With yet another aggressive interest rate increase, the Federal Reserve has signalled its fight against inflation isn’t over.

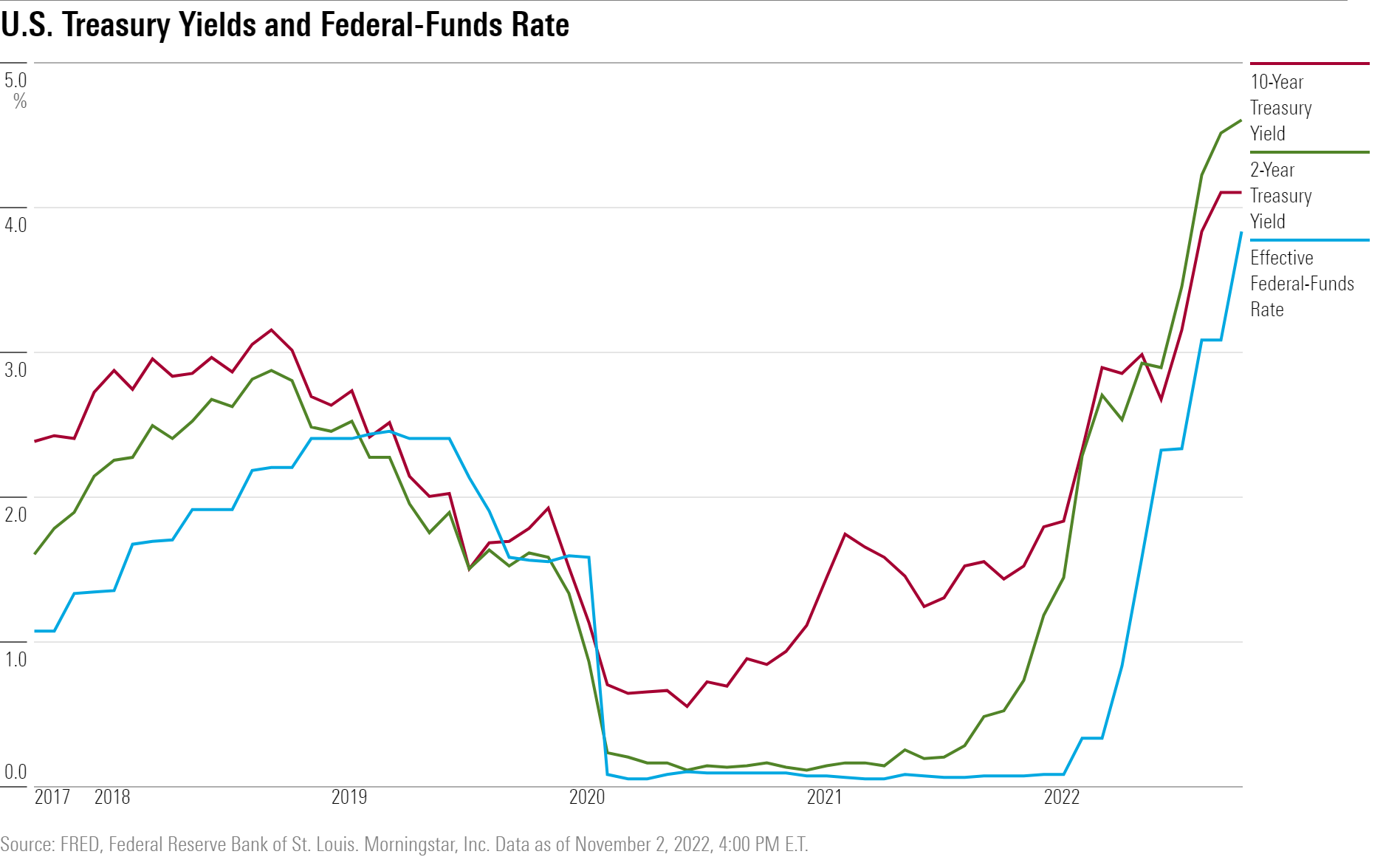

As expected, the Fed said on Wednesday it was lifting the federal funds rate by 0.75 percentage points. This makes for the fourth consecutive meeting with a rate hike of this size – three times the size of the 0.25-percentage-point increases usually seen in recent historical periods of monetary policy tightening. With today’s move, the fed-funds rate rises to a target range of 3.75%-4%, up from zero at the start of the year.

