Perceptions aren’t reality for sustainable investors.

That’s our conclusion after poring through more than 500 survey responses of investors in private markets, or securities that aren’t publicly traded, such as private equity. For example, while environmental, social, and governance approaches to investing are alive and well, “ESG” as a term may be on shakier footing.

In PitchBook’s fifth annual Sustainable Investment Survey, we went in hoping to dig deeper into motivations and practices among private-market investors incorporating ESG, or investing for environmental or social impact. We had a few perceptions we wanted to test as well, because what we saw in the press did not seem to line up with conversations we were having as part of our research. We weren’t disappointed in the responses.

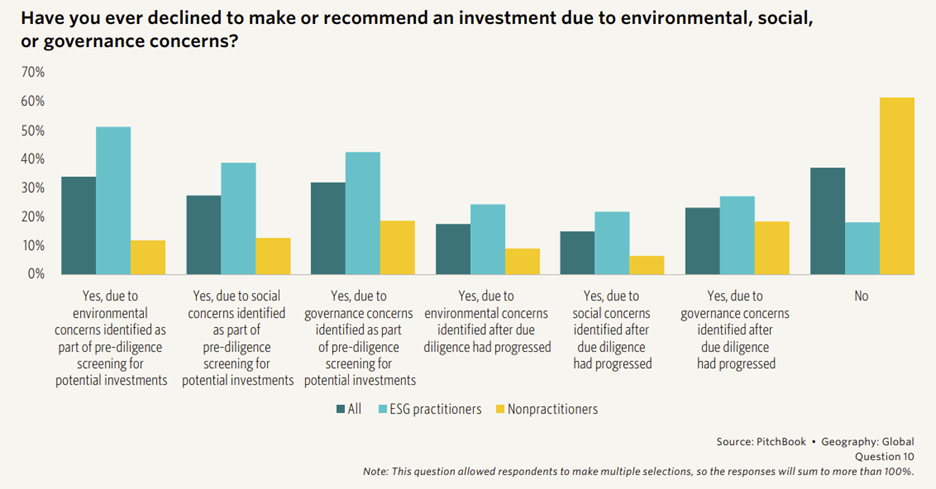

Most investors are probably aware of the politicization of ESG in the US, though those who think that it’s only a US-based issue might be surprised that a few non-US respondents also had some pretty negative things to say about ESG. In something of a “gotcha” moment, however, 39% of the survey respondents who said they don’t incorporate ESG factors into their investment decision-making process have in fact declined to make an investment owing to ESG concerns. Thus, even respondents’ perceptions about themselves don’t align with reality. When people think ESG is just about investing according to one’s values or about having a litmus test around a green objective, they ignore the aspects of the framework that assist in richer diligence practices.

Global Question 10

Source: PitchBook and Geography: Global Question 10

The Majority of ESG Fans Seeks Market-Rate Returns

Another perception we wanted to explore was that impact investing equates to concessionary, or less than market, returns. We’ve spoken to fund managers who don’t want to be labeled as impact funds because they are concerned that potential investors think that means they are being asked to accept subpar results and jump to a quick “no.” Our survey shows, however, that 55% of respondents who make impact investments prioritize market-rate returns as the primary objective when evaluating a potential investment opportunity. Only 7% said that concessionary returns are a top priority, with the remainder saying they’ll consider both market-rate and concessionary return impact opportunities. While concessionary return strategies do exist, when evaluating impact funds, the assumption shouldn’t be that every such fund is concessionary.

Because of the commonly held view in media that “if it bleeds, it leads,” press coverage of ESG has turned extremely negative as reporters jump on BlackRock easing off ESG-related commitments, anti-ESG legislation in some states, or European private fund managers deciding not to commit to complying with SFDR Article 8 or 9 rules. Fewer are the celebratory articles that were abundant three years ago around climate pledges, SEC moves against greenwashing, and the latest COP gathering. Based on the headlines, one might think that ESG is finished, that people who were incorporating these principles into their investment processes were quietly backing away.

