks

There

are

four

types

of

companies

involved

in

the

precious

metals

ecosystem

and

four

areas

of

activities:

1)

exploration

and

development;

2)

mining

and

production

(M&P);

3)

extraction,

refining,

investments,

royalty,

and

streaming;

and

4)

equipment

and

services.

Some

47%

of

these

companies

are

actively

involved

in

precious

metals

exploration

and

development,

while

another

41%

are

associated

with

mining

and

production

activities.

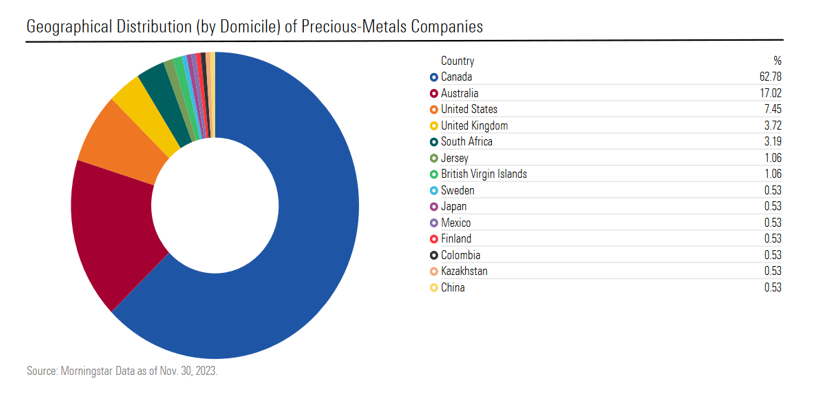

Many

investors

may

expect

mines

to

be

located

in

developing

markets.

But

precious

metals

companies

are

mainly

concentrated

in

Canada

and

Australia

because

of

the

availability

of

raw

materials,

as

well

as

their

long

history

of

exploration

and

production.

Mines,

But

No

Moats

Most

of

the

companies

in

this

ecosystem

do

not

possess

economic

moats

due

to

the

uncertainty

around

successful

exploration,

its

geological

challenges,

and

the

significant

environmental

impacts.

And

the

companies

do

not

have

pricing

power

and

face

challenges

around

fuel

costs,

labour

shortages,

and

volatile

commodity

prices.

Mining

is

capital

intensive

and

has

a

low

return

on

capital.

It

is

unlikely

that

companies

will

generate

economic

return

more

than

cost

of

capital

barring

materially

high

gold

prices.

These

challenges

prevent

the

establishment

of

robust

economic

moats.

Exceptional

Returns,

But

Also

Volatility

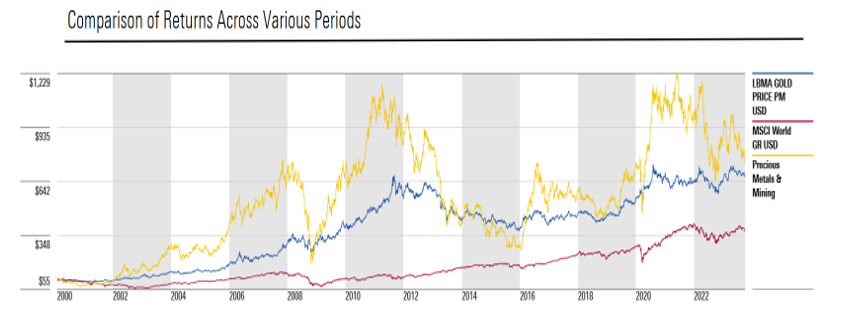

Still,

as

a

group

the

precious

metals

companies

have

generated

exceptional

returns

in

the

long

run.

During

bull

markets,

these

companies

can

deploy

their

operating

leverage

to

maximise

profits.

However,

their

volatility

during

periods

of

market

turbulence

may

put

off

potential

clients

from

owning

the

stocks

in

their

portfolios.

