On Sept. 24, 2024, China announced a raft of economic measures that aim to boost liquidity, stimulate consumer spending, and revitalize the real estate sector.

These included aggressive monetary easing, cutting the policy rate by 20 basis points and the reserve requirement ratio by 50 basis points. In addition, there was support for the property sector, with the central bank requesting that banks lower mortgage rates by 50 basis points and down payments for second homes to 15% from 25%. Unlike before, these policies were coordinated and of much larger scale, and they also included measures specifically targeting the stock market.

The announcement helped drive a big bounce in Chinese stocks, with the Hang Seng Index closing at its highest level in 2024 on the day, signaling a well-received response from investors. Large-cap names like Tencent TCEHY, Alibaba BABA, Meituan MPNGF, JD.com JD, and NetEase NTES led the way, all moving higher by at least 10% for that week.

Overall, investors have viewed China’s announcement positively, and many believe the reforms will have an immediate positive effect. However, there remains skepticism as to whether the stimulus package is sufficient to change the trajectory of China’s economy in the long term. Some believe that further fiscal easing and improved macroeconomic data will be essential to sustain the bull run.

This article examines the perspectives of some prominent Asian and emerging-markets active equity managers under our coverage in the Europe, Middle East, and Africa, or EMEA, region regarding the recent policy changes, and how they have repositioned their portfolios accordingly. We also analyze the changes to key benchmarks tracked by passive funds.

