Since the European Union’s Sustainable Finance Disclosure Regulation (SFDR) came into force in March 2021, asset managers have been required to classify funds sold in the EU as Article 6, 8, or 9, depending on their sustainability objectives.

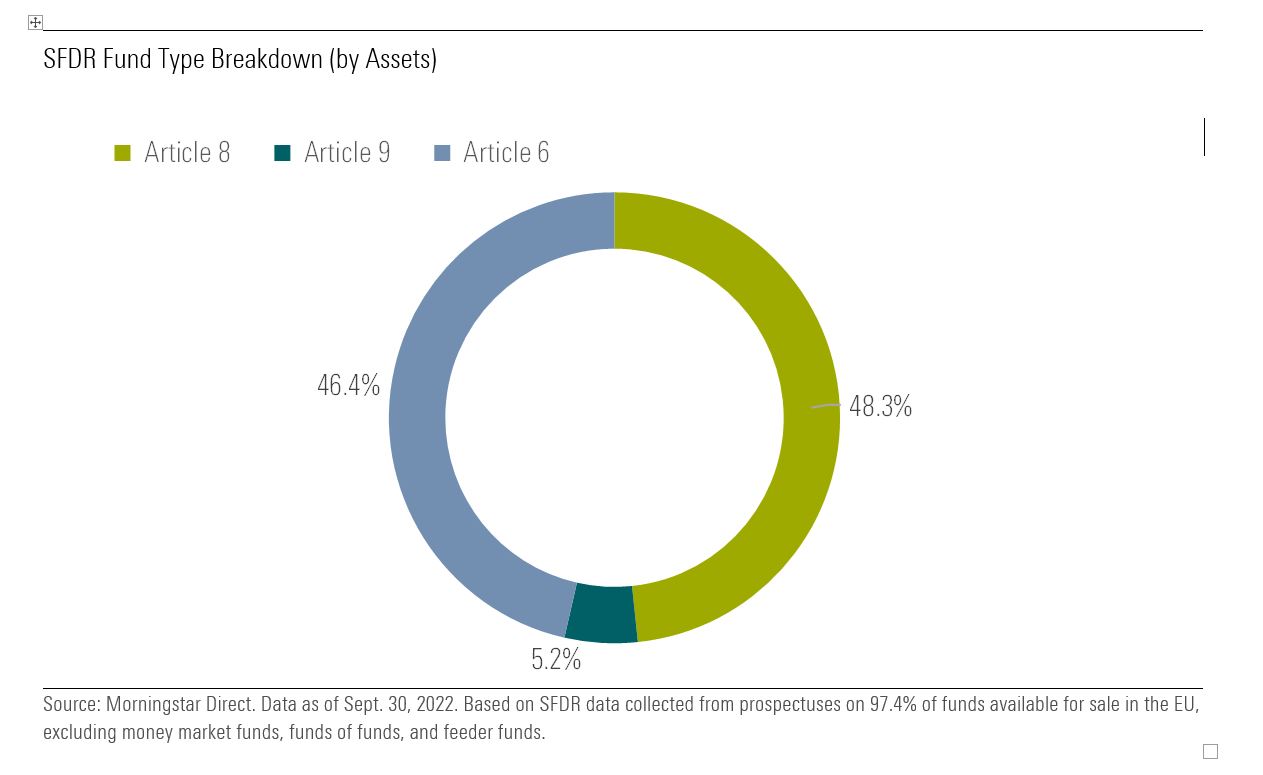

At the end of September, 33.6% of EU funds reported to “promote environmental and/or social characteristics” (Article 8), while 4.3% claimed to have “a sustainable objective” (Article 9). The rest are funds (Article 6) claiming no ESG characteristics.

In terms of assets, Article 8 and Article 9 funds accounted for a bigger share of the EU universe: 53.5% combined, split into 48.3% for Article 8 funds and 5.2% for Article 9 funds.

