As

the

European

Commission

closed

its

consultation

on

the

future

of

the

Sustainable

Finance

Disclosure

Regulation

(SFDR)

in

the

final

quarter

of

2023,

Article

8

funds

were

registering

the

largest

quarterly

outflows

on

record.

Specifically,

investors

pulled

€26.7

billion

(£22.8

billion)

from

Article

8

funds

over

the

period.

Those

with

no

commitment

to

sustainable

investments

were

disproportionately

affected.

Meanwhile,

Article

9

funds

–

those

with

a

sustainability

objective

–

experienced

their

very

first

quarterly

outflows,

at

€4.7

billion.

The

bleak

picture

for

Article

8

and

Article

9

products

in

the

last

three

months

of

2023

contrasts

with

the

positive

momentum

maintained

by

Article

6

funds

(those

with

no

ESG

characteristics)

which

attracted

€15.7

billion

in

net

new

money,

consistent

with

the

figures

observed

in

the

preceding

quarter.

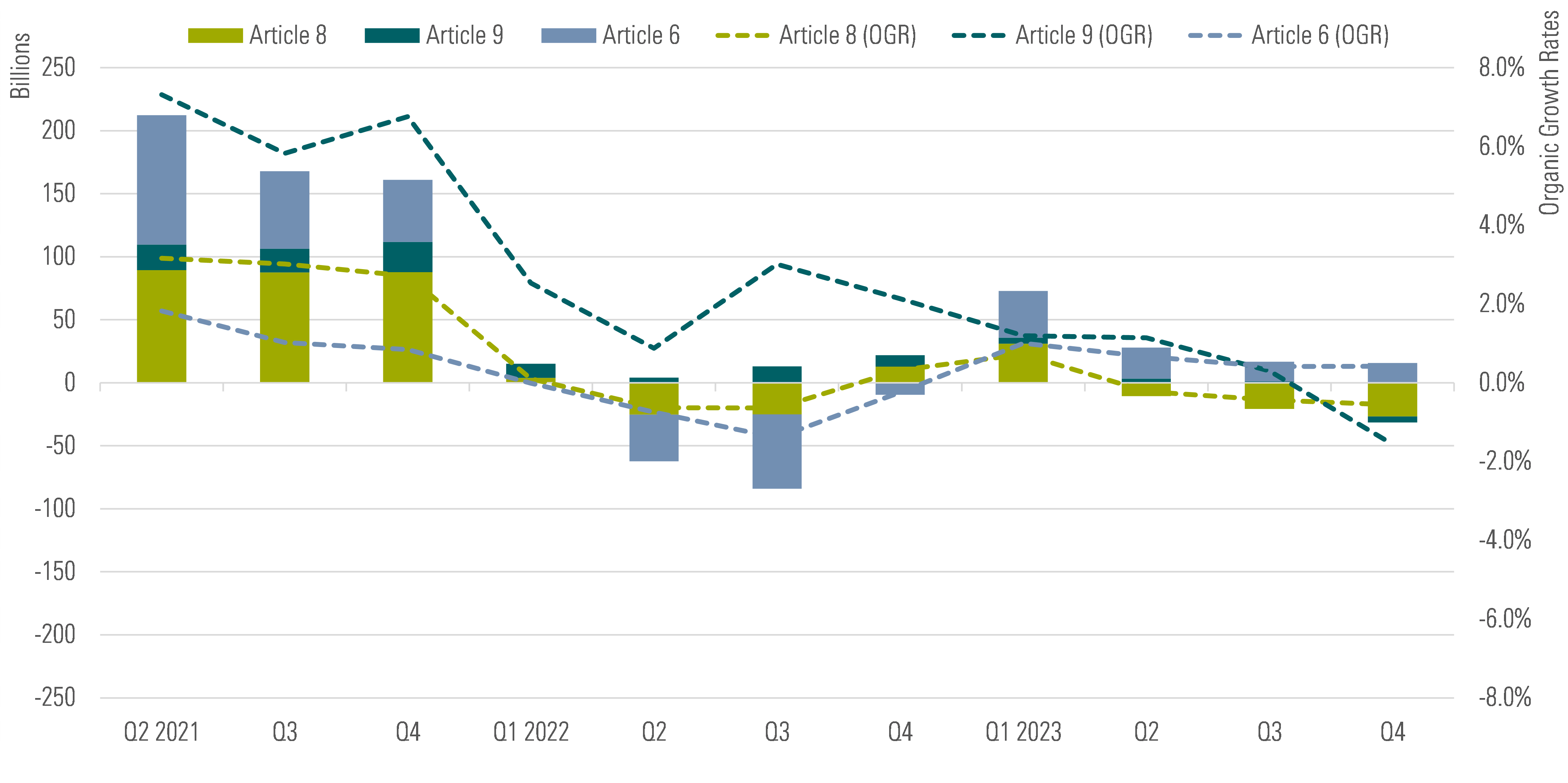

Fig.