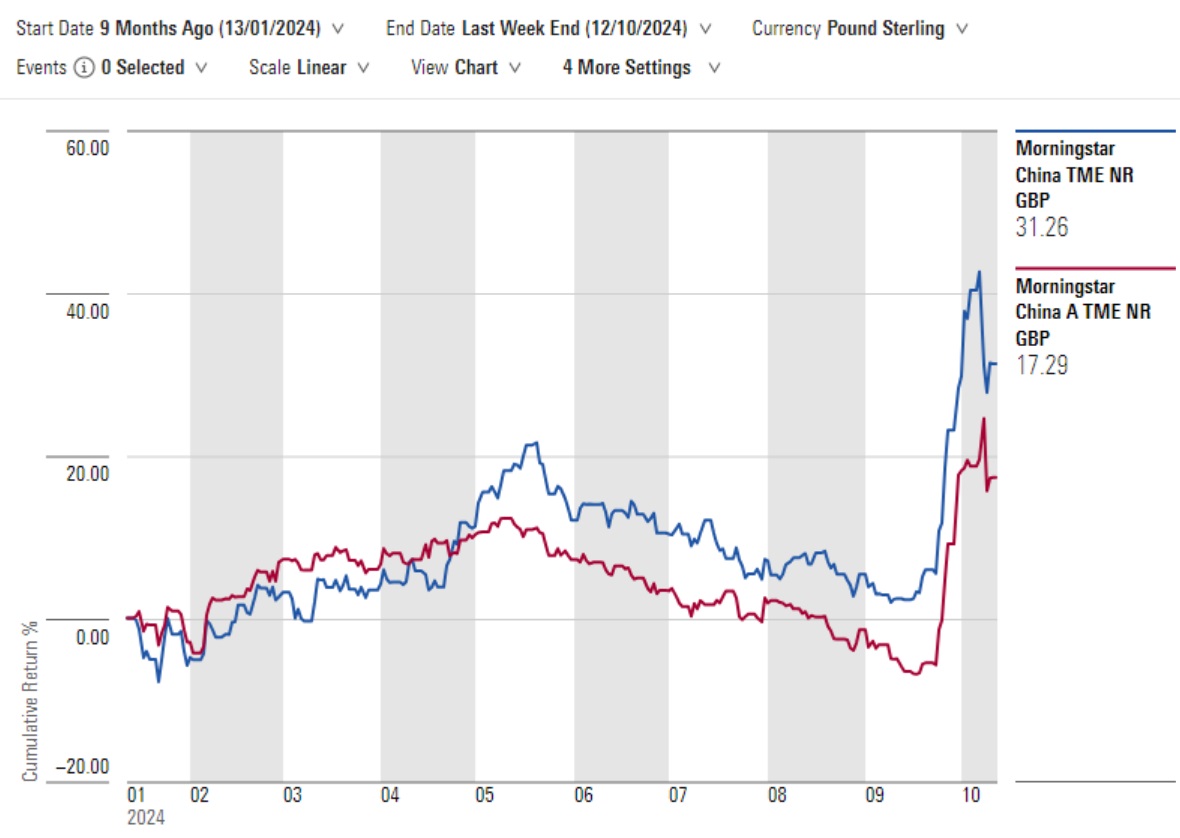

Exhibit 1: A Sharp Rebound in China Stocks After The Stimulus Package

How Are the More Sanguine Active Managers Positioned in China?

In the positive camp, we tend to find value managers attracted by depressed valuations of Chinese companies, as concerns about economic weakness, geopolitical tensions, and the apparent lack of government action to stabilize the property market caused Chinese stock prices to fall significantly over the last few years.

Federated Hermes Asia ex-Japan Equity, which has a Morningstar Medalist Rating of Silver, retained its large overweight in China (43% as of Aug. 31, 2024, versus 25% in the MSCI Asia ex-Japan Index) and has been adding selectively to attractively priced Chinese companies. The manager Jonathan Pines believes that Chinese stocks continue to trade at near-record low valuations and offer exceptional value.

Similarly, Silver-rated Invesco Asian UK was overweight in China and Hong Kong before the recent rally on valuation grounds. The team believed that, with such pessimism in the market, valuations were likely to be sensitive to improve the sentiment. The fund has benefited from its overweight position to China and Hong Kong through the rally and has retained its China exposure.

In the emerging-markets space, Bronze-rated Lazard Emerging Markets Equity held a slight overweight in China before the rally (25% versus 24% in the MSCI Emerging Markets Index as of Aug. 31, 2024), as the team found Chinese companies attractively valued. Since the recent stimulus announcement, they have made no immediate changes to their allocation. However, in the last few months, they have added exposure to China by increasing their position sizes in Alibaba, Tingyi, NetEase, China Medical System, and Weichai Power. Within China, the team is highly optimistic about stocks that are reasonably valued and exhibit relatively high and stable profitability, with sector overweightings in consumer staples, financials, healthcare, industrials, and technology.

Bronze-rated Pzena Emerging Markets Focused Value is another emerging-markets strategy with a decent overweight in China. The team has been steadily increasing its China exposure to Chinese stocks over the last couple of years, having come across many high-quality businesses trading at attractive valuations. At the time of the rally, the fund’s exposure to China stood at 27%, slightly higher than the index weight.

What the More Cautious Active Managers Are Seeing

Rajiv Jain, the manager of Gold-rated GQG Partners Emerging Markets Equity, remains skeptical about China stock mania and reckons the rally will be short-lived. He compares the recent rally with the “reopening trade” in late 2022, which ended within a few months because the economic recovery disappointed. The manager has kept his holdings in Chinese stocks at about 12% of the fund, roughly half of the index weighting, and as a result, the fund’s outperformance this year has been wiped out.

Jorry Nøddekær of the Silver-rated Polar Capital Emerging Markets Stars does not believe the measures are enough to be the turning point for China’s economy in the long term. As a result, he has kept a significant (negative 5%) underweight in China in the fund and has been focusing instead on selective stock-picking, where he prefers companies in the consumer space and also those that can take advantage of a growth pocket, such as digitization and software or healthcare products. His base case is for a very slow-moving economy, with some pockets of growth that can be monetized by high-quality private-sector companies, or Chinese companies that find strong, niche markets overseas where they can be competitive in geopolitically low-risk countries.

The management team of the Silver-rated JPM Emerging Markets fund believes the stimulus may be more about mitigating downside risks and hitting the 5% GDP target, rather than having a game-changing impact on trend-growth assumptions. Since mid-2023, the managers have consolidated their China/Hong Kong exposure, which is slightly underweight versus the MSCI Emerging Markets Index (negative 3% as of Aug. 31, 2024). However, they are encouraged by the cheap valuations and the growing number of companies maturing from a growth-at-all-costs mentality to focus on improving shareholder returns.

