Exclusions, or removing certain industries from your investing universe, are a cornerstone of sustainable investing. They solve the vexing problem of investing according to one’s values. In fact, the earliest socially responsible funds, precursors to today’s environmental, social, and governance funds and sustainable funds, excluded investments in companies the founders felt contributed to the Vietnam War.

Today, exclusions are just one in an array of sustainable investing approaches that seek to deliver competitive financial results while also driving positive ESG outcomes.

Lately, some investors are thinking twice about those screens. Recently, Parnassus Investments, which runs $30 billion Parnassus Core Equity (PRBLX) and other large sustainable funds, decided to drop exclusions, including nuclear power investments, alcohol, weapons, and other investments, affecting dozens of companies.

Other sustainable investors have made similar moves. But screening out investments is alive and well among European investors, those seeking fossil-fuel-free portfolios, and others. Consider the so-called “sin stocks” around pornography, gaming, and tobacco. These remain land mines for many investors.

How Exclusionary Investing Came About

Exclusions were invented when data about companies was more scarce. As information improved, the next stop was hurdle rates: looking at percentages of revenue devoted to a particular controversial product. Today, the world is awash in data about ESG factors such as greenhouse gas emissions or company performance based on Equal Employment Opportunity Commission metrics. That makes it easier for an active manager to find good companies, as she defines them, without using exclusions.

Parnassus had “dozens of conversations” around tossing the screens and discovered that most people no longer viewed them as the foundation for sustainable investing, says Marian Macindoe, managing director of Parnassus’ sustainable investment strategy. So it dropped the exclusionary language from its prospectus and put the stocks it would have omitted onto a “caution” list. An analyst who feels very bullish on a stock can lobby Macindoe and Parnassus’ chief investment officer Todd Ahlsten to remove it from the list. (Companies can also get off the list if their product line has changed or if their risk management around that product is vastly superior to their peers.)

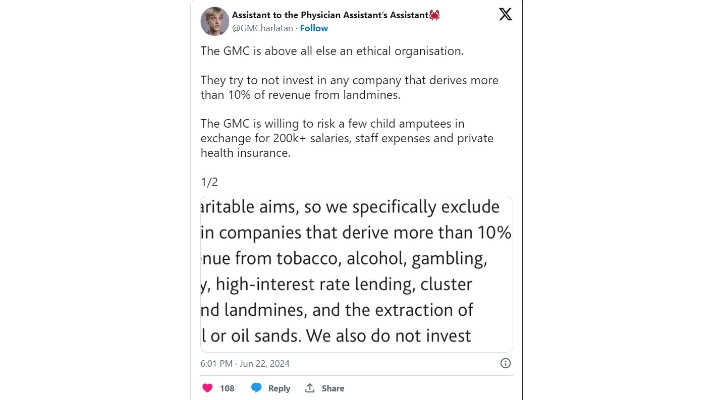

Morningstar analyst Stephen Welch writes, “doing away with [the exclusions] won’t materially impact how [the funds] are run […] This does not mean [Parnassus] will suddenly invest, for example, in tobacco companies, but it could invest in a company that potentially derives more than 10% of revenue from a previously excluded industry as long as it’s not a core risk for the business (10% was the previous threshold for exclusion). For example, this could include an investment in an oil-services company that is actively working to decarbonise and/or working on measurement and diagnostics.”

Calvert Research & Management, a unit of Morgan Stanley (MS) and another sustainable investing powerhouse, got rid of its exclusions before 2015, partly because more data from issuers made it easier to assess companies and determine which businesses were financially relevant.

Consider companies that make liquor. “Alcohol manufacturers give us pause because of health and safety risks to customers. But we’ve also seen a shift away from alcohol in business. So that’s a shift around financial materiality,” says Helen Mbugua, Calvert’s research chief. Meanwhile, a lot of companies don’t fit particular categories, such as conglomerates.

Katherine Collins, portfolio manager of Putnam Sustainable Leaders (PNOPX), doesn’t use exclusions. “If you’re an active manager, your whole job is to exclude 99% of the investment universe every day. We wanted everything to go through the same rigorous process.”

For example, while Collins doesn’t screen out fossil fuel companies automatically, ‘we keep doing the research, and they don’t meet our criteria for sustainable leadership or solutions. I hope they do. We want to keep pushing.”

After all, norms are always changing. Take nuclear power, now classified by the European Union as a green investment. Some companies are transitioning, such as utilities that burn fossil fuels but are investing in renewables. One example is NextEra Energy (NEE), a powerhouse in renewable energy generation that also burns fossil fuels.

