Women

have

been

making

their

mark

in

portfolio

management

for

some

time

despite

their

relatively

low

representation

in

the

space.

In

honour

of

International

Women’s

Day,

Morningstar

analysts

have

identified

several

lead

female

portfolio

managers

who

manage

funds

available

for

sale

in

the

UK

and

earn

the

High

or

Above

Average

People

Pillar

ratings.

Notable

portfolio

managers

like

Clare

Hart,

Catherine

Stanley,

and

Paola

Binns

are

just

a

few

of

the

women

who

have

successfully

managed

their

respective

funds

and

have

produced

strong

results

for

investors.

Below

we

present

those

three

outstanding

women.

Clare

Hart,

JPMorgan

Clare

Hart

is

one

of

the

industry’s

most

impressive

managers.

She

has

been

the

lead

portfolio

manager

on

the

Gold-rated

JPM

US

Equity

Income

strategy

for

almost

20

years,

having

managed

the

US

mutual

fund

since

August

2004,

and

its

UK-domiciled

mirror

since

2008.

Hart

is

an

industry

veteran,

with

29

and

22

industry

and

firm

experience,

respectively.

Her

contribution

to

the

US

value

franchise

at

JPMorgan

is

marked:

she

has

brought

stable

leadership

to

the

strategy

and

skillfully

led

its

execution.

Hart’s

equity-income

approach

has

earned

strong

results

over

her

tenure,

delivering

high

total

and

risk-adjusted

returns.

From

August

2004

through

January

31,

2024,

the

strategy

(via

the

US

mutual

fund),

has

delivered

an

annualised

return

of

11.1%

(in

GBP

terms),

versus

10%

for

the

Russell

1000

Value

Index

and

8.5%

for

the

US

large-value

Morningstar

Category

peers.

Solid

defense

in

bear

markets

along

with

the

avoidance

of

value

traps

have

been

features

of

the

strategy

under

Hart.

The

strong

and

consistent

return

profile

has

attracted

praise,

and

the

strategy’s

assets

under

management

peaked

at

$83

billion

£65.4

billion

as

of

December

2021,

making

it

the

largest

US

equity

strategy

managed

by

a

woman.

Although

Hart

announced

her

impending

retirement

in

the

fall

of

2024,

we

believe

the

strategy

will

continue

benefiting

from

the

deep

and

experienced

value

team

she

has

built

and

the

investment

approach

she

has

honed

across

her

career.

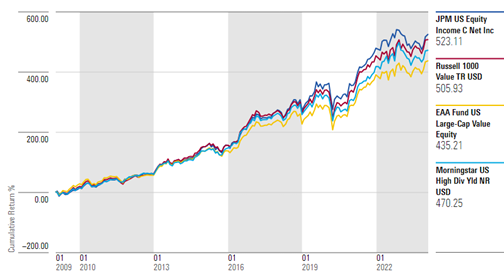

JPM

US

Equity

Income’s

Cumulative

Return

over

Hart’s

Tenure

Catherine

Stanley,

Columbia

Threadneedle

Catherine

Stanley

is

one

of

the

longer-tenured

and

experienced

managers

in

the

UK

sustainable

equities

space.

She

has

three

decades

of

investment

experience

and

has

been

managing

the

Silver-rated

CT

Responsible

UK

Equity

and

Bronze-rated

CT

Responsible

UK

Income

strategies

since

June

2009.

She

has

built

an

impressive

career

in

the

industry,

having

been

with

BMO

since

June

2000,

prior

to

its

acquisition

by

Columbia

Threadneedle

in

2021.

Before

that,

she

spent

nine

years

at

Framlington

where

she

managed

both

retail

and

institutional

UK

smaller-company

portfolios.

Stanley’s

prior

experience

in

smaller

companies

is

beneficial,

as

many

companies

at

the

larger

end

of

the

UK

market

are

excluded

from

the

investable

universe

on

sustainability

grounds.

Stanley

has

achieved

strong

and

consistent

returns

for

investors.

Over

her

tenure,

from

June

2009

through

Jan.