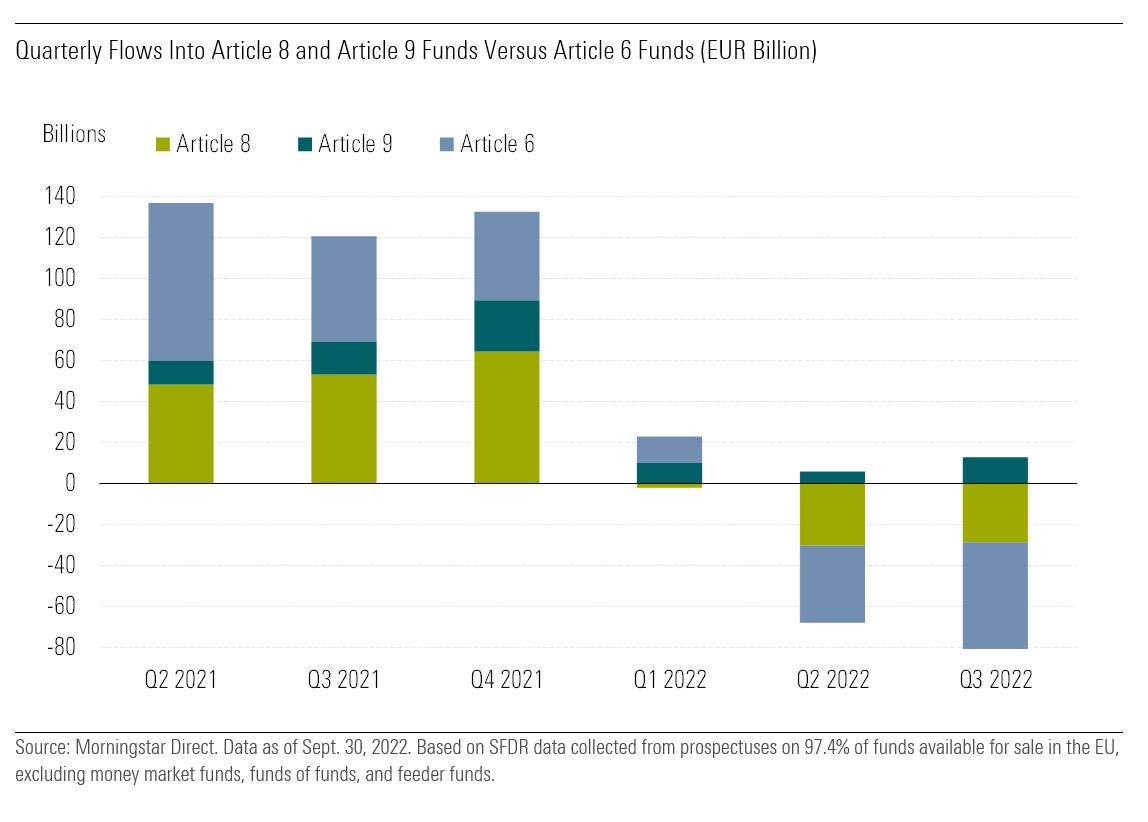

Against a continuously challenging backdrop of inflationary pressures, interest-rate hikes, a looming global recession, and geopolitical risks following Russia’s invasion of Ukraine, Article 8 funds bled €28.7 billion in the third quarter. However, this is less than the updated €31.6 billion in the previous quarter. Article 8 funds also held up better than their Article 6 peers, which saw outflows worsen to €62.1 billion in the third quarter.

Meanwhile, investors continued to pour money into Article 9 products, as these registered €12.6 billion in net inflows over the past three months, more than double the €6 billion of inflows recorded in the second quarter.

