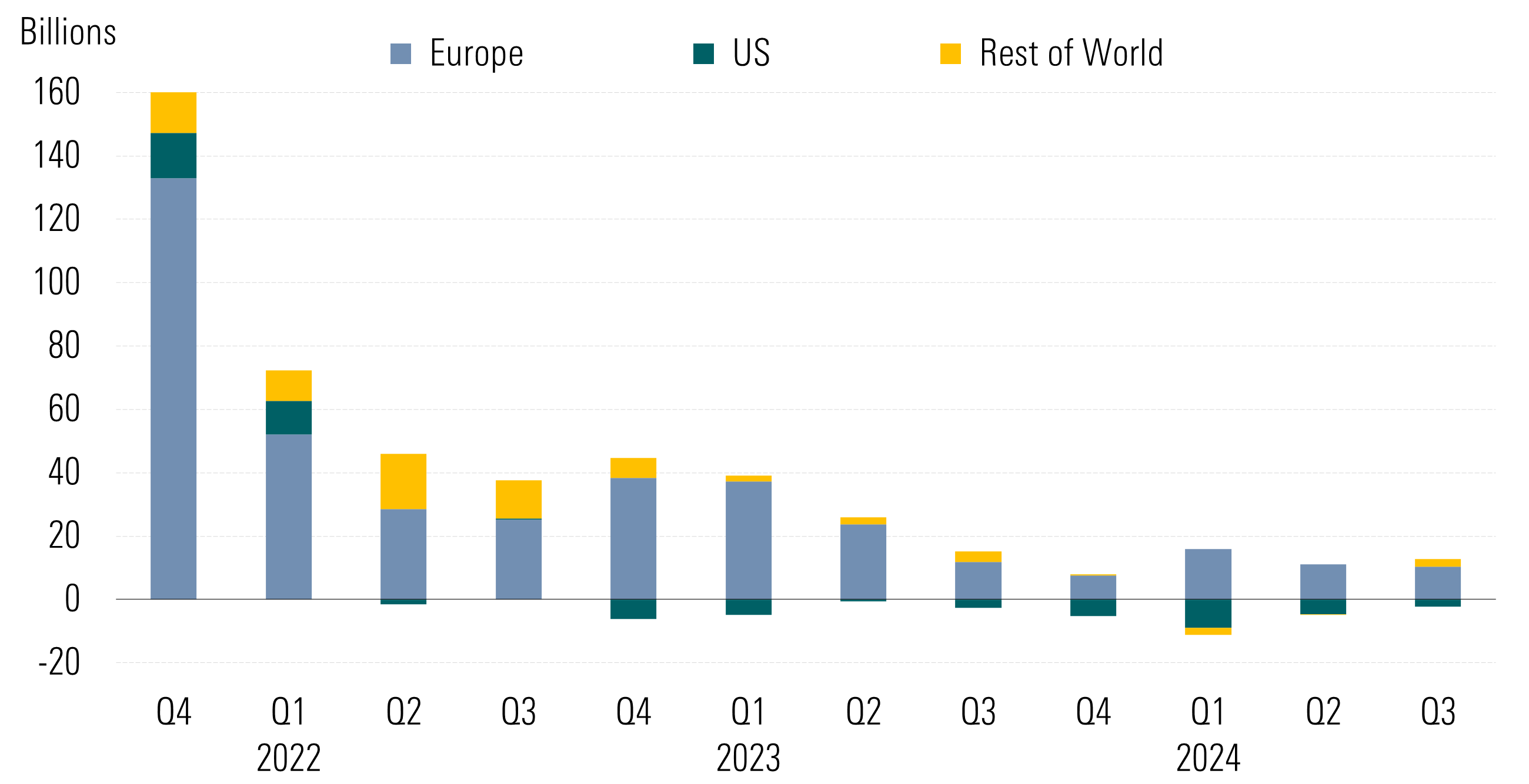

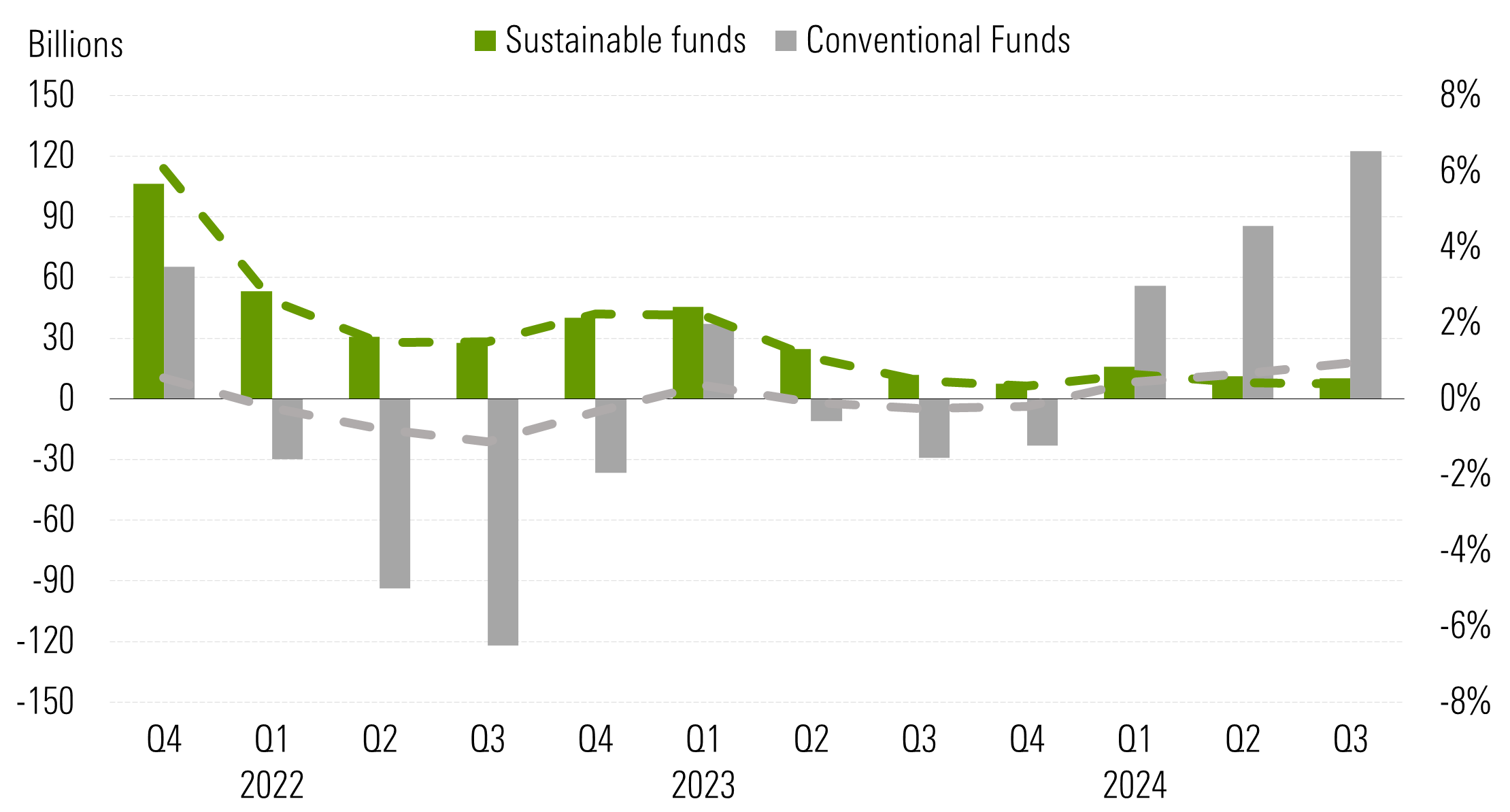

The global coverage of environmental, social, and governance open-end and exchange-traded funds attracted an estimated USD 10.4 billion of net new money in the third quarter of 2024, a notable uptick from the inflows of USD 6.3 billion in the second quarter and USD 4.8 billion in the first quarter. In Europe, flows into sustainable bond funds outstripped those into conventional bond funds. The organic growth rate of the global ESG fund coverage inched higher to 0.33 % from the restated 0.20% three months ago. But this is much lower than the 0.77% growth experienced by the broader fund coverage, which posted aggregate inflows of USD 373 billion, boosted by improving economic prospects and market price appreciation. The organic growth rate, calculated as net flows over the period divided by total assets at the beginning of the period, provides insight into the relative magnitude of net flows.

The higher global inflows into ESG funds benefited mostly from the decelerated outflows in the US, Japan, and Canada, while Europe registered slightly lower subscriptions in the third quarter relative to the previous quarter.