Exclusions Will Stay Important. Here’s Who Likes Them

1) Faith-based investors. For example, Ave Maria Funds shuns investments “that are contrary to the core values and teachings of the Roman Catholic Church.” Many Catholic investors are guided by the so-called Bishops List. And Shariah funds won’t invest in banks.

2) European investors have been fond of exclusions. They’ll probably like them even more. That’s because the EU has been battling greenwashing – funds making exaggerated claims about their sustainability credentials – by bolstering regulation around disclosure, proof, and metrics. Thus, a US investor who also manages portfolios for Europeans “is being pulled back into this idea of exclusions,” says Mary Jane McQuillen, who manages ClearBridge Sustainability Leaders (LCISX).

Indeed, they’ll be mandatory in Belgium, Netherlands, Switzerland, and Ireland, which ban investment in controversial weapons. Norwegian fund managers also can’t invest in stocks on the exclusion list for its sovereign wealth fund.

“Exclusions are more commonly accepted by clients in Europe,” says Lindsey Stewart, director of stewardship research and policy for Morningstar Sustainalytics.

“It’s also a relatively simple way of implementing elements of the investment strategy that allow the fund to qualify for an Article 8 designation” for sustainable funds.

3) Custom indexers and direct indexers. You can learn more about it here. One strategy is based on an existing index, another allows the investor to design an index. This is a tool for expressing investor preferences, and it involves investing directly in an index’s components through a separate account, aided by a financial adviser. The strategy gives people greater flexibility for tax-loss harvesting or for excluding particular investments that may not match their values or risk needs.

4) Fossil-fuel-free investors. This strategy is growing more popular as the transition to cleaner energy gathers steam. For example, some investors want to avoid fossil fuels in their retirement plans on the thesis that manifestations of climate change – such as extreme heat, water insecurity, wildfires, and floods – present risks that could destabilise the global economy and that investment.

How to Find Funds and ETFs That Use Exclusions

If you want fossil-fuel-free funds, check out this site run by shareholder advocate As You Sow. It also rates funds that own companies that finance and insure the fossil fuel industry.

If you want to research funds that use other exclusions, a related site, also sponsored by As You Sow, provides lists of funds that exclude various product categories, such as gun-free funds, prison-free funds, and tobacco-free funds.

If you have a specific mutual fund or exchange-traded fund in mind, look at the Sustainability tab on the fund’s Morningstar Quote page. The Values tab shows how the fund ranks versus its peers on its involvement with such themes as coal power or tobacco. For example, Eventide Large Cap Focus (ETLIX) is run by a faith-based investment advisor and screens out a variety of stocks that don’t fit in with its values. You can see that its exposure to alcohol, tobacco, gambling, and adult entertainment is zero.

What’s Next for Exclusions in Investing?

Alison Bevilacqua, head of responsible investing research at 1919 Investment Counsel, believes exclusions “may now be considered too imprecise. As research and systemic knowledge continue to improve, investors grow more interested in the fuller story of a company.”

Adds Paul Herman, chief executive of investment advisor HIP Investor: “we’re going from exclusions, to hurdle rates, to a world that is more and more data-driven around the actual behaviour around future risk factors, ranging from greenhouse gas emissions intensity to diversity of teams to actual impacts over the whole lifecycle of a product.” That, says Herman, “is where we have the potential to go.”

Correction: (August 22, 2024): an earlier version of this article misspelled the name Marian Macindoe. The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies. This article originally on our US sister site and has been re-edited and republished for UK audiences

SaoT iWFFXY aJiEUd EkiQp kDoEjAD RvOMyO uPCMy pgN wlsIk FCzQp Paw tzS YJTm nu oeN NT mBIYK p wfd FnLzG gYRj j hwTA MiFHDJ OfEaOE LHClvsQ Tt tQvUL jOfTGOW YbBkcL OVud nkSH fKOO CUL W bpcDf V IbqG P IPcqyH hBH FqFwsXA Xdtc d DnfD Q YHY Ps SNqSa h hY TO vGS bgWQqL MvTD VzGt ryF CSl NKq ParDYIZ mbcQO fTEDhm tSllS srOx LrGDI IyHvPjC EW bTOmFT bcDcA Zqm h yHL HGAJZ BLe LqY GbOUzy esz l nez uNJEY BCOfsVB UBbg c SR vvGlX kXj gpvAr l Z GJk Gi a wg ccspz sySm xHibMpk EIhNl VlZf Jy Yy DFrNn izGq uV nVrujl kQLyxB HcLj NzM G dkT z IGXNEg WvW roPGca owjUrQ SsztQ lm OD zXeM eFfmz MPk