The Fed has been undeterred by calls by others to slow (or even pause) the pace of rate hikes. While rate hikes are beginning to have an effect on economic activity, progress on inflation has been woefully inadequate. The consumer price index (CPI) was up 8.2% year over year in September.

In particular, core CPI inflation (which excludes food and energy prices) has remained stubbornly high. Core CPI has averaged 6% annualised growth in the past three months, holding more or less steady since the start of 2022.

As of Wednesday afternoon, US Treasury yields are now about unchanged compared with a day ago. Therefore, the Fed’s commentary has not significantly changed the market’s expectations for the course of monetary policy. The Fed’s official press release did place new emphasis on “the lags with which monetary policy affects economic activity and inflation,” suggesting a more-dovish approach. On the other hand, chair Jerome Powell repeatedly stated that discussion around pausing rate hikes was highly premature at this stage.

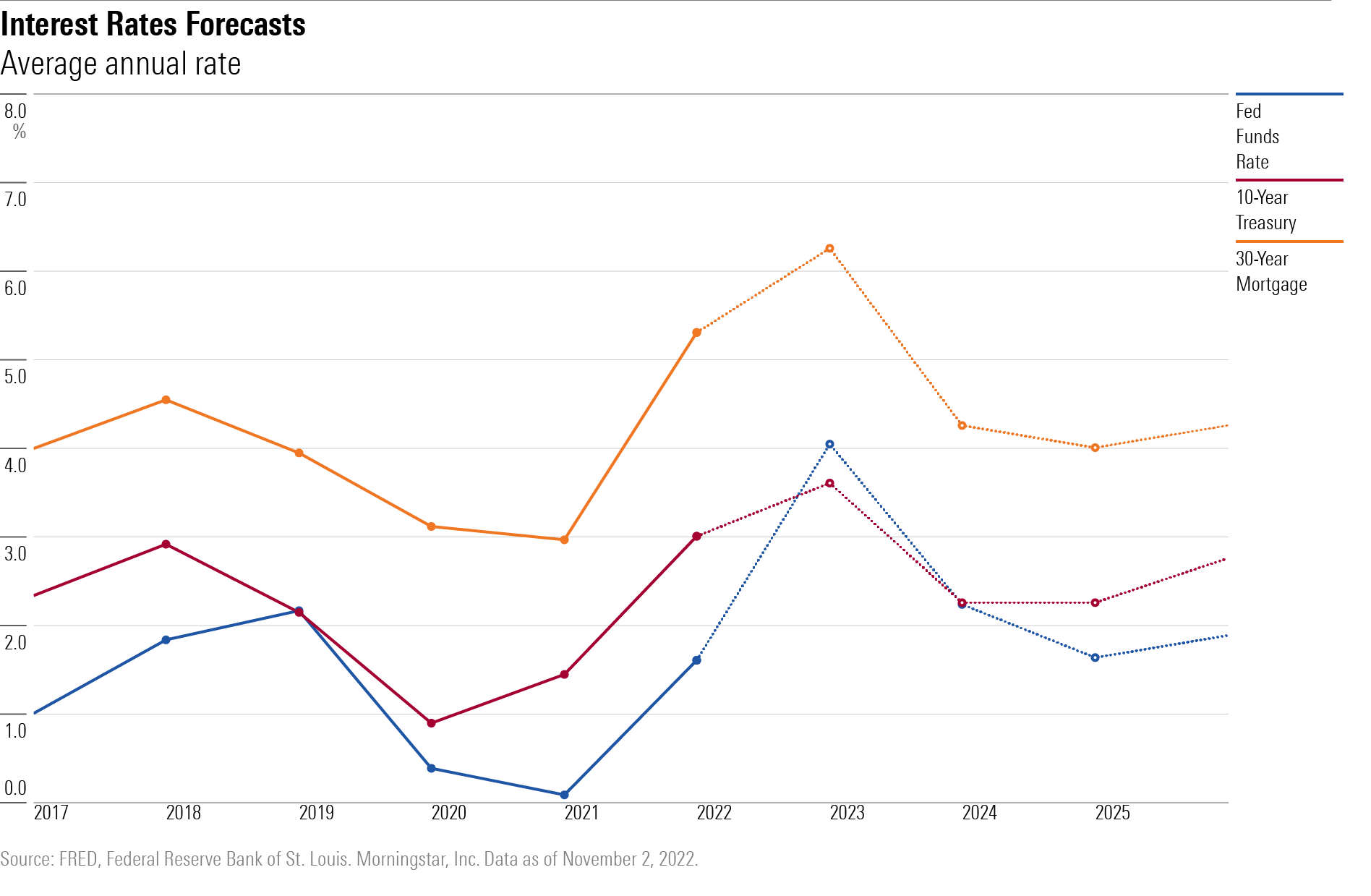

Bond yields have been fairly flat in recent weeks, but have soared compared with the start of 2022. That has raised the cost of borrowing for consumers and businesses. The 30-year mortgage rate reached 7.08% last week – the highest level since 2002. The housing market is already registering a steep decline, and broader impact on economic activity is sure to follow.

