Through

June

24,

the

Morningstar

US

Market

Index,

our

proxy

for

the

broad

US

equity

market,

rose

3.20%

quarter

to

date.

Year

to

date,

the

Morningstar

US

Market

Index

has

risen

13.77%.

While

the

broad

market

index

was

able

to

post

a

healthy

gain

thus

far

in

the

second

quarter,

it

was

only

able

to

do

so

on

the

back

of

concentrated

gains

in

stocks

tied

to

artificial

intelligence.

An

attribution

analysis

reveals

that

without

the

gains

from

Nvidia

(NVDA),

Apple

(AAPL),

Microsoft

(MSFT),

Alphabet

(GOOGL),

and

Broadcom

(AVGO),

the

broad

market

index

would

have

fallen

thus

far

this

quarter.

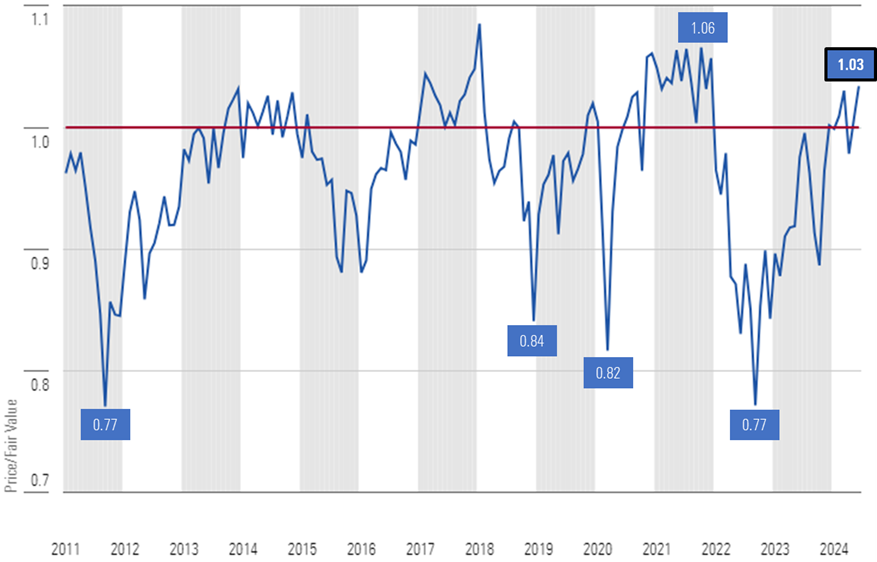

As

of

June

24,

the

price/fair

value

of

the

US

stock

market

rose

to

1.03,

representing

a

3%

premium

to

our

fair

value

estimates.

While

the

market

valuation

is

not

yet

in

overvalued

territory,

this

places

it

near

the

top

end

of

the

fair

value

range.

In

fact,

since

the

end

of

2010,

the

market

has

traded

at

this

much

of

a

premium,

or

more,

only

10%

of

the

time.

Price/Fair

Value

of

Morningstar’s

US

Equity

Research

Coverage

at

Month-End

Anything

related

to

artificial

intelligence

continued

to

surge

in

the

second

quarter.

These

stocks

are

largely

held

within

the

Morningstar

US

Growth

Index

and

in

the

case

of

Alphabet,

Meta

Platforms,

and

Broadcom

are

contained

in

the

Morningstar

US

Core

Index.

Both

of

these

indexes

have

well

outperformed

the

Morningstar

US

Value

Index.

However,

based

on

our

valuations,

we

suspect

that

the

preponderance

of

this

outperformance

is

behind

us.

