Suppose I summarise 2024 proxy-voting support for environmental, social, and governance-themed resolutions in one sentence. Here it is: Support for environmental and social resolutions was lower again in 2024, while support for governance proposals rebounded.

Understanding these patterns is important for shareholders trying to pick a manager whose proxy voting matches their own values. For years, Morningstar’s key resolution analysis has revealed important trends beneath the headline numbers for an important group of “key resolutions” proposed by ESG-conscious shareholders.

(We define “key resolutions” as environmental and social shareholder proposals with at least 40% support, excluding votes cast by insiders such as executives, founders, and their families. We pay close attention to key resolutions because they give a clearer signal of how institutional investors are voting on higher-quality resolutions addressing material issues, in the market’s perception.)

This year, weve extended our key resolution analysis to include more proposals. Our analysis suggests that the pullback in support for ESG proposals by some of the largest US asset managers has continued this year, further shrinking the population of key resolutions.

However, taking another look at “near-miss” proposals – those just below the 40% threshold – indicates that a committed core of sustainability-conscious asset managers continues to support a cohort of resolutions that are no longer being backed by the very largest firms.

We’ll be able to confirm these trends when manager voting records are released in a few weeks.

Resolution Analysis Reveals Important Hidden Trends

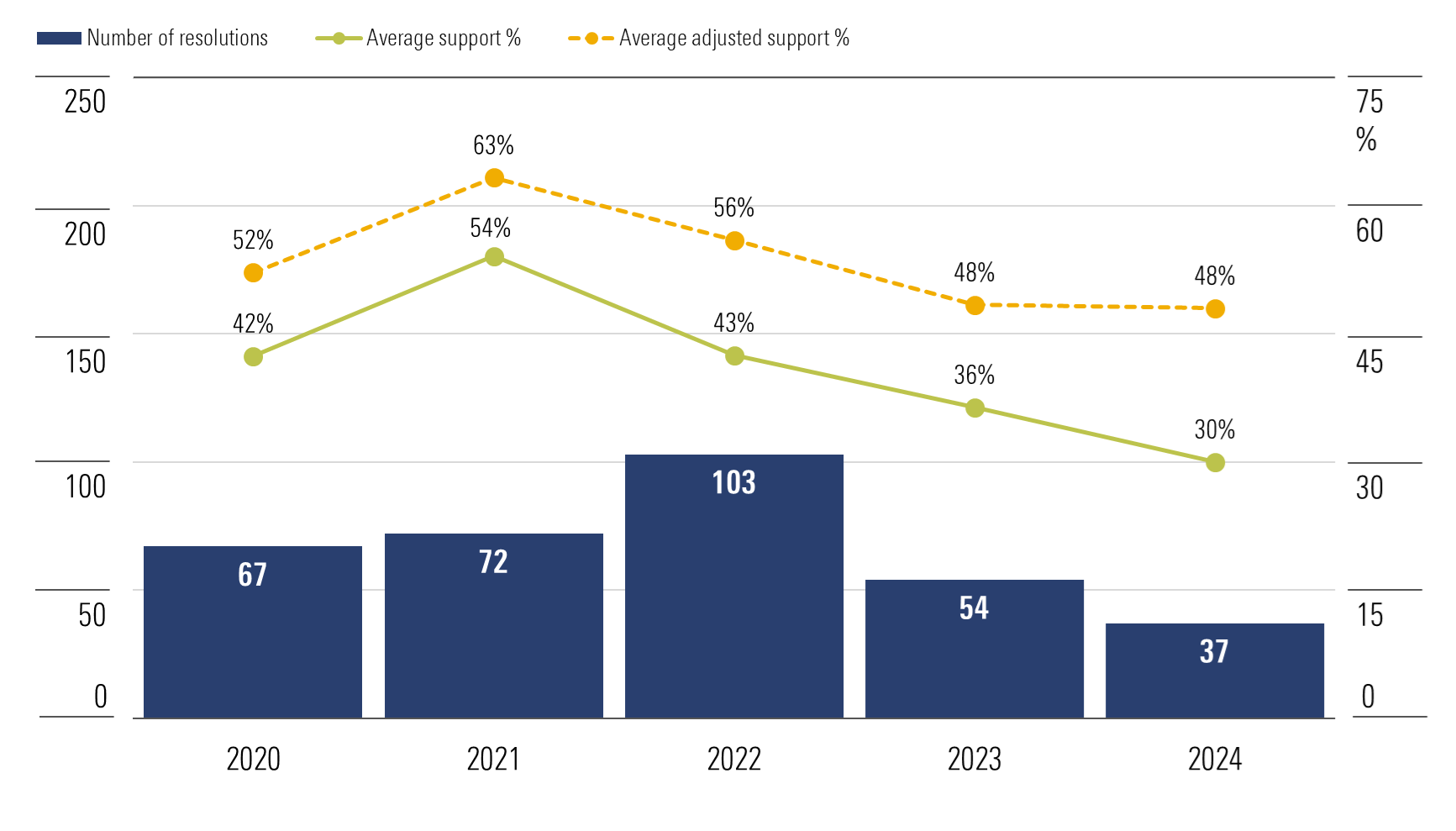

In 2023, the pullback in support for E&S resolutions by several of the largest asset managers caused the number of key E&S resolutions to almost halve, from 103 to 54.

Key E&S Resolutions: Volume and Average Support

Shareholder resolutions in the US market with at least 40% adjusted support

Source: Morningstar proxy voting database, Morningstar Sustainalytics stewardship research. Data as of August 5 2024. Note: chart shows data for the five proxy years ended June 30 2024

In the 2024 proxy year, the population of key resolutions contracted still further to 37, as the chart above shows.

The chart shows a headline decline in average support for key resolutions from 36% in the 2023 proxy year to 30% in 2024. But adjusted for insiders, support is actually unchanged at 48% this year.