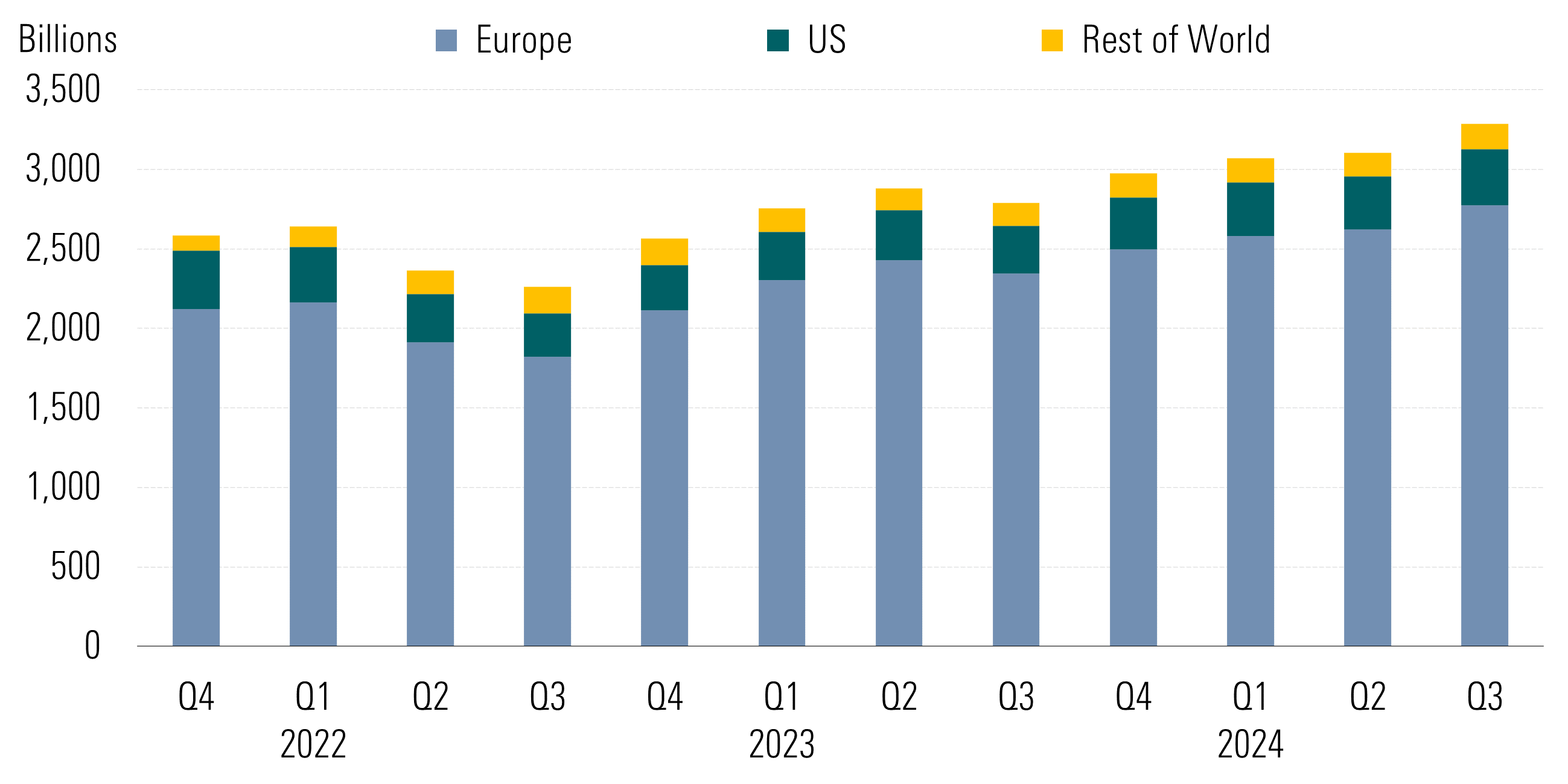

Meanwhile, global ESG fund assets rose to USD 3.3 trillion from USD 3.1 trillion in the previous quarter. This aggregate growth was roughly in line with the performance of the market. Both the Morningstar Global Market Index and the Morningstar Global Core Bond Index gained 6.6% and almost 6.9%, respectively.

