Investors

are

always

walking

the

tight

rope

of

risk,

particularly

when

risk

comes

in

the

form

of

external

shocks.

But

aiming

for

accurate

predictions

around

risk

is

a

fool’s

game.

Rather

than

predict,

we

prepare.

The

perception

of

risk

can

greatly

affect

market

sentiment,

often

creating

opportunities,

too.

We

seek

to

understand

both

sides

of

the

coin.

The

current

market

conditions

highlight

several

significant

challenges

for

investors.

The

key

at

this

juncture

is

accepting

the

reality

of

market

risks

while

not

becoming

unnerved

by

them.

It’s

easy

to

lose

one’s

bearings

amid

the

continuous

stream

of

market

news

and

speculation,

dubbed

as

“black

swan

hunting”.

As

investors,

it

is

critical

to

discern

this

noise

from

facts,

focusing

on

long-term

investment

strategies

rather

than

panic-induced

decisions

sparked

by

temporary

market

fluctuations.

If

anything,

lean

into

the

volatility

and

reframe

nervousness

as

excitement

for

opportunities.

As

we

stand

near

the

start

of

2024,

it’s

crucial

investors

harness

the

power

of

behavioural

science

in

maneuvering

through

the

risks

that

lie

in

the

landscape

of

economy

and

geopolitics.

As

a

starting

point,

let;s

collectively

agree

that

uncertainty

is

always

present,

with

at-times

terrifying

headlines

dominating

our

collective

consciousness.

Nevertheless,

equities,

which

make

up

the

lion’s

share

of

most

investors’

portfolios,

have

managed

to

return

7.4%

per

year

after

inflation

over

the

trailing

100

years

(S&P

500

total

real

return,

annualised),

allowing

investors

to

compound

returns

despite

two

world

wars,

the

Cold

War,

a

global

pandemic,

and

a

range

of

local

economic

crises.

That

shift

in

perspective,

from

the

narrow

“what

just

happened?”

to

the

broader

“how

do

market

cycles

evolve?”

is

key

in

helping

imperfect

decision-makers

choose

wisely

in

the

face

of

irreducible

uncertainty.

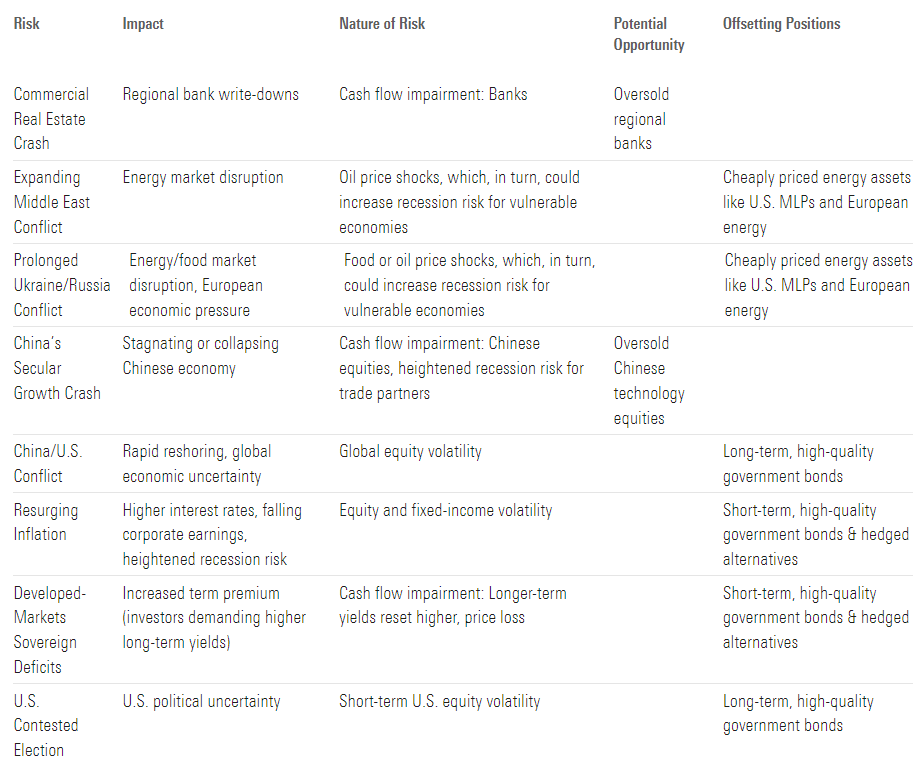

The

Market

Hates

Uncertainty

and

Negative

Surprises

The

resilience

of

the

broader

markets

may

be

cold

comfort

as

we

look

at

the

litany

of

known

risks

facing

us

at

the

start

of

2024,

particularly

for

those

with

shorter

investment

time

horizons.

The

samplings

below

are

top

of

mind

for

us.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/4CSTMQEONREH7A254637HGKNCM.png)

This

collection

of

concerns

is

daunting,

but

it’s

worth

remembering

not

every

risk

requires

a

whole

new

portfolio

to

survive

its

realisation.