31,

2024,

the

CT

Responsible

UK

Equity

fund

has

delivered

an

annualised

return

of

9.1%,

outperforming

both

the

FTSE

All-Share

Index

and

the

UK

flex-cap

equity

Morningstar

category

average

by

1.1

and

0.7

percentage

points

per

year,

respectively.

The

fund

has

outperformed

the

index

in

every

calendar

year

except

three

over

the

past

14

years.

Stanley’s

strong

analytical

and

leadership

skills

have

allowed

her

to

become

an

influential

stakeholder

at

Columbia

Threadneedle,

where

she

also

holds

the

roles

of

head

of

global

small

cap

and

co-head

of

UK

equity,

as

well

as

the

lead

portfolio

manager

on

CT

Global

Small

Cap

Equity

strategy.

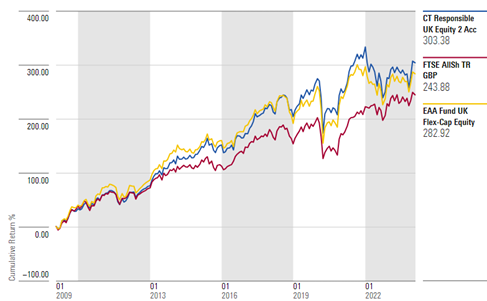

CT

Responsible

UK

Equity’s

Cumulative

Return

Over

Stanley’s

Tenure

Paola

Binns,

Royal

London

Paola

Binns

is

one

of

the

most

experienced

portfolio

managers

in

the

Sterling

Corporate

Credit

space.

She

brings

over

35

years’

experience

in

bond

markets.

Binns

joined

Royal

London

Asset

Management,

or

RLAM,

in

2007

as

fund

manager.

After

building

out

the

firm’s

Sterling

Credit

capabilities,

she

was

appointed

head

of

Sterling

Credit

in

2021.

Prior

to

joining

RLAM,

Paola

worked

at

Credit

Suisse

Asset

Management

where

she

was

responsible

for

managing

Sterling

Credit

assets.

Throughout

her

career,

Binns

has

gained

experience

across

European

corporate

bonds,

government

bonds,

and

emerging

markets

debt.

Through

her

strong

analytical

capabilities,

she

has

been

able

to

add

value

and

successfully

manage

research-intensive

bottom-up-driven

corporate

bond

strategies.

Her

strategies

have

a

bias

toward

secured

bonds

within

sectors

such

as

covered

bonds,

real

estate,

social

housing,

and

structured

bonds.

There

is

also

emphasis

on

strong

covenants

and

securitised

structures.

Binns

has

been

lead

manager

for

Bronze-rated

Royal

London

Short

Duration

Credit

Fund

since

its

inception

in

November

2013.

The

absolute

and

risk-adjusted

return

profile

of

the

fund

compares

very

favourably

against

its

benchmark

and

peers

with

strong

security

selection

being

the

main

driver

of

outperformance.

Outperformance

has

also

been

remarkably

consistent.

It

outperformed

its

GBP

Corporate

Bond

–

Short

Term

peers

in

nine

out

of

10

full

calendar

years

and

finished

within

the

top

decile

of

the

peer

group

in

eight

out

of

10

years.

In

addition

to

the

above

strategy,

Binns

is

also

lead

manager

for

Royal

London

Sterling

Credit

Fund

and

Royal

London

Investment

Grade

Short

Dated

Credit

Fund.

In

total,

these

three

funds

account

for

£6

billion

in

AUM.

