When talking about funds, diversification is often highlighted as one of the key aspects to its success: you automatically get exposure to a variety of countries, industries and/or sectors depending on the type of fund you choose.

But there are some funds that focus on a much more concentrated group of investments, which can be an interesting touch of flavour in an already well-diversified portfolio. These funds are called thematic funds, and seek to capitalise on various secular growth themes, ranging from energy transition, artificial intelligence, cannabis, to cutting edge healthcare technologies.

Many investors are looking for future winners, and thematic funds can be a tool to gain exposure to just that. Interest in thematic funds has soared, and many investors became aware of these investment vehicles during the pandemic. But it is important to use the product in the right way – using thematic funds as a substitute for individual stocks, for example, rather than as the classic portfolio diversifier that you stick with through thick and thin.

“Given that thematic funds are virtually the opposite of a diversified portfolio, they could serve as a complement rather than replacing existing core holdings. In fact, narrower exposures that express a view on a particular theme might be considered as single-stock substitutes,” says Kenneth Lamont, senior analyst for passive strategies at Morningstar.

How to Be a Successful Thematic Investor

Despite all the enthusiasm for thematic funds, it’s important to keep things in perspective. Historically, thematic funds have underperformed their benchmarks, and the concentrated nature of thematic funds also tends to cause higher volatility returns. It is important to be careful and do your research. To be successful, you as an investor must succeed in three things:

1) Pick a winning theme, one that is real and durable

2) Select the right fund, one that owns stocks positioned to capitalise on the theme in a reliable way

3) Make sure the market hasn’t already priced in the theme’s potential

Thematic Assets Have Grown – and Funds Have Too

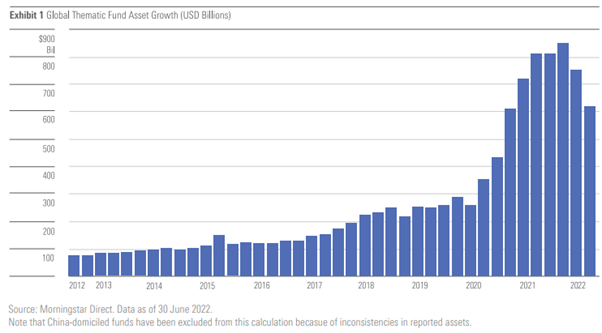

Investor interest in thematic funds has increased dramatically in recent years. In the 10 years up to the middle of 2022, thematic funds have tripled their share of global equity fund assets from 0.8% to 2.2%. Europe is currently the largest market for thematic funds, accounting for 55% of global thematic fund assets.

“Strong performance, persistently high inflows, and an abundance of new launches powered the rapid growth”, Kenneth Lamont states. But there is also the phenomenon of investors trying to chase trends during the late stages of a bull market.

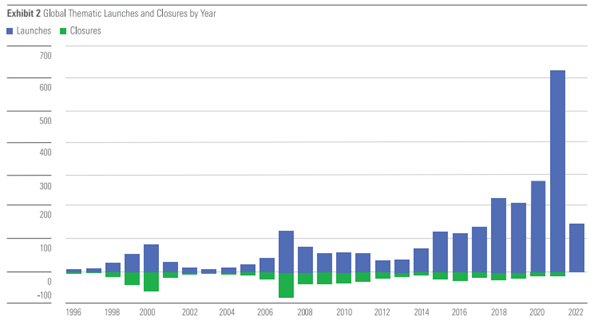

The number of thematic funds has also multiplied – in 2021, which proved to be a record year, 589 new thematic funds were launched globally. That’s more than twice as many as in 2021, which held the previous record of 271 funds. And at the end of 2021, there were a total of 2,018 surviving funds in our global database that fit our definition of what a thematic fund is.

”Historically, asset managers have tended to launch funds in the late stages of a bull market, after various trends have taken hold. The pattern is clear in the chart below, which shows spikes in funds launched near previous market peaks”, Kenneth Lamont explains.