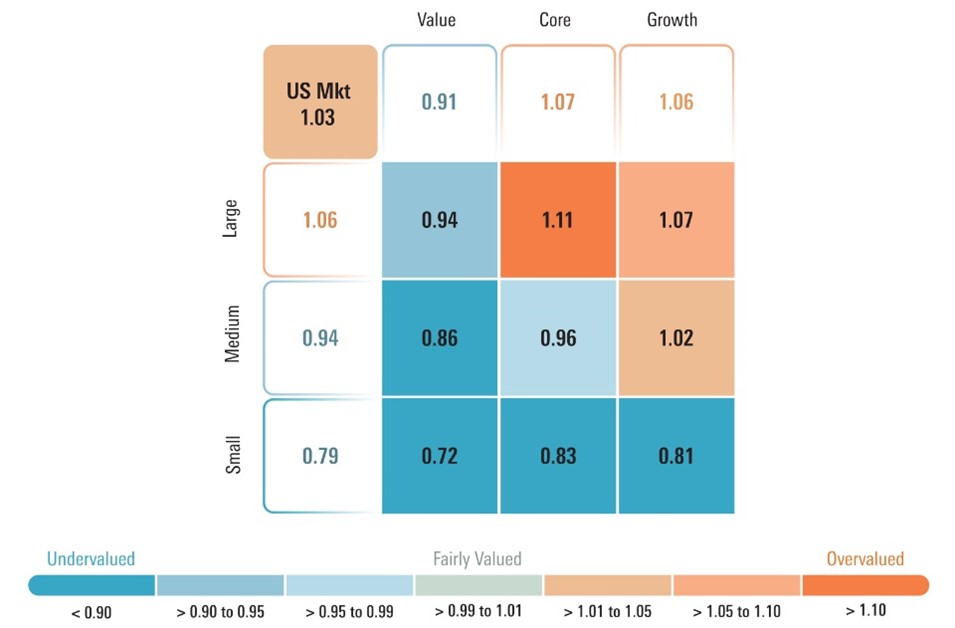

As

of

June

24,

growth

stocks

are

trading

at

a

6%

premium

to

a

composite

of

our

stock

coverage

and

core

stocks

are

trading

at

a

7%

premium,

whereas

value

stocks

remain

attractively

priced

at

a

9%

discount

to

our

valuations.

While

a

rising

tide

can

lift

overvalued

AI

stocks

even

further

into

overvalued

territory

in

the

short

term,

in

the

future

we

think

long-term

investors

will

be

better

off

paring

down

positions

in

growth

and

core

stocks,

which

are

becoming

overextended,

and

reinvesting

those

proceeds

into

value

stocks,

which

trade

at

an

attractive

margin

of

safety.

Price/Fair

Value

by

Morningstar

Style

Box

Category

Based

on

these

valuations,

as

compared

with

our Q2

US

Stock

Market

Outlook,

we

now

advocate

for

moving

to

an

underweight

in

the

core

category

following

its

second-quarter

outperformance

as

compared

with

our

prior

market

weight.

We

continue

to

advocate

an

overweight

in

value

and

underweight

in

growth.

By

capitalisation,

we

continue

to

advocate

for

an

underweight

position

in

large-cap

stocks

in

favor

of

overweighting

small-cap

stocks

and

a

slight

overweighting

in

mid-cap

stocks.

Where

to

go

From

Here?

While

the

broad

market

appears

to

be

getting

frothy,

much

of

the

overvaluation

is

concentrated

in

a

few

thematic,

mega-cap

stocks.

For

example,

if

we

exclude

Nvidia,

Meta

(META)

Platforms,

and

Apple

from

our

valuation

calculation,

the

premium

drops

to

1%

from

3%.

While

not

tied

to

AI,

excluding

Eli

Lilly

(LLY)

(which

has

run

up

well

into

1-Star

territory

on

its

weight-loss

drugs)

from

the

calculation,

it

brings

the

index

down

to

fair

value.

Considering

that

AI

stocks

are

generally

at

best

fairly

valued

and

at

worst

overvalued,

we

see

much

better

opportunities

elsewhere

in

the

market,

specifically

in

the

value

category,

which

remains

the

most

undervalued

according

to

our

valuations,

as

well

as

down

in

capitalisation

into

small-cap

stocks.

While

we

may

have

been

a

little

early

on

the

call

to

start

moving

into

contrarian

plays

last

quarter,

we

continue

to

see

the

best

opportunities

among

those

sectors

and

stocks

that

have

underperformed,

are

unloved,

and –

most

importantly –

undervalued.

These

contrarian

plays

are

often

“story

stocks,”

which

are

typically

situations

such

as

emerging

turnarounds

or

other

catalysts

that

may

have

greater

short-term

risk,

require

a

greater

amount

of

analysis,

and

often

take

time

for

the

story

to

work

out.