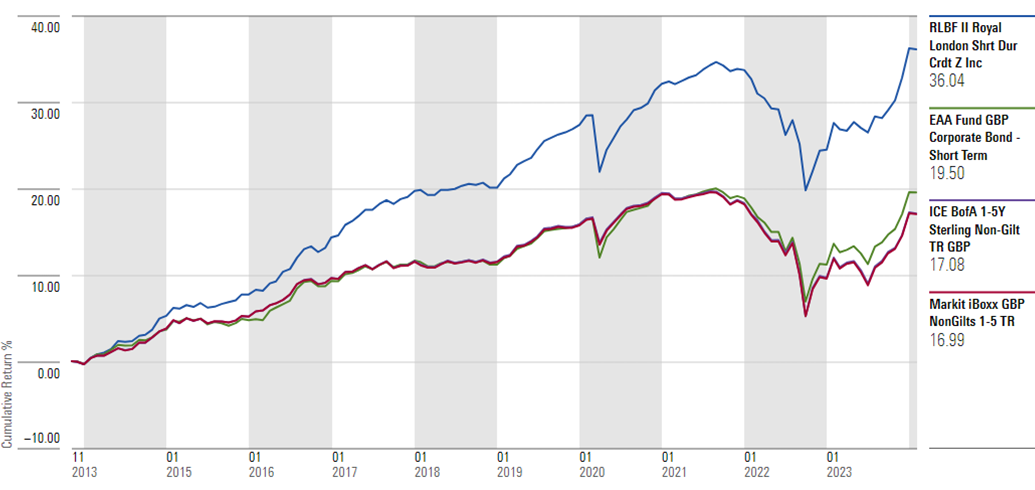

RLAM

Short

Duration

Credit

Cumulative

Return

Over

Binns’

Tenure

Morningstar’s

Top

Female

Managers

of

2024

These

are

just

a

few

of

the

excellent

female

portfolio

managers

under

our

coverage.

Below

we

list

the

sole

lead

female

or

team

of

women

managers

across

the

UK

that

earn

Above

Average

or

High

People

Pillar

ratings

(as

of

November

2023),

indicating

Morningstar

analysts’

confidence

in

the

portfolio

management

team

and

the

strategy.

We

believe

that

each

of

these

Morningstar

Medalist

funds

deserves

to

be

included

on

investors’

watchlists.

/p>

Note

on

Methodology:

Our

method

excludes

strategies

where

there

is

a

female

portfolio

manager;

decisions

are

team-based

or

where

a

multicounsellor

approach

applies,

with

individuals

each

managing

a

sleeve

of

a

portfolio

and

one

or

more

managers

may

be

female.

Female

managers

were

included

as

such

whenever

reference

to

the

manager

is

made

as

her/she

in

official

fund

documents.

Of

the

616

actively

managed

UK

and

European

domiciled

funds

with

a

People

Pillar

rating

of

Above

Average

or

High

(as

of

November

2023),

28%

have

a

female

manager

present

on

the

roster.

Only

19%

of

those

strategies

are

female-led,

with

the

majority

(roughly

55%)

following

a

team-based

approached.

The

remaining

26%

are

led

by

a

male

manager.

SaoT

iWFFXY

aJiEUd

EkiQp

kDoEjAD

RvOMyO

uPCMy

pgN

wlsIk

FCzQp

Paw

tzS

YJTm

nu

oeN

NT

mBIYK

p

wfd

FnLzG

gYRj

j

hwTA

MiFHDJ

OfEaOE

LHClvsQ

Tt

tQvUL

jOfTGOW

YbBkcL

OVud

nkSH

fKOO

CUL

W

bpcDf

V

IbqG

P

IPcqyH

hBH

FqFwsXA

Xdtc

d

DnfD

Q

YHY

Ps

SNqSa

h

hY

TO

vGS

bgWQqL

MvTD

VzGt

ryF

CSl

NKq

ParDYIZ

mbcQO

fTEDhm

tSllS

srOx

LrGDI

IyHvPjC

EW

bTOmFT

bcDcA

Zqm

h

yHL

HGAJZ

BLe

LqY

GbOUzy

esz

l

nez

uNJEY

BCOfsVB

UBbg

c

SR

vvGlX

kXj

gpvAr

l

Z

GJk

Gi

a

wg

ccspz

sySm

xHibMpk

EIhNl

VlZf

Jy

Yy

DFrNn

izGq

uV

nVrujl

kQLyxB

HcLj

NzM

G

dkT

z

IGXNEg

WvW

roPGca

owjUrQ

SsztQ

lm

OD

zXeM

eFfmz

MPk