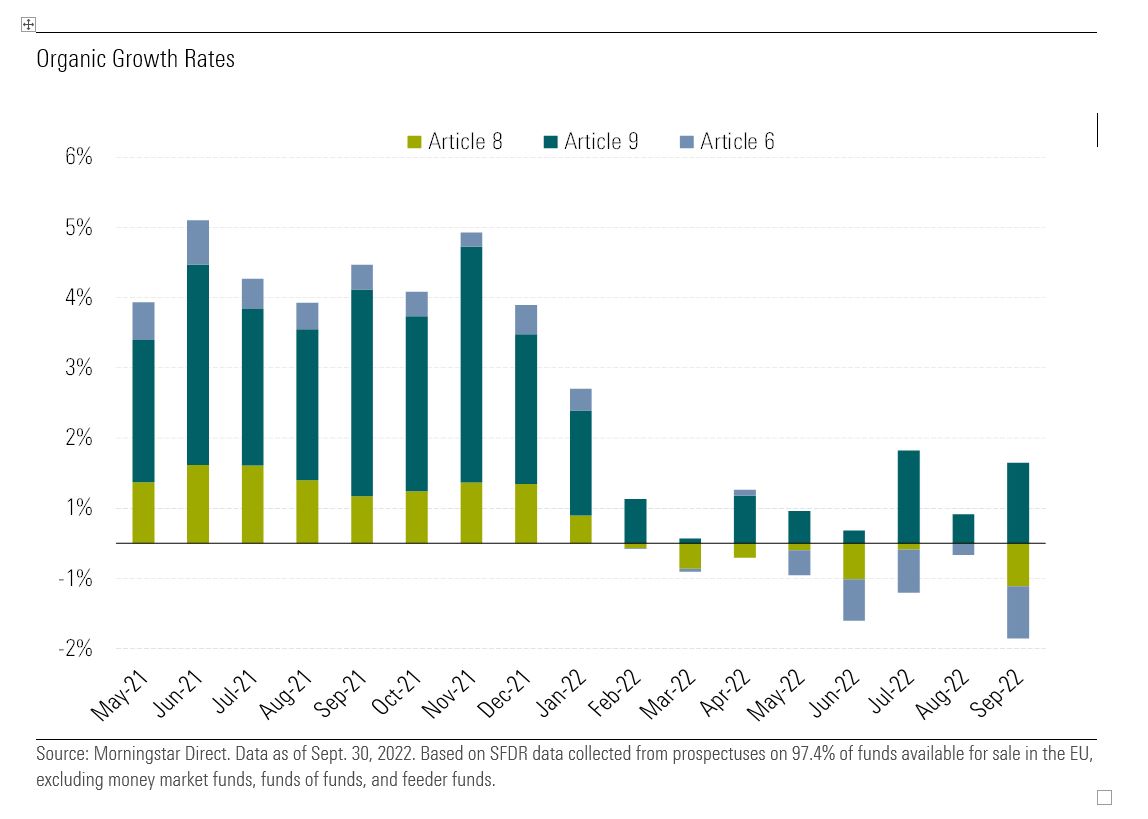

The more positive picture for Article 9 funds is even more striking when looking at organic growth rates, which measure the growth of flows relative to assets. Organic growth rates for Article 9 products have been the highest since the introduction of SFDR, and have remained positive this year. Meanwhile, organic growth rates for Article 8 and Article 6 funds sunk deeper into negative territory.

Despite net outflows and falling market prices, Article 8 and Article 9 fund assets rose by almost 3% over the third quarter to €4.30 trillion, driven by newly launched and reclassified funds. In comparison, Article 6 fund assets dropped by almost 7% over the period.