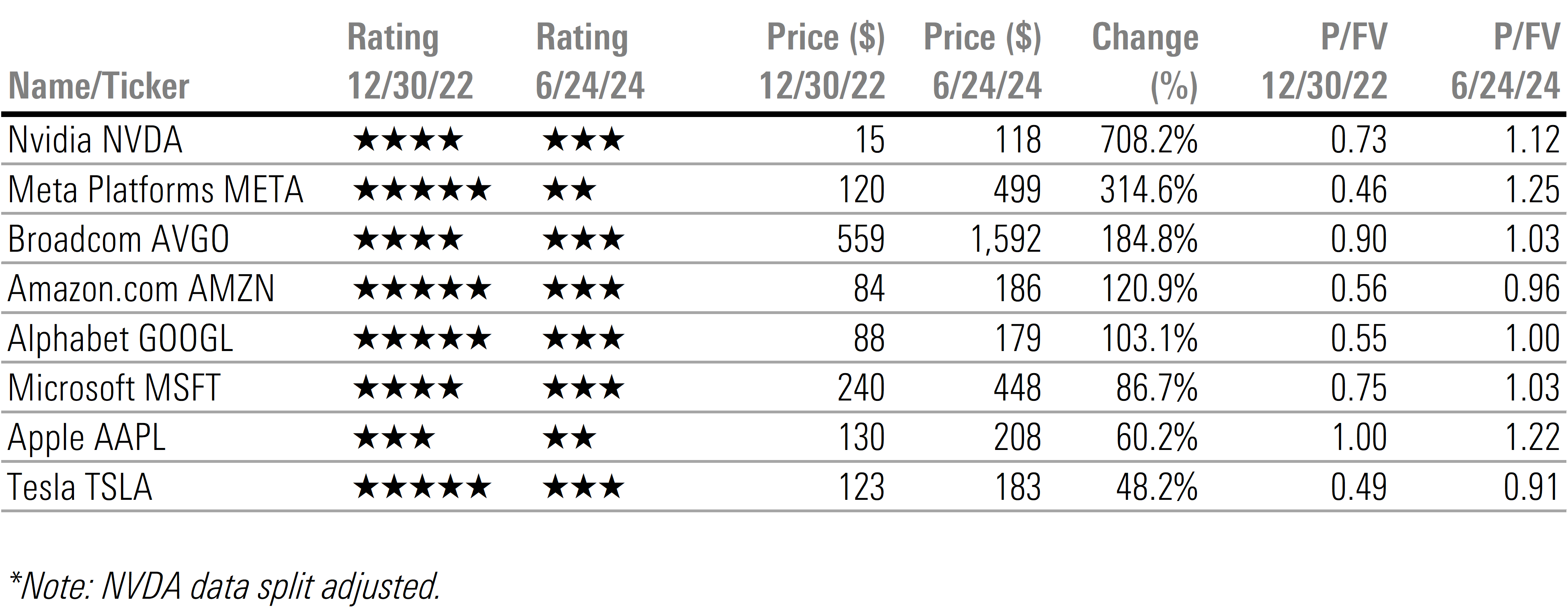

Shifting

From

Thematic

to

Idiosyncratic

In

our 2023

US

Stock

Market

Outlook,

we

noted

that

the

broad

market

was

trading

at

a

deep

discount

to

our

valuations,

especially

growth

stocks,

and

in

particular,

the

communication

and

technology

sectors

were

among

the

most

undervalued

sectors.

In

our

Stocks

for

2023

section,

many

of

those

stocks

tied

to

artificial

intelligence

were

rated

4

or

5

Stars.

Fast

forward

to

one

and

a

half

years

later,

these

same

stocks

tied

to

AI

are

now

at

best

fully

valued,

or

at

worst

overvalued.

Performance

of

Selected

AI-Related

Stocks

Based

on

these

valuations,

as

well

as

those

stocks

closely

tied

to

both

the

AI

and

weight-loss

drug

themes,

we

think

it

is

unlikely

that

what’s

worked

for

the

past

one

and

a

half

years,

will

be

what

continues

to

work

in

the

future.

Opportunities

Across

Undervalued

Sectors

and

Stocks

Morningstar

Price/Fair

Value

by

Sector

Real

Estate

No

sector

is

hated

as

much

by

Wall

Street

than

real

estate.

Yet

this

negative

sentiment

is

also

why

we

see

numerous

opportunities

among

REITs

that

invest

in

real

estate

with

defensive

characteristics,

which

have

traded

off

in

conjunction

with

urban

office

space.

For

example,

5-Star-rated

Healthpeak

(DOC) and

4-star-rated

Ventas

(VTR) invest

across

a

diversified

range

of

healthcare

assets

including

medical

offices,

life

sciences

research

facilities,

senior

housing,

and

hospitals.