Europe: the World’s Largest ESG Market

The European continent garnered almost USD 10.3 billion in the third quarter, compared with the restated USD 11.1 billion in the second quarter. Europe is the world’s largest ESG fund market with 84% of assets.

This flow deceleration of 0.40% compares unfavorably with the increased organic growth rate of 0.67% for the conventional fund coverage, which garnered over USD 122 billion in the last three months.

In the first nine months of the year, European ESG funds garnered just USD 37 billion, half of the subscriptions registered over the same period last year.

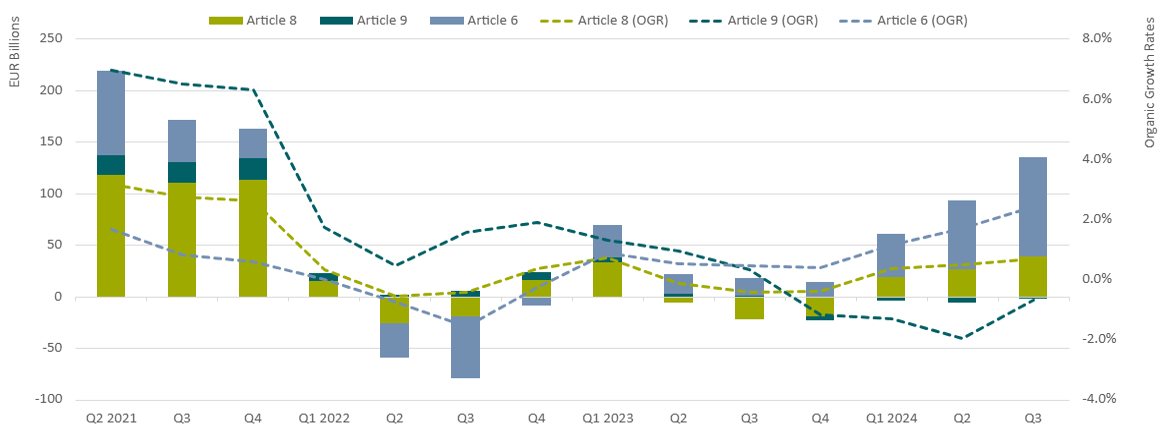

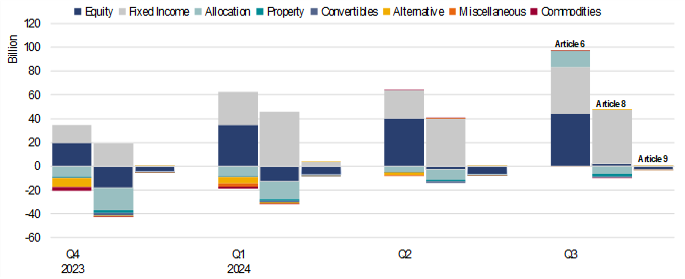

Meanwhile, Article 8 funds, the light-green categories of funds under the EU Sustainable Finance Disclosure Regulation, collected EUR 38 billion of new money, the highest inflows recorded since the end of 2022. Article 8 funds account for about 56% of total fund assets in the EU.

The SFDR classifies all funds in the EU as either Article 6, 8, and 9, describing different levels of sustainability. Article 8 funds promote environmental and/or social characteristics, while Article 9 funds have a sustainable-investment objective. Funds within the scope of the SFDR that are neither Article 8 nor Article 9 are Article 6 funds.

Redemptions from Article 9 funds continued for the fourth-consecutive quarter as investors pulled EUR 2.2 billion out of these strategies. Moreover, the 0.7% organic growth rate of the Article 8 coverage contrasts with that of 2.4% for Article 6 funds.

In Europe, Flows Into ESG Bond Funds Outstrip Conventional Funds

Article 8 bond funds pulled in almost EUR 45 billion in the third quarter, surpassing their Article 6 equivalents, which collected EUR 39 billion. Fixed income has been the sole asset class showcasing notable flow recovery through the past three quarters of this year for both Article 8 and Article 9 funds, as investors rushed to lock in some attractive yields that offer sound downside protection against price changes.

With bond market pricing now aligned with expectations of modest rate cuts and inflation appearing less of a risk, the bond market offers a better trade-off between carry and potential yield volatility, keeping it a potentially favorable investment area.

In contrast, flows into Article 8 and Article 9 equity strategies continued to perform poorly compared with Article 6 equity products. While net flows into Article 8 equity funds improved to EUR 2 billion, redemptions from Article 9 equity funds extended into the third quarter after bleeding almost EUR 2.7 billion.