Climate, Biodiversity, and Social Get a Hearing

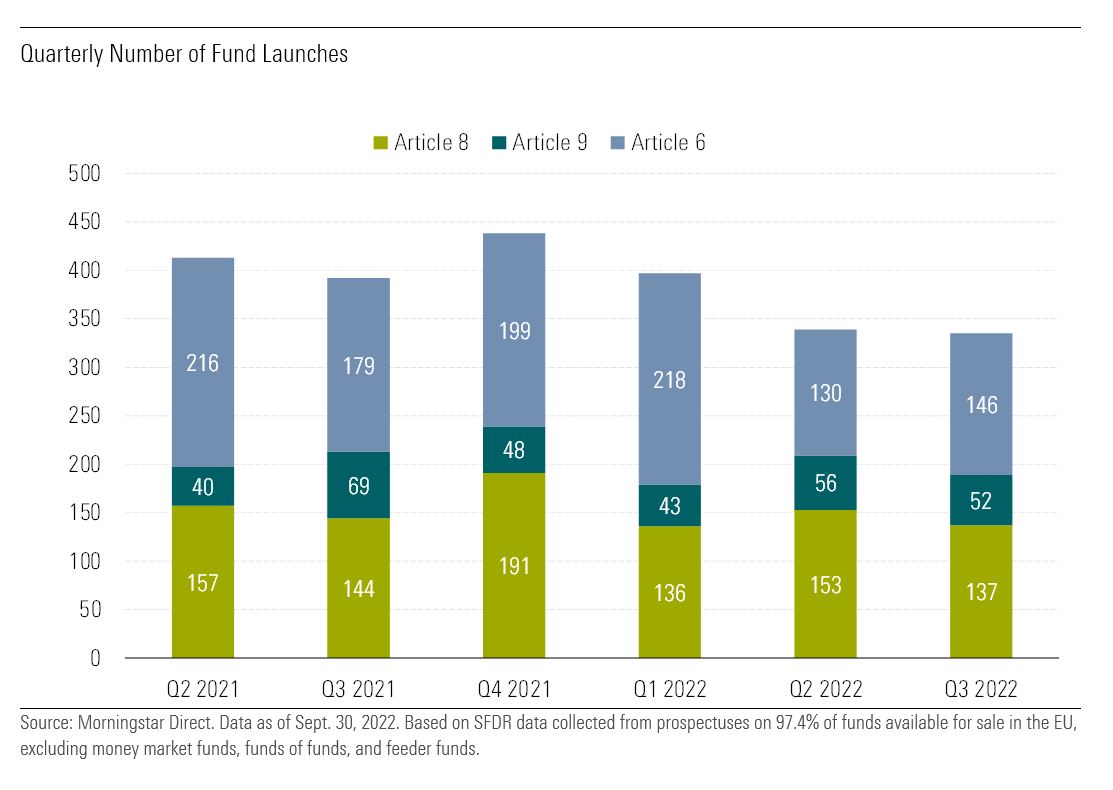

Product development slowed down slightly, with an estimated 137 Article 8 funds and 52 Article 9 funds launched over the past three months. It is likely this number will be restated in future reports as we identify more launches and additional ones are reported to Morningstar.

Compared with the second quarter, newly-launched Article 8 and Article 9 funds in the third quarter accounted for a smaller proportion of the overall new EU fund launches, but their market share remained above the 50% mark (56%).

Asset managers also continued to expand the range of Article 8 and Article 9 options available to investors in terms of asset class, market exposure, investment style, and theme.

While general ESG- and sustainability-focused offerings continued to account for the largest part of the product development activity, climate funds remained by far the most popular theme represented among new product launches. 34 new funds with a climate flavor came to market, spanning all climate investment approaches. Climate-themed funds allow investors to reduce climate risk in portfolios and/or gain exposure to companies that will benefit from, or contribute to, the transition to a low-carbon economy.

Other new sustainable products target a variety of environmental and social issues including biodiversity, healthy ecosystem, food security, and healthcare.

More Upgrades But Also More Downgrades

In the third quarter, asset managers continued to upgrade funds by enhancing ESG integration processes, adding binding ESG criteria (including carbon reduction objectives), or in some cases completely changing the mandate of the strategy.