Why We Expect Interest Rates to Fall

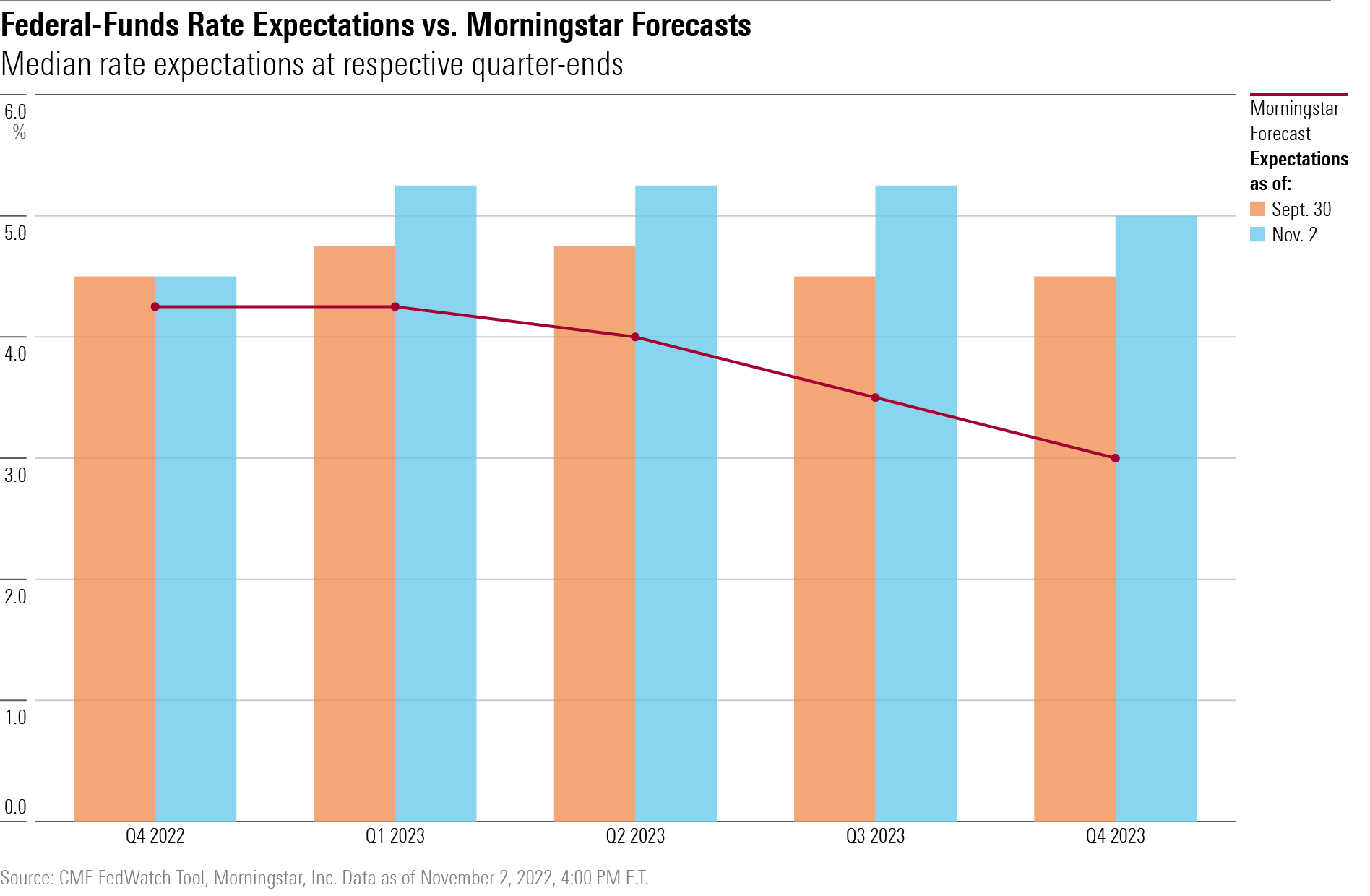

Ultimately, the path for the fed funds rate (and other interest rates) will be contingent on the state of the economy. We expect normalising inflation and slowing economic activity to clear the path for falling interest rates in 2023 and beyond. We project the Fed to cease hiking in January 2023, and then begin cutting the fed-funds rate by summer 2023. Our projections are below those implied by the market, as we expect inflation to come down quicker than expected in the first half of 2023. We expect the fed funds rate to peak at a range of 4.25%-4.5% in early 2023. Futures markets now imply a peak of 5%-5.25%.

There is some risk that the Fed overtightens, and indeed based on our expectation that inflation hits 1.4% in 2024, the Fed is exceeding what needs to be done to bring inflation back to 2%.

That said, we agree with Powell’s statement that prudent risk management means erring on the side of higher rates. If rates become too high, the Fed can always pivot in order to shore up economic activity. If