Realty

Income

(O),

rated

5

Stars,

owns

roughly

13,400

properties,

most

of

which

are

freestanding,

single-tenant,

triple-net-leased

retail

properties.

A

large

percentage

of

their

tenants

are

in

defensive

industries

such

as

grocery,

convenience,

dollar,

and

home

improvement

stores.

Energy

Over

the

long-term,

we

expect

oil

prices

to

decline,

as

our

midcycle

forecast

for

West

Texas

Intermediate

crude

is

$55/barrel.

Yet,

even

with

that

bearish

forecast

compared

with

today’s

$80/barrel

price,

we

see

value

among

much

of

the

energy

sector,

which

trades

at

a

7%

discount

to

our

fair

valuations.

We

also

think

exposure

to

the

energy

sector

provides

a

good,

natural

hedge

to

portfolios

to

hedge

against

rising

geopolitical

risk

and

if

inflation

were

to

stay

higher

for

longer.

Among

the

global

major

oil

producers,

4-star-rated

Exxon

(XOM) is

our

preferred

integrated

oil

company,

given

its

earnings-growth

potential

from

a

combination

of

high-quality

asset

additions

and

cost

savings.

For

investors

looking

for

domestic

producers,

we

highlight

4-Star-rated

Devon.

For

investors

with

a

higher

risk

tolerance,

we

suggest

looking

at

APA

(APA),

which

could

have

significant

upside

from

a

potential

play

in

Suriname.

The

evidence

to

date

suggests

a

very

large

petroleum

system

that

could

be

transformative

for

the

company.

At

this

point,

we

think

it

is

very

likely

that

one

or

more

of

the

discoveries

will

progress

to

the

development

stage,

though

none

have

been

officially

sanctioned

yet.

A

final

investment

decision

for

Suriname

is

planned

by

the

end

of

2024

with

the

first

oil

in

2028.

Basic

Materials

As

economic

growth

slows,

the

basic

materials

sector

has

fallen

out

of

favour

and

is

now

trading

at

a

5%

discount

to

fair

value.

Within

this

sector,

we

see

value

in

select

gold

miners

and

agricultural

chemicals.

Gold

miners

such

as

4-Star-rated

Newmont

Mining

(NEM) trade

at

a

deep

discount

to

our

fair

value,

even

though

we

have

a

relatively

bearish

view

on

the

long-term

price

of

gold.

If

gold

prices

stay

elevated

or

move

higher,

we

think

there

is

a

lot

of

upside

leverage.

Crop

chemical

producers,

such

as

5-Star-rated

FMC,

fell

throughout

2023.

The

agricultural

industry

overordered

too

much

product

in

2021-22

due

to

supply

constraints

and

shipping

bottlenecks.

As

a

result,

sales

were

constrained

in

2023

as

those

excess

inventories

were

used

up.

We

think

the

supply/demand

dynamics

will

normalise

this

year,

and

therefore

we

see

opportunity

in

undervalued

crop

chemical

producers.

Where

to

Be

Wary:

Sectors

Trading

at

Premiums

to

our

Fair

Values

Technology

The

technology

sector

has

a

long

history

of

swinging

between

boom

and

bust.

Right

now,

we

are

in

the

boom

stage,

where

valuations

are

becoming

increasingly

stretched

as

the

surge

from

artificial

intelligence

has

propelled

these

stocks

higher

and

pushed

the

sector

to

a

10%

premium

to

our

valuations.

At

this

point,

we

look

at

technology

stocks

as

generally

divided

into

three

buckets:

AI

and

cloud,

traditional

technology,

and

legacy

technology.

AI

and

cloud

is

where

we

see

the

highest

growth

and

positive

long-term

secular

trends,

yet

at

this

point,

these

stocks

are

generally

fully

valued

to

overvalued.

The

area

we

find

undervalued

opportunities

in

is

the

traditional

technology

stocks.

These

stocks

include

industries

such

as

semiconductors,

software,

and

services.

Among

the

semiconductors,

we

just

upgraded

our

Morningstar

Economic

Moat

Rating

on

5-star-rated

NXP

Semiconductors

(NXPI) to

wide

from

narrow.

Among

software,

we

see

value

in

4-Star-rated

Adobe

(ADBE),

which

trades

at

a

14%

discount.

Within

the

services

area,

we

see

positive

long-term

secular

trends

in

cybersecurity,

of

which

our

current

pick

is

4-Star-rated

Fortinet

(FTNT).

