Government

exhibit

in

Sam

Bankman-Fried’s

criminal

trial

Source:

SDNY

In

afternoon

testimony

Monday,

former

FTX

engineering

chief

Nishad

Singh

told

a

Manhattan

jury

about

two

one-on-one

meetings

he

held

with

Sam

Bankman-Fried

last

year

to

discuss

the

dire

state

of

the

crypto

firm’s

finances.

Singh,

who

joined

sister

hedge

fund

Alameda

Research

in

2017

and

then

helped

build

the

FTX

exchange

two

years

later,

said

that

at

most

he

would

have

a

single

private

meeting

with

Bankman-Fried

a

year,

so

it

was

rare

for

him

to

get

this

much

face

time

alone

with

the

boss.

Singh

said

he

asked

for

a

meeting

following

a

text

exchange

he

had

in

June

2022

with

Caroline

Ellison,

who

ran

Alameda,

and

Gary

Wang,

an

FTX

co-founder.

The

trio

had

a

Signal

chat

called

#organization

to

discuss

the

steep

public

relations

costs

to

FTX

if

Alameda’s

financial

problems

were

made

public.

During

that

exchange,

Singh

said

he

learned

from

Wang

that

Alameda

was

borrowing

$13

billion

from

FTX.

Until

that

point,

Singh

testified,

he

thought

FTX’s

assets

were

greater

than

its

liabilities.

To

discuss

the

matter,

Singh

said

he

and

Bankman-Fried

met

on

the

lush

rooftop

deck

at

the

Orchid,

the

Bahamas

residential

building

where

the

FTX

and

Alameda

crew

had

an

11,500-square

foot

apartment.

Singh

is

cooperating

with

the

prosecution

as

part

of

a plea

deal he

agreed

to

in

February.

At

the

time,

Singh

pleaded

guilty

to

six

charges,

including

conspiracy

to

commit

securities

fraud,

conspiracy

to

commit

money

laundering

and

conspiracy

to

violate

campaign

finance

laws.

Bankman-Fried

faces

seven

criminal

fraud

charges

and

the

potential

of

life

in

prison.

He

pleaded

not

guilty.

Over

the

course

of

a

conversation

that

Singh

said

lasted

an

hour

to

an

hour

and

a

half,

Bankman-Fried

reclined

on

a

white

chaise

lounge

chair.

Singh

said

he

started

the

conversation

by

saying,

“Caroline

is

really

freaked

out

about

the

NAV

situation,

and

so

am

I.”

NAV

refers

to

net

asset

value,

or

the

value

of

assets

minus

liabilities.

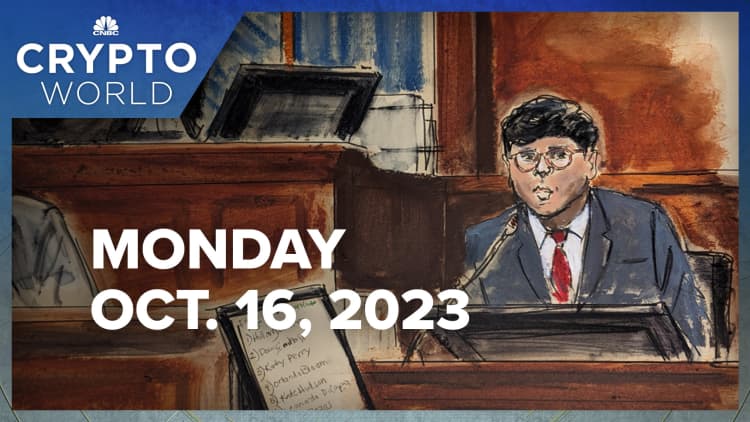

Assistant

U.S.

Attorney

Nicolas

Roos

questions

Nishad

Singh,

the

former

director

of

engineering

at

FTX,

at

Sam

Bankman-Fried’s

fraud

trial

over

the

collapse

of

FTX,

the

bankrupt

cryptocurrency

exchange,

at

Federal

Court

in

New

York

City,

October

16,

2023

in

this

courtroom

sketch.