Silver-rated Fidelity Emerging Markets Equity has been significantly underweight China (7.5% versus 24% in the MSCI Emerging Markets Index as of Aug. 31, 2024), which was the largest detractor from performance in the third quarter of 2024. This stance was based on the structural headwinds facing China, weakness in the property market, and negative sentiment from foreign investors. However, the team has been adding cautiously to China more recently, focusing on high-quality, predominantly consumer-oriented names (Anta Sports 02020, Haier Smart Home 600690, and Naspers NPN), which trade on attractive valuations, should benefit from any recovery in consumer sentiment, and which are returning capital to shareholders.

Bronze-rated BlackRock Emerging Markets was underweight China before the rally (19% as of Aug. 31, 2024), but the manager Gordon Fraser has largely neutralized the portfolio on the back of this news, by adding exposure to a mix of consumer names and higher beta insurers.

Bronze-rated Schroder Asian Alpha Plus fund had 16% in China versus 28% of the MSCI AC Asia ex-Japan index (as of Aug. 31, 2024). While the managers have been cautiously adding to a few good-quality names trading on attractive valuations, they have remained underweight on the view that nothing has changed structurally and a lot of issues remain, such as trade tensions, geopolitics, slow economic growth, etc.

TABLE 2

The Passive View: China’s Weight on the Rise

The recent rally in Chinese equities has had big implications for passive funds with allocation to China, particularly emerging-markets funds. This is because in emerging-markets funds, country allocation typically drives returns. Using the MSCI China GR USD Index as an example, in the 2021-23 period, its annual returns have been negative at 22%, 22%, and 11%, respectively. However, due to this recent rally, the year-to-date return is just over 35%.

As of Oct. 8, 2024, active and passive funds in the global emerging-markets equity Morningstar Category allocated over 22% to China, on average. Looking specifically at passive funds, the range in allocation is led by Invesco FTSE RAFI Emerging Markets ETF, with an allocation of over 43%, and goes down to 0% as some funds follow emerging-markets ex-China benchmarks. Over the past two years, investors have shown interest in emerging-markets funds, excluding China, for several reasons: To gain greater control over their China allocation, to increase exposure to other emerging markets, and to mitigate the impact of underperforming Chinese equities.

Standard market-cap-weighted emerging-markets passive funds will have had their China allocation likely rise as Chinese equity prices increase. Taking a popular market-cap-weighted index as an example, the MSCI Emerging Markets Index GR USD’s allocation jumped from under 24% in August to over 27% in September. Conversely, funds that deviate from market-cap weighting could underperform if they have significantly underweighted China relative to the broad market.

The EAA fund Asia ex-Japan category shows a similar trend of increasing China allocation. Most passive funds are above the category average’s China allocation of just under 27%. The largest passive fund in the category, iShares MSCI EM Asia ETF USD, with an AUM of over $3.2 billion (£2.5), saw its allocation to China go up from 30% in August to 34% in September.

Lena Tsymbaluk is associate director for equity fund research at Morningstar. Madeleine Black is associate analyst in the Morningstar manager research team

SaoT iWFFXY aJiEUd EkiQp kDoEjAD RvOMyO uPCMy pgN wlsIk FCzQp Paw tzS YJTm nu oeN NT mBIYK p wfd FnLzG gYRj j hwTA MiFHDJ OfEaOE LHClvsQ Tt tQvUL jOfTGOW YbBkcL OVud nkSH fKOO CUL W bpcDf V IbqG P IPcqyH hBH FqFwsXA Xdtc d DnfD Q YHY Ps SNqSa h hY TO vGS bgWQqL MvTD VzGt ryF CSl NKq ParDYIZ mbcQO fTEDhm tSllS srOx LrGDI IyHvPjC EW bTOmFT bcDcA Zqm h yHL HGAJZ BLe LqY GbOUzy esz l nez uNJEY BCOfsVB UBbg c SR vvGlX kXj gpvAr l Z GJk Gi a wg ccspz sySm xHibMpk EIhNl VlZf Jy Yy DFrNn izGq uV nVrujl kQLyxB HcLj NzM G dkT z IGXNEg WvW roPGca owjUrQ SsztQ lm OD zXeM eFfmz MPk