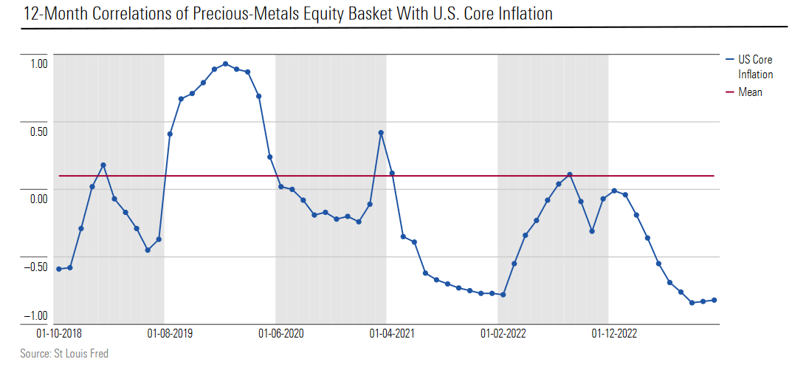

Correlation,

Inflation

What

about

correlation

with

other

assets?

There

is

a

fair

level

of

correlation

between

precious

metal

stocks

and

commodities,

US

real

estate

investment

trusts,

and

equity

market

returns.

But

the

low

correlation

with

fixed

income

and

negative

correlation

with

the

dollar

index

does

offer

some

respite

here.

The

connection

with

inflation

is

illustrated

in

the

following

graph,

which

shows

the

12-month

rolling

correlation

between

US

core

inflation

and

a

precious-metals

equity

basket

over

the

last

five

years.

The

horizontal

line

indicates

the

historical

correlation

average

from

2000

to

2023.

The

basket

performed

well

during

the

coronavirus

pandemic

as

correlations

started

falling.

But

during

the

bear

market

of

2022,

correlations

started

to

improve

(i.e.

became

less

negative),

resulting

in

an

increase

in

the

precious

metals

basket

returns.

Owning

precious

metals

miners

has

benefits

but

also

brings

risks.

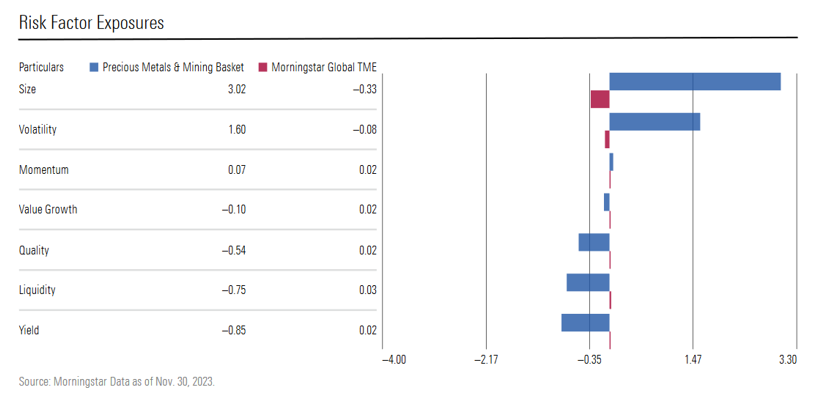

What’s

obvious

is

the

sector

is

overexposed

to

small-cap

and

highly

volatile

companies,

but

liquidity,

quality,

and

yield

remain

areas

of

opportunity.

Given

these

factors,

they

may

have

a

place

in

portfolios.

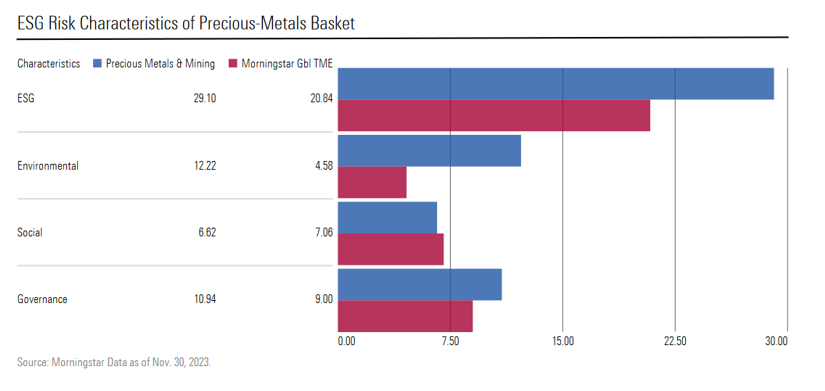

These

companies

also

have

ESG

issues.

