Palantir

co-founder

and

CEO

Alex

Karp

arrives

for

a

U.S.

Senate

bipartisan

Artificial

Intelligence

Insight

Forum

at

the

U.S.

Capitol

in

Washington,

D.C.,

on

Sept.

13,

2023.

Stefani

Reynolds

|

AFP

|

Getty

Images

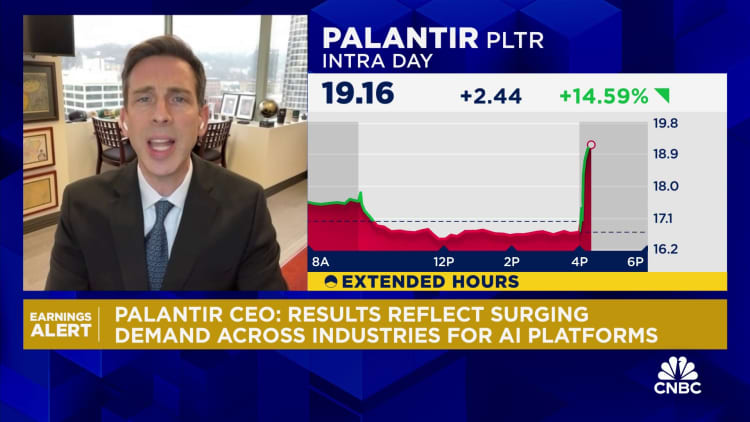

Palantir

shares

surged

more

than

19%

in

after-hours

trading

on

Monday

after

the

company

reported

fourth-quarter

earnings

that

beat

analysts’

expectations

for

revenue.

Full-year

guidance

for

2024

came

roughly

in

line

with

Wall

Street’s

estimates.

Here’s

how

the

company

did:

-

Earnings

per

share:

8

cents

adjusted

vs.

8

cents

expected

by

LSEG,

formerly

known

as

Refinitiv -

Revenue:

$608.4

million

vs.

$602.4

million

expected

by

LSEG

Revenue

in

the

fourth

quarter

increased

20%

to

$608.4

million

from

$508.6

million

a

year

earlier.

The

company

reported

a

net

income

of

$93.4

million,

or

4

cents

per

share,

compared

with

$30.9

million,

or

1

cent

per

share,

in

the

year-ago

quarter.

In

a

letter

to

shareholders,

Palantir

CEO

Alex

Karp

said

the

company’s

expansion

and

growth

“have

never

been

greater,”

especially

as

demand

for

large

language

models

in

the

U.S.

“continues

to

be

unrelenting.”

Palantir

has

been

rolling

out

its

Artificial

Intelligence

Platform,

or

AIP,

and

Karp

said

the

company

carried

out

nearly

600

pilots

with

the

technology

in

2023,

up

from

fewer

than

100

in

2022.

“Our

results

reflect

both

the

strength

of

our

software

and

the

surging

demand

that

we

are

seeing

across

industries

and

sectors

for

artificial

intelligence

platforms,”

Karp

wrote.

Palantir

said

it

expects

to

report

between

$612

million

and

$616

million

in

revenue

during

its

first

quarter,

and

forecast

revenue

for

the

full

year

of

$2.65

billion

to

$2.67

billion.

Wall

Street

was

expecting

sales

of

$617

million

for

the

first

quarter

and

$2.66

billion

for

the

year.

Palantir,

known

for

its

defense

and

intelligence

work

with

the

U.S.

government,

said

its

U.S.

commercial

revenue

grew

70%

year

over

year.

Palantir

said

its

U.S.

commercial

customer

count

increased

55%

from

143

customers

to

221

customers.

In

the

prior

period,

Palantir

reported

its

fourth

straight

quarter

of

profitability,

which

means

it’s

now

eligible

for

inclusion

in

the

S&P

500.

WATCH:

Palantir

shares

climb

after

earnings

show

jump

in

commercial

customers

watch

now