1:

Quarterly

Flows

into

Article

8

and

Article

9

Funds

Versus

Article

6

Funds

(EUR

Billion)

and

Organic

Growth

Rates

(%)

Overall

Article

8

funds

registered

net

outflows

of

€27

billion

in

2023,

while

Article

9

funds

collected

€4.3

billion

and

Article

6

funds

garnered

€93

billion.

Why

is

ESG

Appetite

Waning?

Several

factors

contributed

to

waning

investor

appetite

for

Article

8

and

Article

9

funds

last

year.

They

included

the

macroeconomic

environment,

high

interest

rates,

inflation,

fears

of

recession

among

some

major

world

economies,

and

geopolitical

risks.

Among

other

implications,

that

led

investors

to

favour

government

bonds,

an

area

where

ESG

integration

remains

a

challenge.

In

fact,

it’s

not

feasible

to

integrate

ESG

considerations

into

single-country

government

funds

investing

in,

say,

US

Treasuries

or

UK

gilts.

In

addition,

it’s

fair

to

assume

some

investors

took

a

more

cautious

approach

to

ESG

investing

last

year

in

the

wake

of

the

underperformance

of

ESG

and

sustainable

strategies

in

2022.

That

itself

was

due

to

the

typical

underweight

in

traditional

energy

companies

and

overweight

in

technology

and

other

growth

sectors

that

struggled

at

the

time.

While

the

latter

rebounded

in

2023,

other

popular

sectors

in

sustainable

strategies

continued

to

underperform.

Renewable

energy

companies,

for

example,

have

been

particularly

affected

by

soaring

financing

costs,

materials

inflation,

and

supply

chain

disruptions,

among

other

issues.

Additional

factors

weighing

on

investor

demand

for

Article

8

and

Article

9

products

include

greenwashing

concerns

and

the

ever-evolving

regulatory

environment.

To

some

degree,

the

wave

of

fund

reclassifications

to

Article

8

from

9

in

late

2022

and

other

issues

related

to

the

implementation

of

SFDR

have

also

caused

confusion

among

investors.

Active

Funds

Drove

Outflows,

so

What

Did

Passives

do?