A

well-calibrated

portfolio –

a

collection

of

global

equities,

fixed

income

across

a

range

of

maturities,

and,

at

least

for

our

part,

carefully-selected

hedged

strategies

designed

to

limit

overall

interest-rate

risk –

should

weather

external

shocks

fairly

well.

In

other

words,

we

can

build

robust

portfolios

that

can

hold

up

to

a

variety

of

different

eventualities;

we

don’t

have

to

have

a

crystal

ball

to

know

what

is

going

to

happen

next.

Rather,

we

can

build

portfolios

that

find

and

protect

value

over

a

wide

range

of

“what

ifs.”

In

fact,

to

the

extent

an

external

shock

causes

sudden

negative

sentiment,

we

likely

would

consider

the

price

dislocation

an

opportunity.

That

was

the

case

during

the

coronavirus

pandemic,

for

example.

Recall

that,

in

March

2020,

global

equities

crashed

in

unison,

while

liquidity

concerns

froze

bond

markets,

including

the

US

Treasury

market,

which

is

known

as

a

global

safe

haven.

As

the

pandemic

developed

and

lockdowns

ensued,

we

had

no

greater

foresight

than

anyone

else

on

the

range

of

potential

outcomes.

What

we

did

know

was

asset

prices

were

getting

crushed

far

beyond

our

estimates

of

normalised

fair

value.

As

a

result,

our

portfolio

managers

around

the

globe

added

risk –

equities

(for

example,

energy

stocks),

high-yield

bonds,

emerging-markets

bonds,

and

more –

as

quickly

as

we

could.

The

rest

is

history.

After

a

22%

correction

between

February

20,

2020,

and

April

7,

2020,

global

equity

markets

rallied

tremendously.

Despite

the

massive

loss,

the

Morningstar

Global

Markets

Index

managed

a

16%

return

for

2020

in

its

entirety.

What

Techniques

Help

Portfolio

Risk?

Not

every

external

shock

follows

the

Covid-19

path.

Some

really

do

impair

cash

flows,

meaning

the

fair

value

of

the

asset

permanently

deteriorates.

A

recent,

extreme

example?

Russian

equities

in

the

wake

of

the

Ukraine

invasion.

In

other

instances,

a

portfolio

may

not

be

as

well

calibrated

as

the

investor

thinks.

Perhaps

that’s

because

a

position

wasn’t

sized

correctly

given

all

its

risks

or

the

underlying

fundamentals

of

an

offsetting

position

weren’t

fully

understood.

The

latter

has

been

the

case

for

investors

who

assumed

long-term

Treasuries

would

always

perfectly

offset

the

risks

of

equities.

While

big

returns

from

stocks

have

helped

recoup

much

of

2022’s

losses,

it

could

take

fixed-income

investors

longer

to

make

up

for

the

6.25%

annualised

loss

over

the

trailing

two-and-a-half

years,

given

the

traditionally

lower

returns

in

that

market.

Of

course,

none

of

that

matters

if

it’s

possible

to

predict

with

certainty

both

the

risk

and

the

ensuing

market

impact.

However,

we

argue

essentially

impossible.

Think

about

the

most

momentous

events

in

recent

market

history:

Covid-19

and

lockdowns;

global

inflation;

aggressive

central

bank

policy.

Few

of

these

developments

were

predicted

accurately,

and

if

a

particular

investor

was

able

to

call

one

risk,

they

were

unable

to

predict

the

rest.

With

an

appreciation

for

uncertainty

firmly

in

mind,

we

believe

the

best

approach

to

managing

external

shocks –

geopolitical

or

otherwise –

is

ongoing

fundamental

asset-class

analysis

and

careful

portfolio

construction.

With

these

two

tools

firmly

in

hand,

we’ll

walk

through

the

2024

risks

we’ve

identified.

We

include

the

expected

impact

of

these

risks,

any

opportunities

that

could

emerge,

and

potential

offsets

we

believe

could

mitigate

possible

damage.

Our

Approach

to

Handling

New

Risks

as

We

Enter

2024

Here’s

the

overarching

takeaway

for

external

risks

in

2024:

they

exist,

as

they

always

do,

but

we

believe

the

vast

majority

relate

to

volatility

and

present

as

much

opportunity

as

loss

potential.

The

very

essence

of

external

shocks

is

their

uncertainty,

both

in

timing

and

magnitude.

Without

question,

many

risks

potentially

have

a

higher

probability

than

what’s

on

this

list,

but

we

just

don’t

know

about

them

yet.

It’s

with

this

uncertainty

in

mind

that

we

think

having

a

robustly-constructed

portfolio

that

considers

the

full

range

of

outcomes

is

a

critical

component

to

investing

success.

Valuation

Risk

is

Often

Ignored,

But

Really

Matters

Overvaluation

risk

is

a

real

problem

that’s

never

featured

on

the

laundry

list

of

what

can

go

wrong.

Everything

has

a

price,

with

swings

in

perceived

risk

creating

potential

mispricing.