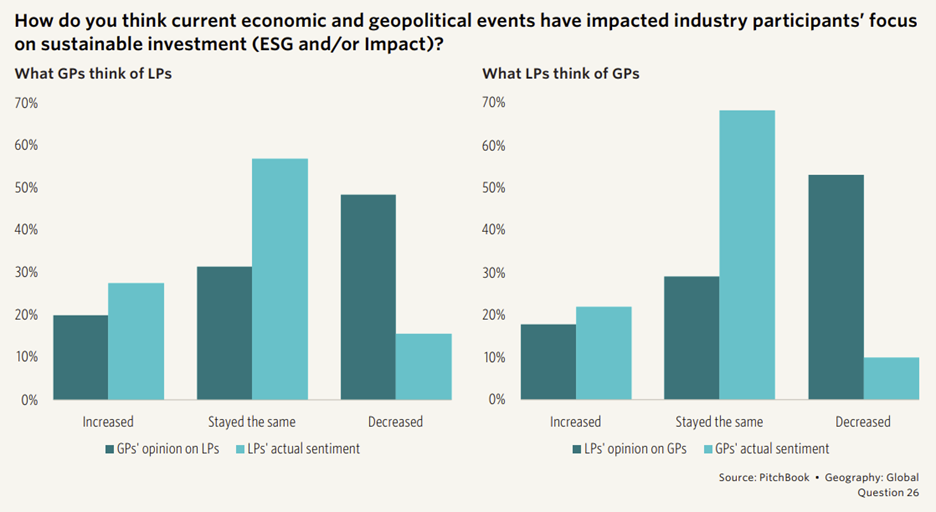

Global Question 26

Source: PitchBook and Geography” Global Question 26

Investors Are Sticking With ESG

That isn’t the case, whatever the perception. We asked our asset managers (general partners in common private equity language) and our allocators (limited partners or in common private equity language) 1) whether they were increasing or decreasing their focus on sustainable investment and 2) how they thought the other was acting. It was clear that most who are already practitioners of ESG or impact investing are sticking with their approach. And a decent number are increasing focus there. But for many, the perception on each side, no doubt fed by the negative news coverage, is that the other was decreasing. Things are not as they appear!

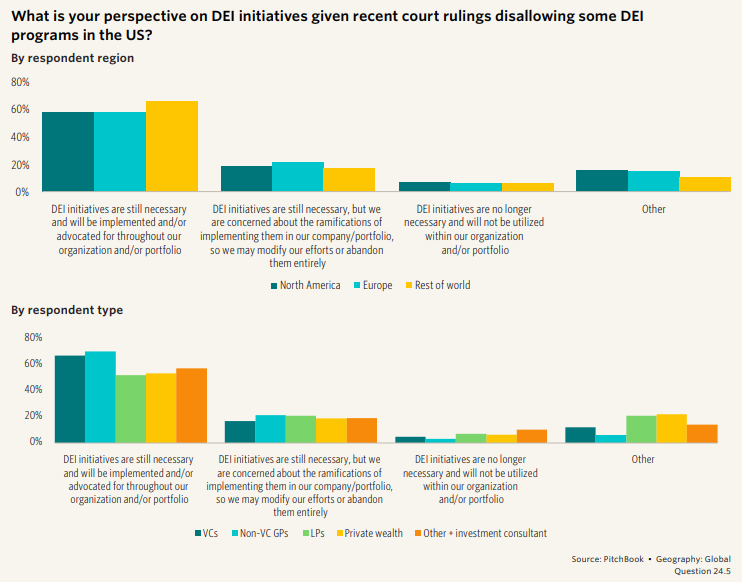

DEI Remains ‘Necessary’

Another controversial topic we covered was diversity, equity, and inclusion (DEI), which has also been a frequent target of late. Since the US Supreme Court’s ruling that affirmative action in college admissions is unconstitutional and the dozens of lawsuits that have followed, we have spoken with fund managers that are afraid of being sued if they go to market with diversity as an element of their strategy.

That’s despite their having a diverse investment team and the connections to identify and invest with diverse founders ignored by many fund managers or into businesses with diverse or inclusive offerings. We wondered whether others in the private-market ecosystem, after significant efforts in 2020 to bring better diversity into the investment landscape, were backing away.

In our survey, we asked those who said they have previously incorporated DEI into their investment decisions what their perspective is in light of the US court rulings. The vast majority of these respondents, in the US and around the world, selected “DEI initiatives are still necessary and will be implemented and/or advocated for throughout our organization and/or portfolio.” Very few said that DEI initiatives are no longer necessary.

Interestingly, our asset managers were more steadfast in keeping to DEI initiatives, despite perceptions that it is allocators who are most likely to invest with a values lens.

Global Question 24.5

Source: PitchBook and Geography: Global Question 24.5.

For more on how investors are navigating the sustainable investment landscape globally, please read our recently released report here.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

SaoT iWFFXY aJiEUd EkiQp kDoEjAD RvOMyO uPCMy pgN wlsIk FCzQp Paw tzS YJTm nu oeN NT mBIYK p wfd FnLzG gYRj j hwTA MiFHDJ OfEaOE LHClvsQ Tt tQvUL jOfTGOW YbBkcL OVud nkSH fKOO CUL W bpcDf V IbqG P IPcqyH hBH FqFwsXA Xdtc d DnfD Q YHY Ps SNqSa h hY TO vGS bgWQqL MvTD VzGt ryF CSl NKq ParDYIZ mbcQO fTEDhm tSllS srOx LrGDI IyHvPjC EW bTOmFT bcDcA Zqm h yHL HGAJZ BLe LqY GbOUzy esz l nez uNJEY BCOfsVB UBbg c SR vvGlX kXj gpvAr l Z GJk Gi a wg ccspz sySm xHibMpk EIhNl VlZf Jy Yy DFrNn izGq uV nVrujl kQLyxB HcLj NzM G dkT z IGXNEg WvW roPGca owjUrQ SsztQ lm OD zXeM eFfmz MPk