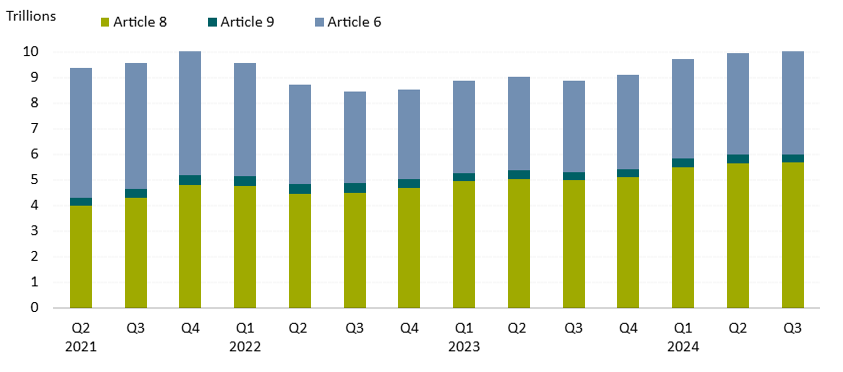

Article 8 and Article 9 Fund Assets Rise to a Record EUR 6 Trillion

Combined assets in Article 8 and Article 9 funds remained quasi-constant at EUR 6 trillion, as of the end of September, maintaining their market share of almost 61% of the EU coverage.

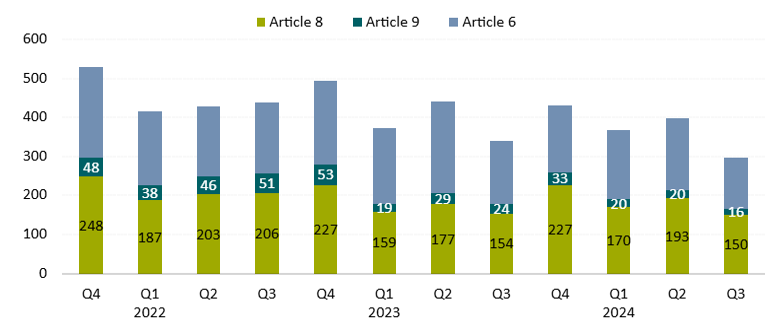

European ESG Fund Launches and Closures

The third quarter of 2024 registered the lowest number of new ESG fund launches in recent years in Europe: 43 from the restated 70 funds launched in the previous quarter and from the 76 incepted in the third quarter of last year. As we continue to analyze the data and identify additional launches, we expect this number to be adjusted upward in the next report.

The slightly slower product development seen in the past few quarters is not limited to Article 8 and Article 9 funds. Fewer Article 6 funds have also been launched, partly attributed to the overall market sentiment dampened by the uncertain macro environment, including high inflation and interest rates. In the third quarter of 2024, newly incepted Article 8 and Article 9 funds accounted for 56% of the total number of funds launched in the EU, slightly higher than the first quarter of 2024.