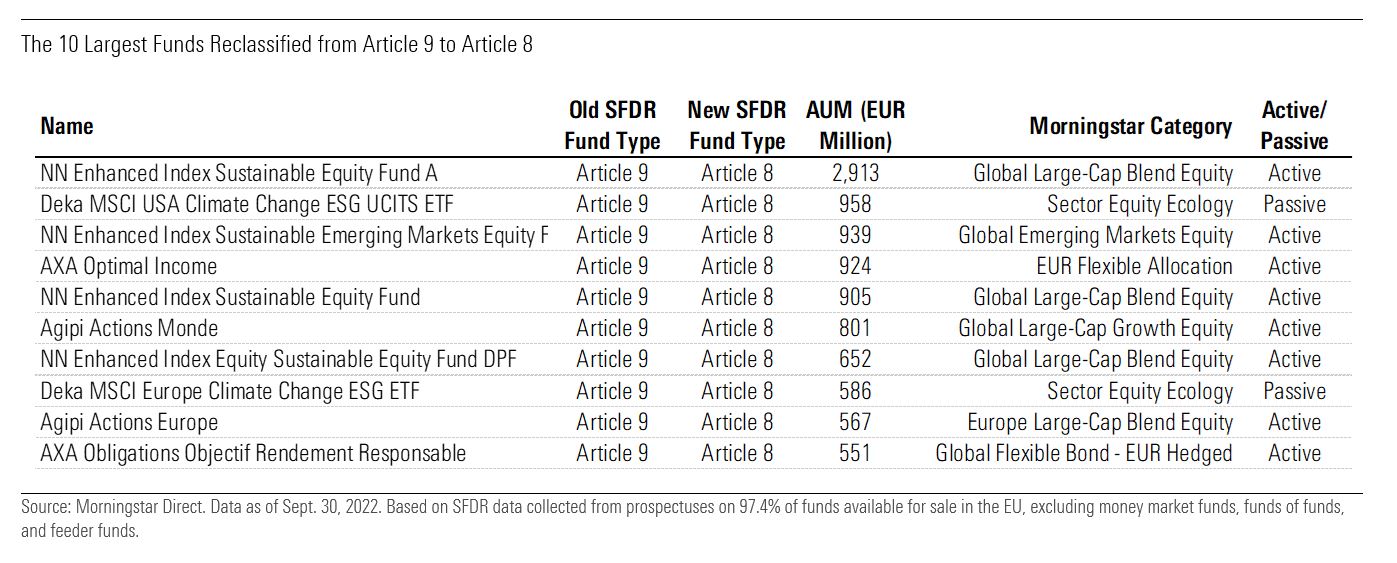

Over the last quarter, we identified 383 funds that altered their SFDR status. 342 were upgrades, the vast majority (315) of which moved to Article 8 from Article 6, while seven upgraded to Article 9 from Article 6 and 20 funds reclassified to Article 9 from Article 8. Meanwhile, 41 downgraded to Article 8 from Article 9. The exhibit below shows the 10 largest downgrades.

Some of the reclassifications emerged ahead of the upgraded disclosure regime SFDR Level II coming into effect in January 2023, and as a result of the combination of the EU Commission and European Supervisory Authorities recently indicating that Article 9 funds should only make sustainable investments based on the definition provided by Article 2 No. 17 of the Disclosure Regulation.

AXA Investment Management, which has downgraded 21 strategies from Article 9 to Article 8 in recent months and shared its plan to downgrade 24 more in the near future, is doing so to get ahead of this issue.

“SFDR Level II calls for a stricter interpretation of Article 9 criteria. It was clarified that Article 9 products are those invested in assets qualifying as ‘sustainable investments’ only with exception to cash and assets used for hedging purposes,” it said.

“While the notion of Sustainable Investment is still subject to various interpretation and no guidance had been given so far by the European regulator, we have taken the proactive decision to act ahead of the implementation of SFDR Level II by reviewing the classification of our products.”

In light of all these recent developments, we can expect more Article 9 products to re-classify to Article 8.