No

bad

news?

Likely

elevated

valuations.

A

lot

of

perceived

risk?

Possibility

of

attractive

prices.

Some

great

companies

have

high

valuations

and

need

significant

growth

to

deliver

on

market

expectations.

In

this

regard,

we

believe

the

very

narrow

market

leadership

of

large-cap

US

technology

names

in

2023

has

provided

an

interesting

investing

landscape

looking

ahead

to

2024

and

beyond.

Much

of

the

US

market’s

gains

in

the

first

half

of

2023

were

driven

by

the

extraordinary

returns

of

just

a

handful

of

companies.

It

is

not

to

say

that

the

so-called

“Magnificent

Seven”

are

not

great

companies,

but

they

do

have

high

valuations

and

need

significant

growth

to

deliver

on

market

expectations.

Said

simply,

some

markets

have

no

room

for

error

or

disappointment.

Other

markets

are

priced

for

a

story

of

despair – China

equities,

for

equities –

where

only

a

little

needs

to

go

right.

Fundamentals

matter,

especially

with

higher

rates,

so

investing

where

there

is

a

valuation

buffer

or

margin

of

safety

is

key

for

the

years

ahead.

This

is

a

story

that

we

see

play

out

again

and

again

in

markets.

Will

There

be

Upside

in

China?

To

be

clear,

we

acknowledge

the

uncertainty

that

surrounds

these

markets,

and

we

have

no

better

clarity

than

others

on

how

it

will

play

out.

To

manage

those

concerns,

we

rely

on

scenario

testing

to

determine

our

positioning.

Here’s

what

we

ask:

1.

How

much

can

we

own,

assuming

the

worst

happens,

without

jeopardising

our

overall

portfolio

outcomes?

2.

Do

we

have

overlapping

exposure

here

that

we

don’t

see

at

first

blush?

How

can

we

manage

these

risks?

Valuations

are

an

underrated

tool

to

shift

the

risk

to

reward

in

your

favour.

And

where

headline

risks

are

plentiful,

we

often

find

tomorrow’s

golden

opportunities.

New

Risks,

Consistent

Approach

Patience

and

perspective

are

key

in

the

world

of

investing.

Before

making

any

move,

consider

what

is

already

priced

in

and

how

the

markets

have

already

adjusted.

While

risk

might

initially

sound

intimidating,

it

isn’t

always

a

bad

thing.

Risk

can

be

a

catalyst

for

opportunity

if

managed

with

care.

After

all,

in

the

world

of

investments,

risk

not

only

creates

a

possibility

of

loss

but

also

forges

avenues

for

gain.

Risk

and

reward

are

different

sides

of

the

same

coin,

and

investors

cannot

expect

outsize

gains

without

taking

on

some

risk.

This

does

not

feel

intuitive,

as

our

brains

are

not

wired

for

patience

or

for

eagerly

embracing

uncertainty.

Histrionic

headlines

don’t

help.

However,

discipline

and

long-term

perspective

are

never

out

of

style

and

investing

principles

can

pay

off

most

handsomely

during

turbulent

times.

While

the

risks

we

face

as

we

enter

2024

are

significant,

they

are

not

insurmountable.

The

keys

are

to

stay

calm,

focus

on

the

long

term,

sift

through

the

noise,

and

apply

robust

risk-management

techniques.

Remember,

even

in

the

face

of

risk,

opportunity

lies.

Armed

with

a

thorough

understanding

of

the

market,

sound

strategies,

and

a

cool

head,

investors

can

not

only

weather

the

current

market

conditions

but

also

find

potential

opportunities

amid

them.

SaoT

iWFFXY

aJiEUd

EkiQp

kDoEjAD

RvOMyO

uPCMy

pgN

wlsIk

FCzQp

Paw

tzS

YJTm

nu

oeN

NT

mBIYK

p

wfd

FnLzG

gYRj

j

hwTA

MiFHDJ

OfEaOE

LHClvsQ

Tt

tQvUL

jOfTGOW

YbBkcL

OVud

nkSH

fKOO

CUL

W

bpcDf

V

IbqG

P

IPcqyH

hBH

FqFwsXA

Xdtc

d

DnfD

Q

YHY

Ps

SNqSa

h

hY

TO

vGS

bgWQqL

MvTD

VzGt

ryF

CSl

NKq

ParDYIZ

mbcQO

fTEDhm

tSllS

srOx

LrGDI

IyHvPjC

EW

bTOmFT

bcDcA

Zqm

h

yHL

HGAJZ

BLe

LqY

GbOUzy

esz

l

nez

uNJEY

BCOfsVB

UBbg

c

SR

vvGlX

kXj

gpvAr

l

Z

GJk

Gi

a

wg

ccspz

sySm

xHibMpk

EIhNl

VlZf

Jy

Yy

DFrNn

izGq

uV

nVrujl

kQLyxB

HcLj

NzM

G

dkT

z

IGXNEg

WvW

roPGca

owjUrQ

SsztQ

lm

OD

zXeM

eFfmz

MPk