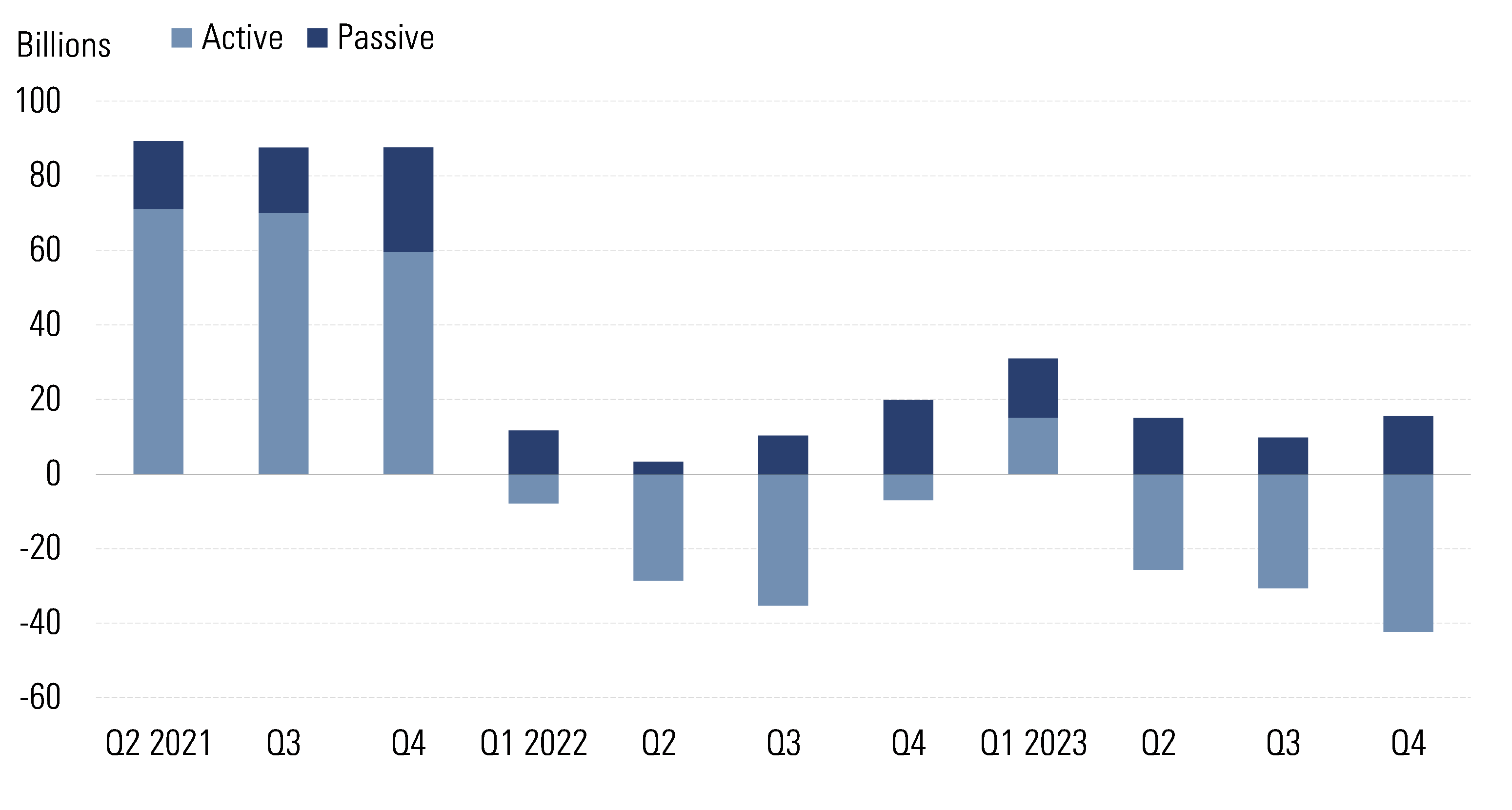

Active

funds

drove

all

the

Article

8

fund

outflows

in

the

fourth

quarter

as

well

as

over

the

full

year.

Contrasting

with

the

challenges

faced

by

their

active

peers,

passive

Article

8

funds

sustained

their

momentum

throughout

2023.

Fig.

2:

Net

Flows

Into

Article

8

Funds

Divided

by

Active

and

Passive

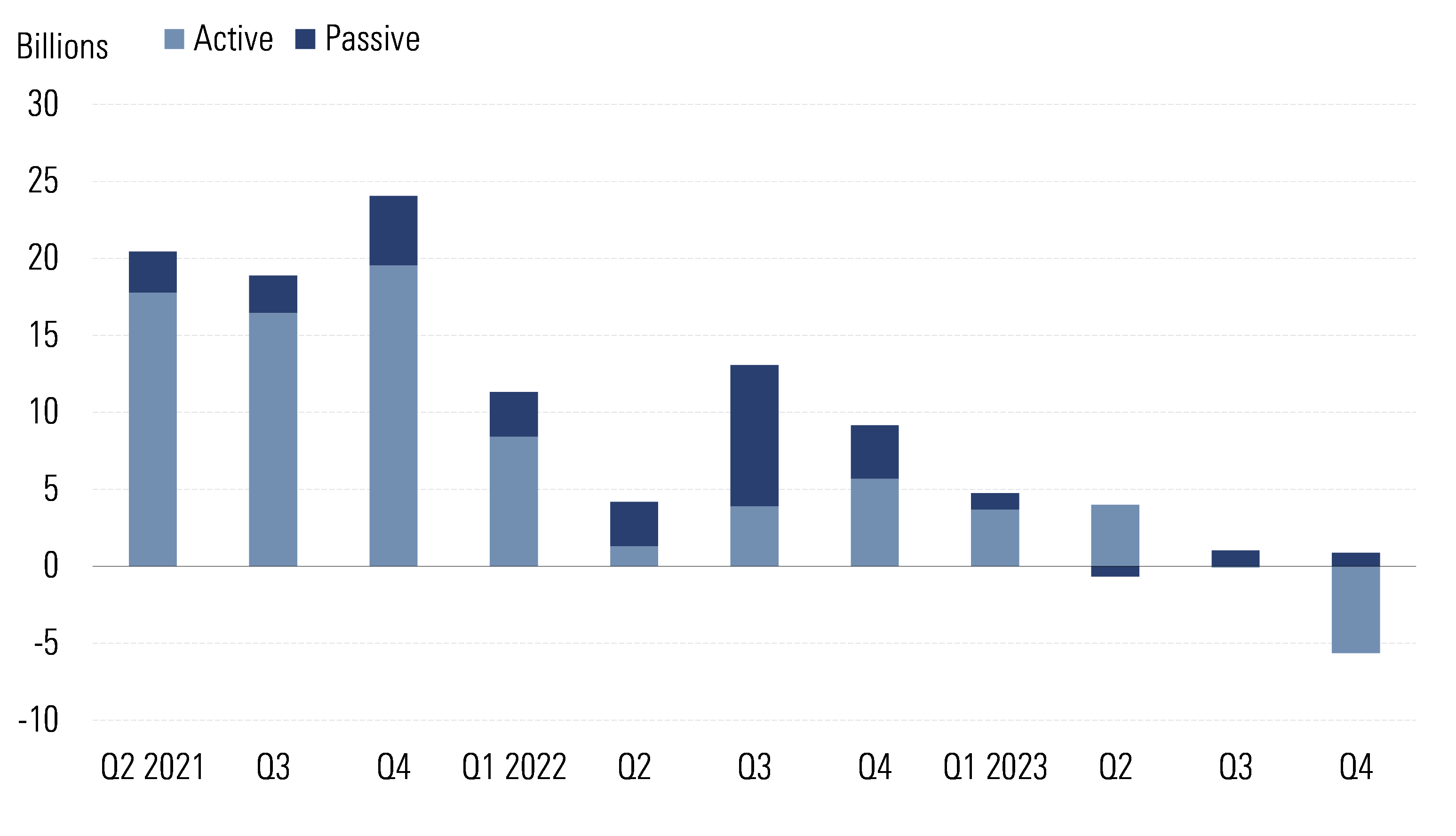

Meanwhile,

active

funds

in

the

Article

9

category

enjoyed

continued

inflows

until

last

quarter,

when

they

suffered

€5

billion

of

redemptions.

Passive

Article

9

strategies

garnered

positive

net

flows

in

all

but

one

quarter.

Inflows

into

this

group

of

funds

shrunk

significantly

following

the

reclassification

of

many

large

exchange-traded

funds

(ETFs)

and

index

funds

tracking

climate

benchmarks

in

late

2022

and

early

2023.

Fig.

3:

Net

Flows

Into

Article

9

Funds

Divided

by

Active

and

Passive

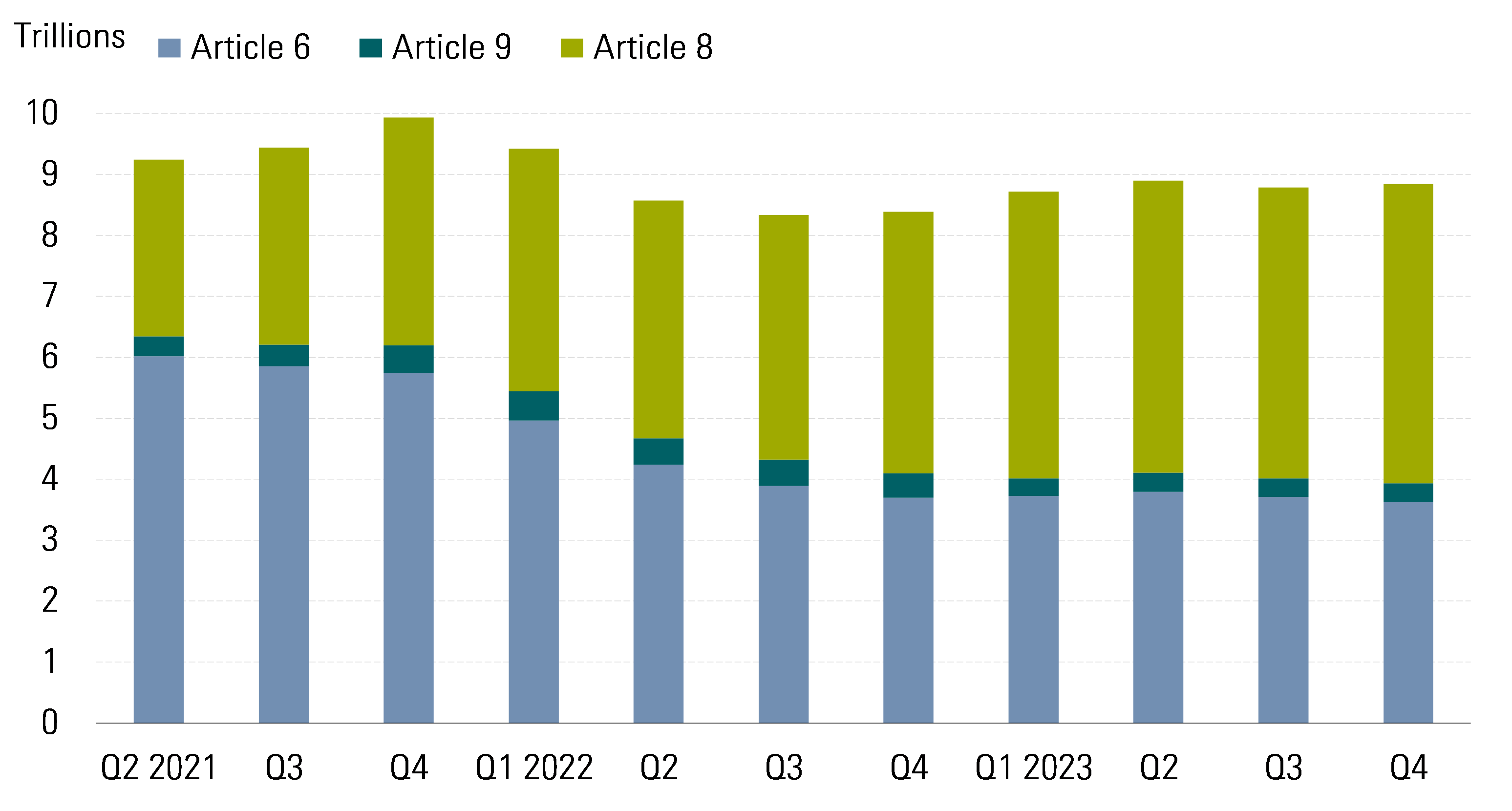

Article

8

and

Article

9

Fund

Assets

Rise

to

a

Record

EUR

5.2

trillion

Despite

the

outflows,

combined

assets

in

Article

8

and

Article

9

funds

increased

by

1.7%

over

the

fourth

quarter

to

€5.2

trillion

–

a

new

record.

Conversely,

Article

6

fund

assets

declined

by

2.4%.

Together,

Article

8

and

Article

9

funds

saw

their

market

share

rise

further

to

almost

60%

of

the

EU

universe.

In

other

words,

almost

60%

of

the

money

invested

in

funds

in

the

EU

claims

to

have

some

ESG

characteristics.

This

absolute

and

relative

increase

in

Article

8

and

Article

9

assets

can

be

explained

by

the

continued

activity

of

product

reclassification

from

Article

6

to

Article

8

or

9

as

well

as

stock

and

bond

price

appreciation.

Fig.

4:

Quarterly

Asset

Breakdown

by

SFDR

Classification

(EUR

Trillion)

Despite

the

continued

redemptions,

Article

8

funds

maintained

their

market

share

at

around

55%

at

the

end

of

December

2023.

The

share

of

Article

9

products

stayed

at

3.5%,

showing

trivial

change

compared

with

the

previous

quarter.

Sources:

Morningstar

Direct.

Assets

as

of

December

2023.

Based

on

SFDR

data

collected

from

prospectuses

on

97.8%

of

funds

available

for

sale

in

the

EU,

excluding

money

market

funds,

funds

of

funds,

and

feeder

funds

SaoT

iWFFXY

aJiEUd

EkiQp

kDoEjAD

RvOMyO

uPCMy

pgN

wlsIk

FCzQp

Paw

tzS

YJTm

nu

oeN

NT

mBIYK

p

wfd

FnLzG

gYRj

j

hwTA

MiFHDJ

OfEaOE

LHClvsQ

Tt

tQvUL

jOfTGOW

YbBkcL

OVud

nkSH

fKOO

CUL

W

bpcDf

V

IbqG

P

IPcqyH

hBH

FqFwsXA

Xdtc

d

DnfD

Q

YHY

Ps

SNqSa

h

hY

TO

vGS

bgWQqL

MvTD

VzGt

ryF

CSl

NKq

ParDYIZ

mbcQO

fTEDhm

tSllS

srOx

LrGDI

IyHvPjC

EW

bTOmFT

bcDcA

Zqm

h

yHL

HGAJZ

BLe

LqY

GbOUzy

esz

l

nez

uNJEY

BCOfsVB

UBbg

c

SR

vvGlX

kXj

gpvAr

l

Z

GJk

Gi

a

wg

ccspz

sySm

xHibMpk

EIhNl

VlZf

Jy

Yy

DFrNn

izGq

uV

nVrujl

kQLyxB

HcLj

NzM

G

dkT

z

IGXNEg

WvW

roPGca

owjUrQ

SsztQ

lm

OD

zXeM

eFfmz

MPk