A

PayPal

sign

is

seen

at

its

headquarters

in

San

Jose,

California,

on

Jan.

30,

2024.

Justin

Sullivan

|

Getty

Images

News

|

Getty

Images

PayPal

reported

better-than-expected

fourth-quarter

results

Wednesday,

but

issued

guidance

that

was

a

bit

below

estimates.

The

shares

slid

8%

in

extended

trading.

Here’s

how

the

company

did:

-

Earnings

per

share:

$1.48

adjusted

vs.

$1.36

expected

by

LSEG,

formerly

known

as

Refinitiv -

Revenue:

$8.03

billion

vs.

$7.87

billion

expected,

according

to

LSEG

Revenue

increased

9%

in

the

quarter

from

$7.38

billion

a

year

earlier.

The

number

of

active

accounts

fell

2%

to

426

million,

trailing

analyst

expectations

of

427.17

million,

according

to

StreetAccount.

Net

income

rose

52%

to

$1.4

billion,

or

$1.29

per

share,

from

$921

million,

or

81

cents

per

share,

a

year

earlier.

The

company

reported

total

payment

volume

of

$409.8

billion

for

the

quarter,

up

15%

from

the

prior

year

and

surpassing

the

$405.51

billion

expected

by

analysts

polled

by

StreetAccount.

PayPal

provided

guidance

for

the

full

year

and

first

quarter

that

fell

just

short

of

expectations.

The

company

anticipates

full-year

earnings

of

$5.10

per

share,

below

the

$5.48

analysts

expected,

according

to

LSEG.

For

the

first

quarter,

PayPal

estimated

year-over-year

earnings

per

share

growth

would

fall

in

the

mid-single

digits,

compared

with

a

consensus

estimate

of

8.7%.

Finance

Chief

Jamie

Miller

said

on

the

earnings

call

that

the

company

will

stop

providing

annual

guidance,

and

instead

just

provide

an

outlook

for

the

current

quarter.

“Given

the

considerable

changes

underway

at

the

company,

we

believe

it

is

prudent

to

guide

revenue

one

quarter

ahead

and

provide

updates

as

the

year

progresses,”

Miller

said.

PayPal

announced

last

week

that

it

would

cut

9%

of

its

global

workforce,

or

about

2,500

jobs.

Last

month,

the

company

introduced

new

artificial

intelligence

features,

the

first

major

announcement

under

CEO

Alex

Chriss,

who

called

it

the

start

of

the

company’s

“next

chapter.”

“We’re

driving

significant

transformation

across

our

company

and

are

committed

to

making

the

necessary

changes

to

our

business

to

drive

profitable

growth

in

the

years

ahead,”

Chriss,

a

former

Intuit

executive,

who

was

named

CEO

in

August,

said

in

the

earnings

release.

Shares

of

PayPal

are

up

3%

this

year

as

of

Wednesday’s

close

after

falling

for

three

straight

years.

They’re

about

80%

off

their

record

from

July

2021.

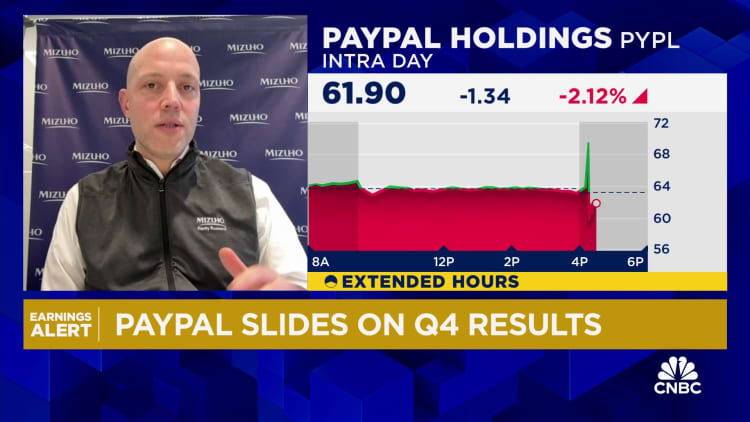

WATCH:

PayPal

slides

on

Q4

results

watch

now