The diverging averages also highlight an issue that’s surfaced in increased support for governance proposals this year: unequal shareholder rights.

The number of key resolutions at companies with dominant shareholders (sometimes with multiple-class share structures that magnify their voting power) has grown in recent years. Alphabet (GOOGL), Berkshire Hathaway (BRK.B), Meta Platforms (META), Nike (NKE), Oracle (ORCL), and Tesla (TSLA) all made the list this year, as they often have previously.

Shareholders tend not to agree on very much when it comes to ESG matters, but they do tend to agree that having companies controlled by a small group of insiders does not serve their interests. This year, there has been resurgent support for governance resolutions requesting greater board accountability through more frequent director elections, and better alignment of shareholder rights with their economic stake in the business.

From Key Resolutions to Gold, Silver, and Bronze Tiers

The shrinking cohort of key resolutions is largely the result of a few large firms’ decisions.

Key resolutions tend to be supported by at least one of the very largest managers. The easiest way to get above that 40% threshold is for an asset manager holding 5%, or sometimes 10% or more, of the independent vote to back the resolution at hand. And those managers tend to be the very largest.

So, the pullback in support for environmental and social shareholder proposals last year by several large asset managers, including Vanguard, BlackRock, and Capital Group, presents a particular problem for key resolution analysis. Recognising this last year, we created an analysis this year that covers the entire US market under a new three-tier method.

1. We’ve sorted strongly supported E&S resolutions into three tiers, based on adjusted support level: a Gold tier, a Silver tier, and a Bronze tier. (It is an Olympic year, after all.)

2. Resolutions in the Gold tier have adjusted support of 50% or more, which means a majority of independent shareholders backed the proposal.

3. The Silver tier contains resolutions that fell just short of an independent majority: those with between 40% and 50% adjusted support. This means that the Gold- and Silver-tier resolutions in aggregate correspond to the existing key resolutions.