As

can

be

seen

in

the

following

chart,

the

precious

metals

basket

has

higher

risk

scores

relative

to

broad

equity

markets.

Mining

Valuations

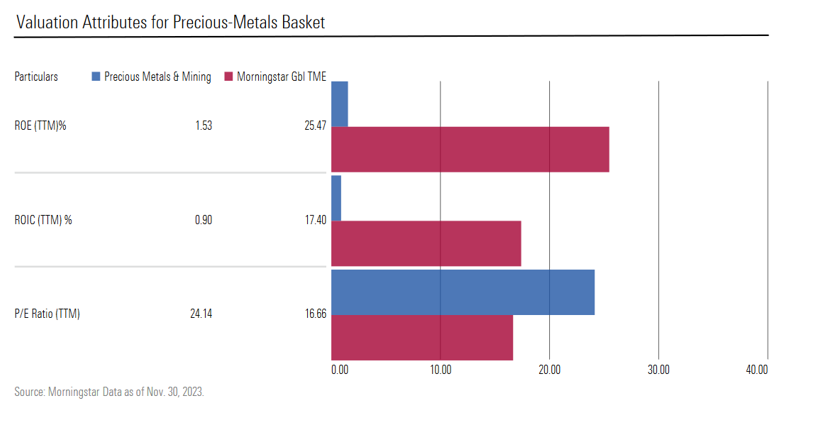

Stretched?

There

are

clearly

challenges

with

valuations

with

precious

metals.

Return

of

equity

(ROE)

and

return

on

invested

capital

(ROIC)

being

lower

than

broad

markets

and

price/earnings

ratios

also

seem

too

high.

The

higher

P/E

suggests

that

investors

are

willing

to

pay

more

for

the

future

growth

potential,

capitulating

on

rising

prices

of

precious

metals,

despite

their

current

lower

profitability

compared

with

the

broader

market.

The

low

return

can

be

attributed

to

the

capital-intensive

nature

of

the

mining

industry,

which

is

triggered

by

challenges

in

managing

cost

structures

and

exploration

costs

due

to

the

scarce

availability

of

these

metals.

In

addition,

risks

of

volatile

commodity

prices,

geopolitical

issues,

and

regulatory

ecosystems

further

impact

profit

margins.

Read

Read

more:

why

one

company

is

bullish

on

bullion

and

the

case

for

holding

gold

next

year

SaoT

iWFFXY

aJiEUd

EkiQp

kDoEjAD

RvOMyO

uPCMy

pgN

wlsIk

FCzQp

Paw

tzS

YJTm

nu

oeN

NT

mBIYK

p

wfd

FnLzG

gYRj

j

hwTA

MiFHDJ

OfEaOE

LHClvsQ

Tt

tQvUL

jOfTGOW

YbBkcL

OVud

nkSH

fKOO

CUL

W

bpcDf

V

IbqG

P

IPcqyH

hBH

FqFwsXA

Xdtc

d

DnfD

Q

YHY

Ps

SNqSa

h

hY

TO

vGS

bgWQqL

MvTD

VzGt

ryF

CSl

NKq

ParDYIZ

mbcQO

fTEDhm

tSllS

srOx

LrGDI

IyHvPjC

EW

bTOmFT

bcDcA

Zqm

h

yHL

HGAJZ

BLe

LqY

GbOUzy

esz

l

nez

uNJEY

BCOfsVB

UBbg

c

SR

vvGlX

kXj

gpvAr

l

Z

GJk

Gi

a

wg

ccspz

sySm

xHibMpk

EIhNl

VlZf

Jy

Yy

DFrNn

izGq

uV

nVrujl

kQLyxB

HcLj

NzM

G

dkT

z

IGXNEg

WvW

roPGca

owjUrQ

SsztQ

lm

OD

zXeM

eFfmz

MPk