Legacy

technology

includes

those

stocks

that

we

think

have

their

best

days

behind

them.

This

includes

stocks

such

as

2-star-rated

International

Business

Machines

(IBM),

which

trades

at

a

23%

premium

to

our

fair

value

and

2-Star-rated

HP

(HPE),

which

trades

at

a

12%

premium.

Consumer

Defensive

The

consumer

defensive

sector

is

currently

trading

at

an

8%

premium

to

our

fair

value.

To

some

degree,

valuations

in

the

sector

are

barbell-shaped

with

several

large-cap

stocks,

such

as

1-Star-rated

Costco

(COST) and

2-Star-rated

Procter

&

Gamble

(PG),

which

are

trading

well

above

our

intrinsic

valuations.

While

we

rate

Costco

with

a

wide

moat

and

a

Morningstar

Uncertainty

Rating

of

Medium,

the

stock

trades

at

an

eye-popping

50

times

forward

earnings.

The

area

we

see

the

best

value

is

among

the

packaged

food

companies.

These

companies

have

been

under

pressure

the

past

few

years

as

they

have

struggled

to

raise

prices

as

fast

as

their

own

costs.

As

inflation

moderates,

we

expect

they

will

be

able

to

raise

their

operating

margins

back

toward

historical

averages

as

price

increases

and

efficiencies

improve.

Two

such

examples

include

5-star-rated

Kraft

Heinz

(KHC),

of

which

we

just

increased

its

moat

rating

to

narrow

this

past

quarter

and

raised

our

fair

value,

and

4-Star-rated

Kellanova

(K).

Industrials

The

industrials

sector

is

trading

at

a

6%

premium

to

our

valuations.

In

our

view,

industrials

should

remain

underweighted

in

portfolios,

especially

the

transportation

names

that

are

the

most

overvalued.

For

example,

2-Star-rated

Southwest

Airlines

(LUV) and

United

Airlines

(UAL),

which

trade

at

50%

and

38%

premiums,

respectively,

remain

some

of

the

most

overvalued

names

across

our

coverage.

In

addition,

2-Star

stocks

such

as

XPO

Logistics

(XPO) and

Saia

(SAIA) remain

at

high

premiums

of

28%

and

24%,

respectively.

One

of

the

few

areas

where

we

see

undervalued

stocks

in

the

sector

include

the

aerospace

and

defense

contractors

such

as

5-Star

Huntington

Ingalls

(HII) and

4-Star-rated

Northrop

Grumman

(NOC).

Stock

Selection

for

Sectors

Trading

Near

Fair

Value

Consumer

Cyclical

Investors

will

need

to

be

adroit

in

their

stock-picking

across

the

consumer

cyclical

sector.

Several

anecdotes

from

first-quarter

earnings

reports

may

be

the

canary

in

the

coal

mine,

indicating

that

the

compound

impact

from

two

years

of

high

inflation

is

weighing

on

the

middle-income

consumers.

For

example,

Starbucks

(SBUX) reported

a

7%

decrease

in

foot

traffic

across

its

stores,

McDonalds

(MCD)

reported

relatively

weak

results,

and

Nike

(NKE) shares

dropped

precipitously

after

it

guided

to

a

mid-single-digit

percentage

sales

decline

for

fiscal

2025.

On

the

flip

side

of

the

coin,

discounter

Walmart

(WMT) reported

an

increase

in

comparable

sales,

driven

entirely

by

traffic

growth.

Middle-income

consumers

were

originally

able

to

offset

high

inflation

over

the

past

two

years

by

using

excess

savings

from

the

pandemic,

but

those

savings

appear

to

be

used

up.

They

have

also

eaten

into

their

savings

rate,

but

savings

rates

are

already

lower

than

prepandemic

levels.

We

are

seeing

consumers

pull

back

on

those

items

that

are

considered

indulgent

as

well

as

other

discretionary

items

whose

purchases

can

be

delayed.

However,

other

areas

such

as

travel,

where

consumers

have

already

bought

or

booked

tickets

and

have

set

aside

funds

to

pay

for

their

summer

vacations,

remain

steady.

Financial

Services

A

little

over

a

year

ago,

Silicon

Valley

Bank

failed

and

stocks

across

the

entire

regional

bank

industry

plummeted.

While

we

lowered

our

fair

value

on

a

number

of

these

stocks,

market

prices

fell

further

and

faster.