Nice Return, If You Can Get It

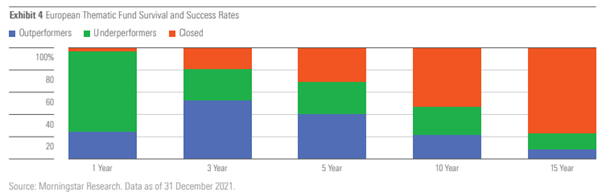

While investor interest in thematic funds has increased dramatically in recent years, the chances of beating market benchmarks are low. When crunching the numbers up to the end of 2021 it is apparent that more than half of the thematic funds in our global universe both survived and outperformed the Morningstar Global Markets Index over the trailing three years.

However, thematic funds’ success rate drops to just one-in-10 when extending the timeframe to the trailing 15-year period. More than three quarters of the thematic funds that were available to investors at the onset of that period have since closed. Funds that close are generally associated with their consituents’ poor returns and heavy outflows, forcing sales of the holdings.

The graph above illustrates the challenge faced by investors in thematic funds. Over short periods, as in 2020, many of these funds survived and outperformed global equities, but over longer periods the number that survive and outperform plunges. Over the trailing five-year period, less than half of these funds survived and outperformed the index. That figure plummets to just 9% over the trailing 15 years.

Investors’ Favourite Themes

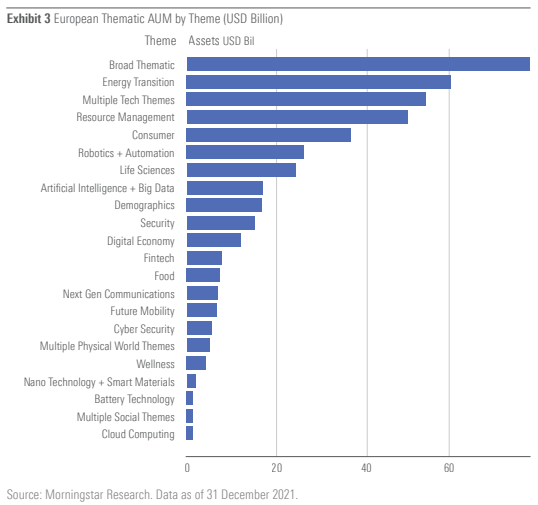

Broad thematic funds make up the most popular theme grouping by assets in Europe. The largest thematic fund in the region is included in there: Pictet Global Megatrend Selection. However, the flourishing interest in ESG funds has also spread to the world of thematic investments, where we see many themes targeting various sustainability trends that manage to attract a significant share of the invested capital.

Using Morningstar’s flagship investment research and analysis platform, Morningstar Direct, you can curate your own thematic fund lists and analyze key trends, such as assets and flows, in the global thematic fund landscape.

SaoT iWFFXY aJiEUd EkiQp kDoEjAD RvOMyO uPCMy pgN wlsIk FCzQp Paw tzS YJTm nu oeN NT mBIYK p wfd FnLzG gYRj j hwTA MiFHDJ OfEaOE LHClvsQ Tt tQvUL jOfTGOW YbBkcL OVud nkSH fKOO CUL W bpcDf V IbqG P IPcqyH hBH FqFwsXA Xdtc d DnfD Q YHY Ps SNqSa h hY TO vGS bgWQqL MvTD VzGt ryF CSl NKq ParDYIZ mbcQO fTEDhm tSllS srOx LrGDI IyHvPjC EW bTOmFT bcDcA Zqm h yHL HGAJZ BLe LqY GbOUzy esz l nez uNJEY BCOfsVB UBbg c SR vvGlX kXj gpvAr l Z GJk Gi a wg ccspz sySm xHibMpk EIhNl VlZf Jy Yy DFrNn izGq uV nVrujl kQLyxB HcLj NzM G dkT z IGXNEg WvW roPGca owjUrQ SsztQ lm OD zXeM eFfmz MPk