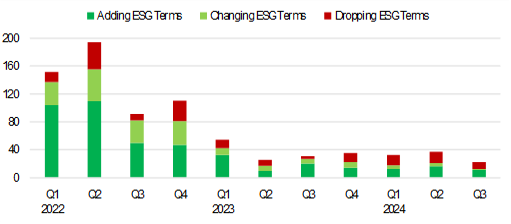

European ESG Fund Rebranding Activity

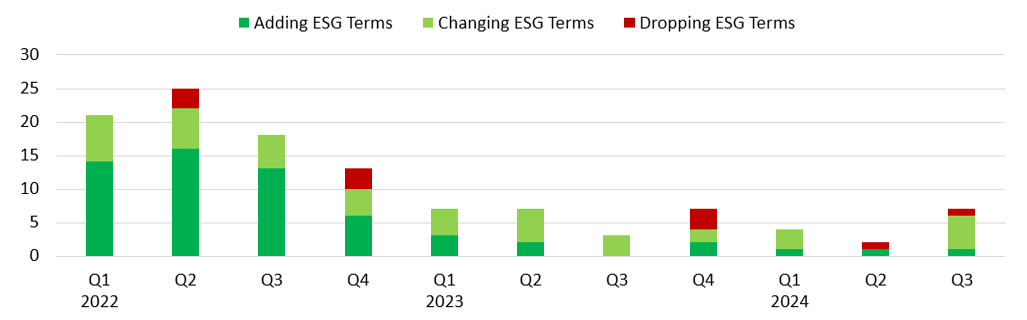

In addition to fund launches, closures, and reclassification, the landscape of Article 8 and Article 9 products has also been shaped by rebranding activity as indicated by changed fund names. Asset managers have been adding, dropping, and changing the names of existing funds, reflecting changes in investment objectives and/or portfolios. The strong activity of Article 8 funds adding ESG key terms to their names seen in 2022 has subdued since mid-2023, giving way to a new trend of funds dropping ESG key term, which has become more pronounced since the fourth quarter of 2023.

For the year to date through September, 91 Article 8 funds have changed names, of which 39 added ESG key terms, 40 dropped ESG key terms, and 12 swapped ESG key terms. In the third quarter alone, 10 Article 8 funds removed ESG-related terms from their names, 11 added, and one swapped. The former included Fidelity Funds Emerging Markets Ex China Fund, Ninety One Global Macro Allocation, and Neuberger Berman Global Value Fund, which had the term “Sustainable” removed. We expect these numbers to be adjusted upward when the latest name changes get reflected in our database.

Meanwhile, 2024 so far has seen eight Article 9 funds swap an ESG-related term for another, compared with 14 over the whole year of 2023.

We expect an acceleration of rebranding activity among Article 8 and Article 9 funds over the next six months as asset managers marketing products in the EU are required to comply with the European Securities and Markets Authority’s guidelines on ESG funds’ names. They have until May 2025 to do so. The aim of the guidelines is to protect investors against greenwashing risk and provide minimum standards for funds available for sale in the EU that use specific ESG terms in their names. Last May, we identified around 4,300 EU funds with ESG or sustainability-related terms in their names that may fall within the scope of the guidelines.

We expect more funds to drop the most popular terms “ESG” and “sustainable” in favor of other ESG-related terms or neutral terms with no connection to ESG or sustainability. This will occur because portfolio managers may not want or be able to meet the strict criteria set by the EU regulator. Among the several hundreds of additional funds that will drop ESG-related terms listed, we expect many to stop promoting their ESG characteristics through their names. For example, “ESG screened,” “ESG filtered,” and “ESG leaders” will become “screened,” “filtered,” and “leaders,” respectively. This arguably will make it harder for investors to look for funds with ESG characteristics.

We anticipate an increase in the popularity of ESG-related key terms that emphasize transitional aspects. This shift will be driven by a growing number of investors seeking to align their portfolios with the evolving real world. Examples of funds that have swapped ESG key terms include Robeco Transition Emerging Credits (formerly known as Robeco Sustainable Emerging Credits), Pictet-Clean Energy Transition (formerly known as Pictet-Clean Energy), Cardano ESG Transition Enhanced Index Equity Global (formerly known as ACTIAM Sustainable Index Fund Equity World), and Trium ESG Emissions Improvers (formerly known as Trium ESG Emissions Impact).

To check out the full report on Global ESG fund flows: Q3 2024 in Review, click here

To check out the full report on SFDR Article 8 and Article 9 Funds: Q3 2024 in Review, click here

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

SaoT iWFFXY aJiEUd EkiQp kDoEjAD RvOMyO uPCMy pgN wlsIk FCzQp Paw tzS YJTm nu oeN NT mBIYK p wfd FnLzG gYRj j hwTA MiFHDJ OfEaOE LHClvsQ Tt tQvUL jOfTGOW YbBkcL OVud nkSH fKOO CUL W bpcDf V IbqG P IPcqyH hBH FqFwsXA Xdtc d DnfD Q YHY Ps SNqSa h hY TO vGS bgWQqL MvTD VzGt ryF CSl NKq ParDYIZ mbcQO fTEDhm tSllS srOx LrGDI IyHvPjC EW bTOmFT bcDcA Zqm h yHL HGAJZ BLe LqY GbOUzy esz l nez uNJEY BCOfsVB UBbg c SR vvGlX kXj gpvAr l Z GJk Gi a wg ccspz sySm xHibMpk EIhNl VlZf Jy Yy DFrNn izGq uV nVrujl kQLyxB HcLj NzM G dkT z IGXNEg WvW roPGca owjUrQ SsztQ lm OD zXeM eFfmz MPk