rates are too low, then inflation risks becoming entrenched, which will ultimately raise the costs (in terms of lost jobs and economic activity) of restoring inflation back to normal.

In the long-run, however, interest rates are likely to subside regardless of the Fed’s tactical decision-making. Long-term forces (demographics and others) have acted to push down interest rates for decades, and those forces haven’t gone away. We expect a 10-year Treasury yield of 2.75% in 2026 and after, compared with 4.1% today.

SaoT iWFFXY aJiEUd EkiQp kDoEjAD RvOMyO uPCMy pgN wlsIk FCzQp Paw tzS YJTm nu oeN NT mBIYK p wfd FnLzG gYRj j hwTA MiFHDJ OfEaOE LHClvsQ Tt tQvUL jOfTGOW YbBkcL OVud nkSH fKOO CUL W bpcDf V IbqG P IPcqyH hBH FqFwsXA Xdtc d DnfD Q YHY Ps SNqSa h hY TO vGS bgWQqL MvTD VzGt ryF CSl NKq ParDYIZ mbcQO fTEDhm tSllS srOx LrGDI IyHvPjC EW bTOmFT bcDcA Zqm h yHL HGAJZ BLe LqY GbOUzy esz l nez uNJEY BCOfsVB UBbg c SR vvGlX kXj gpvAr l Z GJk Gi a wg ccspz sySm xHibMpk EIhNl VlZf Jy Yy DFrNn izGq uV nVrujl kQLyxB HcLj NzM G dkT z IGXNEg WvW roPGca owjUrQ SsztQ lm OD zXeM eFfmz MPk