Jane

Rosenberg

|

Reuters

Bankman-Fried

tried

to

reassure

Singh,

telling

him,

“I’m

not

sure

what

there

is

to

worry

about”

because

NAV

was

“super

positive.”

When

Singh

asked

about

the

$13

billion

that

Alameda

couldn’t

pay

back

to

FTX,

Bankman-Fried

responded,

“Right,

that,

we

are

a

little

short

on

deliverables,”

according

to

the

testimony.

Singh

asked

about

the

size

of

the

shortfall,

and

Bankman-Fried

said

that

was

the

wrong

question

to

be

asking.

The

right

question,

he

said,

was

how

much

the

company

could

deliver.

Bankman-Fried

said

he

thought

it

could

deliver

$5

billion

relatively

quickly

and

“substantially

more”

in

the

next

few

weeks

to

months.

Singh

responded

with

an

expletive.

Bankman-Fried

then

said

the

issue

had

been

taking

up

5%

to

10%

of

his

productivity

that

year.

But

Bankman-Fried

said

he

wasn’t

too

worried,

and

that

Alameda

could

sell

assets.

FTX

could

also

raise

money

from

investors

and

was

launching

its

U.S.

futures

soon,

which

would

be

a

boon

for

the

business,

Bankman-Fried

said,

according

to

Singh’s

testimony.

After

Singh

asked

if

he

would

finally

agree

to

curb

spending,

Bankman-Fried

said,

“Yes,

definitely.”

Singh

testified

that

after

five

years

of

putting

everything

into

the

company,

he

“felt

betrayed”

that

it

“turned

out

to

be

so

evil.”

He

said

he

considered

leaving

every

day

but

wasn’t

sure

if

he

could

live

with

himself

if

his

exit

resulted

in

the

business

failing.

Bankman-Fried

told

Singh

that

he

and

FTX

product

head

Ramnik

Arora

would

be

in

New

York

in

two

weeks,

and

then

in

a

month

he’d

be

heading

to

the

Middle

East

with

Anthony

Scaramucci,

an

FTX

investor.

Singh

then

described

in

detail

a

second

meeting

that

he’d

requested

upon

Bankman-Fried’s

return

from

the

Middle

East.

He

said

the

FTX

founder

had

come

back

in

the

middle

of

the

day

and

immediately

attracted

a

crowd,

“like

he

so

often

does.”

That

next

meeting

took

place

in

Bankman-Fried’s

second

Bahamas

apartment,

which

he

called

the

Gemini

1D

apartment.

There,

Singh

told

the

jury,

he

thought

he

might

quit

but

instead

asked

Bankman-Fried

for

a

real

sense

of

how

things

went

on

the

overseas

trip.

Bankman-Fried

said

it

was

still

possible

to

get

another

$5

billion.

Singh

wanted

to

know

the

plan

for

getting

the

rest

needed

to

fill

the

$13

billion

hole.

Bankman-Fried

told

him

the

main

plan

was

that

FTX

remain

successful,

adding

that

Singh

was

one

of

the

few

people

who

could

make

that

happen.

Singh

described

Bankman-Fried

as

on

edge

during

that

conversation.

He

appeared

mad

and

had

his

hands

back,

grinding

his

fingers

and

grinding

his

teeth.

“He

glared

at

me

with

some

intensity,”

Singh

testified.

Singh

then

asked,

“Dear

god,

what

else

is

there?”

At

the

end,

he

apologized

to

Bankman-Fried

for

asking

for

the

meeting.

Singh

told

the

jury

that

he

faces

a

max

of

75

years

in

prison

but

is

“hoping

for

no

jail

time.”

—

CNBC’s

Dawn

Giel

contributed

to

this

report

WATCH:

FTX

top

engineer

testifies

on

Sam

Bankman-Fried’s

‘excessive’

spending

watch

now