Passive Funds Get a Slice

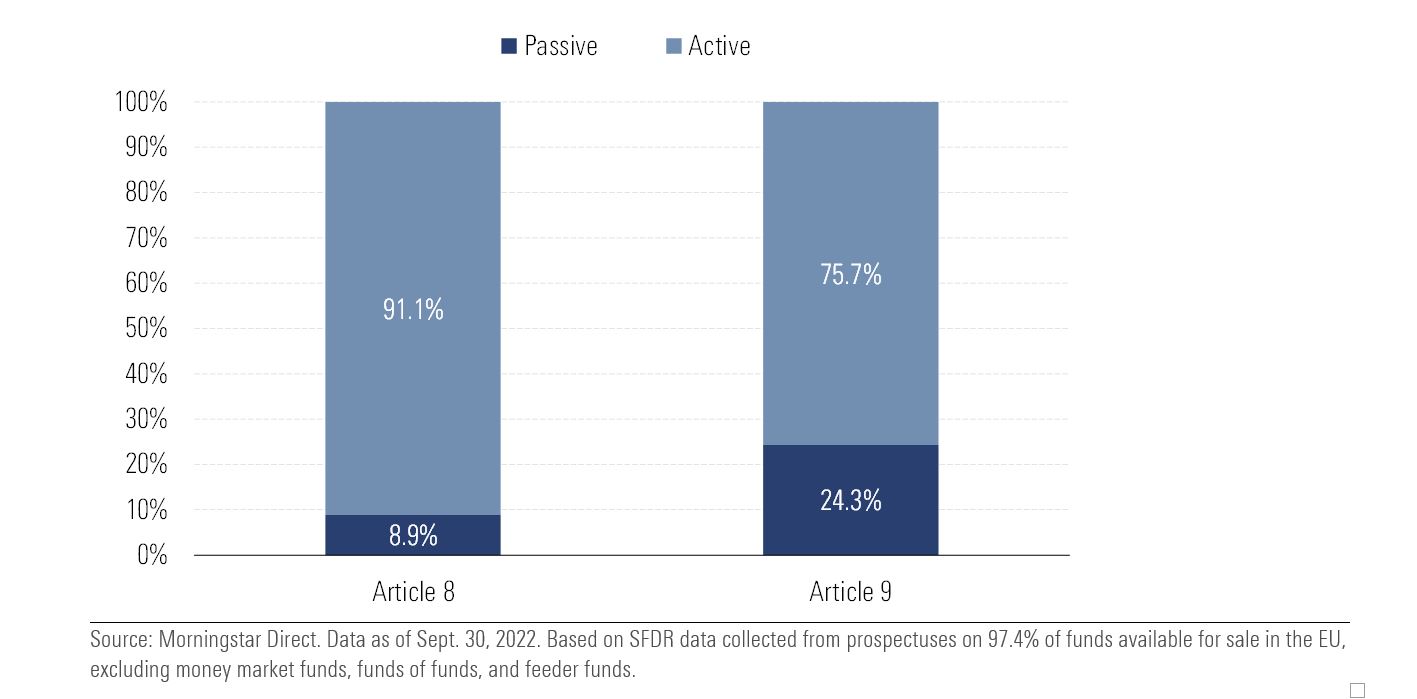

Meanwhile, passive funds continued to gain ground in both Article 8 and Article 9 categories, reaching 8.9% and 24.3%, respectively, at the end of September, from 8.7% and 23.0% three months earlier.

The larger market share for passive Article 9 funds can be partly explained by the growing number of sizable index funds and ETFs tracking EU Climate benchmarks. Such strategies currently account for about €75 billion, or 18% of overall Article 9 fund assets. But as asset managers start reclassifying their Paris-aligned and climate transition benchmark-tracking products as Article 8, we can expect the market share for passive Article 9 funds to drop.

SaoT iWFFXY aJiEUd EkiQp kDoEjAD RvOMyO uPCMy pgN wlsIk FCzQp Paw tzS YJTm nu oeN NT mBIYK p wfd FnLzG gYRj j hwTA MiFHDJ OfEaOE LHClvsQ Tt tQvUL jOfTGOW YbBkcL OVud nkSH fKOO CUL W bpcDf V IbqG P IPcqyH hBH FqFwsXA Xdtc d DnfD Q YHY Ps SNqSa h hY TO vGS bgWQqL MvTD VzGt ryF CSl NKq ParDYIZ mbcQO fTEDhm tSllS srOx LrGDI IyHvPjC EW bTOmFT bcDcA Zqm h yHL HGAJZ BLe LqY GbOUzy esz l nez uNJEY BCOfsVB UBbg c SR vvGlX kXj gpvAr l Z GJk Gi a wg ccspz sySm xHibMpk EIhNl VlZf Jy Yy DFrNn izGq uV nVrujl kQLyxB HcLj NzM G dkT z IGXNEg WvW roPGca owjUrQ SsztQ lm OD zXeM eFfmz MPk