One

year

later,

most

of

these

stocks

have

regained

much

of

their

value,

yet

this

is

still

where

we

see

the

best

valuation

as

the

mega

banks

are

fully

valued

to

overvalued.

Among

the

regional

banks,

we

continue

to

see

value

in

4-Star-rated

US

Bank

(USB),

which

trades

at

a

25%

discount

to

fair

value.

US

Bank

is

the

only

regional

bank

we

rate

with

a

wide

economic

moat.

Communications

The

valuation

of

the

communication

sector

is

skewed

upward

by

3-star-rated

Alphabet

and

2-star-rated

Meta

Platforms,

as

those

stocks

account

for

44%

and

24%

of

the

Morningstar

US

Communications

Services

Index,

respectively.

Within

the

sector,

we

see

the

best

value

among

traditional

communication

names.

For

example,

AT&T

(T) and

Verizon

(VZ) are

two

4-Star-rated

stocks

that

trade

at

close

to

20%

discounts

to

our

valuation

and

whose

dividend

yields

both

yield

near

6%.

Among

the

media

names,

Comcast

(CMCSA) is

rated

5

stars,

trades

at

a

30%

discount

to

fair

value,

and

its

dividend

yield

is

3.2%.

Healthcare

The

overall

valuation

of

the

healthcare

sector

has

been

skewed

higher

by

the

performance

of

Eli

Lilly on

the

back

of

its

weight-loss

drugs.

Eli

Lilly,

rated

1-Star,

trades

at

a

68%

premium

to

fair

value,

making

it

one

of

the

most

overvalued

stocks

across

our

coverage.

Elsewhere

within

the

healthcare

sector,

we

are

seeing

a

number

of

stocks

that

rarely

have

traded

at

much

of

a

discount,

such

as

Johnson

&

Johnson

(JNJ),

slip

into

4-Star

territory.

Within

healthcare

we

prefer

stocks,

such

as

5-Star-rated

Zimmer

Biomet

(ZBH) and

4-Star-rated

Medtronic

(MDT).

These

are

stocks

that

not

only

trade

at

a

discount

to

our

fair

values

and

have

long-term

durable

competitive

advantages

but

also

are

tied

to

the

long-term

secular

trend

of

the

aging

baby

boomer

generation.

Utilities

Obvious

plays

on

the

rapid

growth

of

AI

have

already

run

up

to

levels

that

we

think

are

fully

valued

to

overvalued.

As

such,

investors

have

been

looking

for

other

ways

to

play

this

growth.

Recently

we

have

seen

an

increase

in

the

number

of

stories

that

make

the

case

that

the

utility

sector

will

benefit

from

the

heightened

demand

for

electricity.

We

agree

with

this

thesis,

as

AI

computing

requires

multiple

times

more

electricity

to

power

its

semiconductors

than

traditional

computing.

In

fact,

in

our 4Q

2023

US

Market

Outlook,

we

highlighted

that

the

utility

sector

was

trading

at

valuation

levels

that

were

near

their

lowest

levels

over

the

past

decade,

yet

we

noted

that

fundamentally

the

outlook

for

the

sector

was

as

strong

as

we

had

ever

seen

it.

At

that

point,

we

had

already

incorporated

into

our

forecasts

that

the

amount

of

electricity

demand

growth

from

data

centers

would

increase

a

cumulative

46%

through

2032.

However,

in

our

view,

if

you

are

just

buying

utilities

today

to

play

this

theme,

you

are

already

nine

months

late

to

the

game.

Since

the

utility

sector

bottomed

out

on

Oct.

2,

the

Morningstar

US

Utility

Index

has

risen

28%

through

June

24.

One

utilities

stock

that

has

lagged

the

sector

but

has

upside

leverage

tied

to

AI

electric

demand,

is

4-star-rated

WEC

Energy

Group

(WEC).

There

are

several

data

centers

in

development

in

Wisconsin,

with

Microsoft

the

most

recent

to

announce

its

plans

to

build

a

data

center

in

southeast

Wisconsin.

WEC

trades

at

an

18%

discount

to

our

fair

value

estimate

and

yields

approximately

4.3%.

Key

Takeaways:

-

US

stock

market

at

a

3%

premium,

not

yet

overvalued,

but

getting

stretched; -

We

doubt

what’s

worked

for

the

past

one-and-a-half

years

will

be

what

continues

to

work

in

the

future; -

Value

category

and

small

caps

remain

most

undervalued,

shifting

core

category

to

underweight.