4. A new group of near-miss resolutions, with between 30% and 40% adjusted support, forms the Bronze tier.

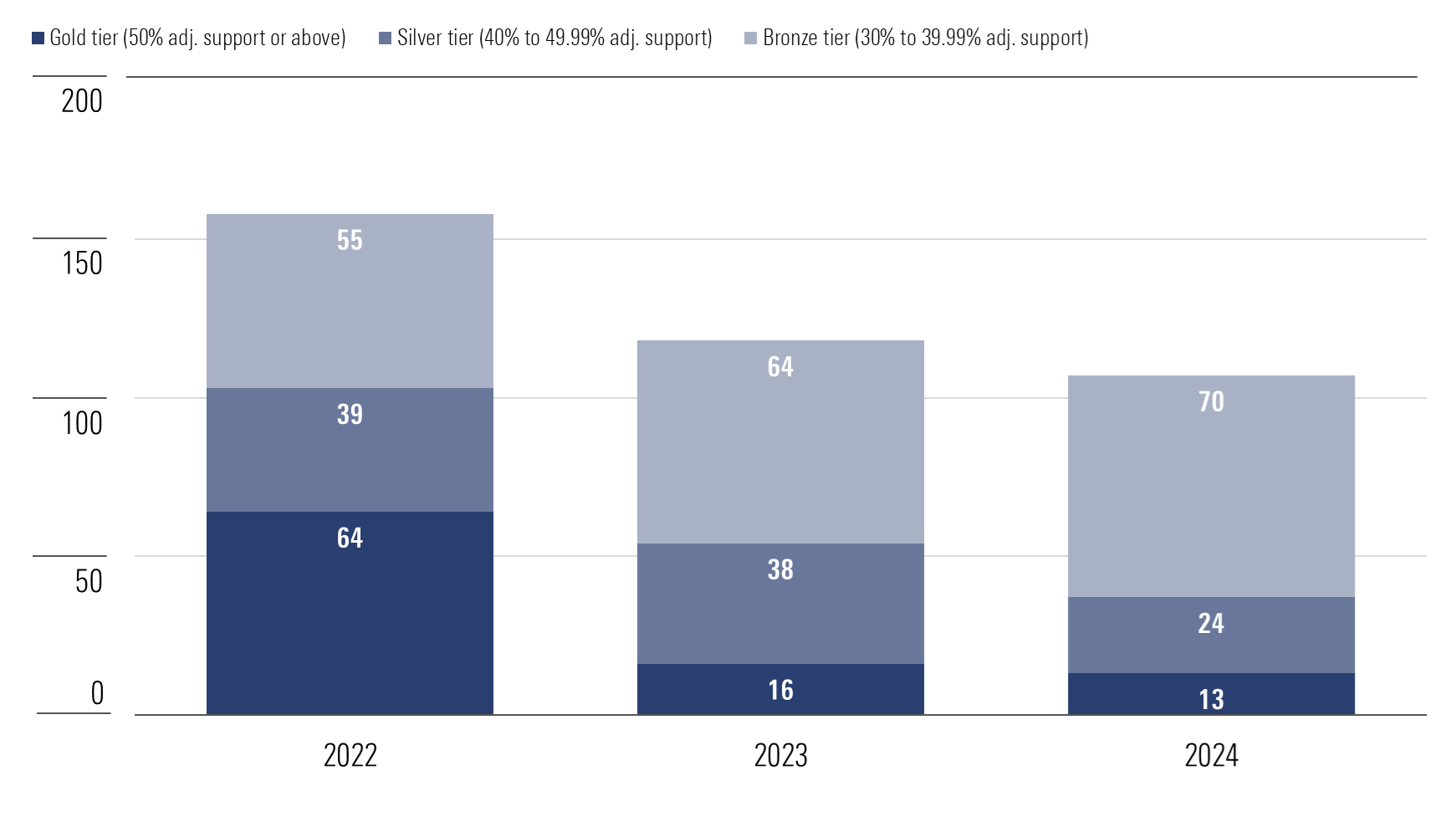

Volume of E&S Resolutions by Tier

Shareholder resolutions in the US market with at least 30% adjusted support

Source: Morningstar proxy voting database, Morningstar Sustainalytics stewardship research. Data as of August 5 2024. Note: chart shows data for the proxy years ended June 30 2024

Source: Morningstar proxy voting database, Morningstar Sustainalytics stewardship research. Data as of August 5 2024. Note: chart shows data for the proxy years ended June 30 2024

The chart above shows how many resolutions sat in each tier over the last three proxy years. It’s notable that over that period the size of the Gold tier has shrunk by 80%, while the Silver tier has shrunk by 40%. Reduced support of the Big Three for E&S resolutions (primarily BlackRock and Vanguard) was the biggest factor in the decline. Partial-year reporting of voting results suggests that trend continued into this year.

However, the Bronze tier has actually grown over the last three years, expanding from 54 resolutions in 2022 to 70 in 2024.

Generally, the Bronze tier of resolutions has enjoyed less support from the very largest asset managers, so they are less negatively affected when those large managers withdraw their support.

For example, in last year’s study, we found that over 30 of E&S resolutions in the new Bronze tier would have been key resolutions, if we excluded the effect of reductions in support by the Big Three index managers: BlackRock, State Street, and Vanguard. We’re likely to see a similar effect later this year when the three firms publish their voting records.

This may mean that there remains a large number of asset managers with smaller stakes in US companies whose support for ESG resolutions has been less volatile than the very largest firms. This is important to know for sustainability-conscious investors picking a manager.

Questions About Resolution Quality Persist

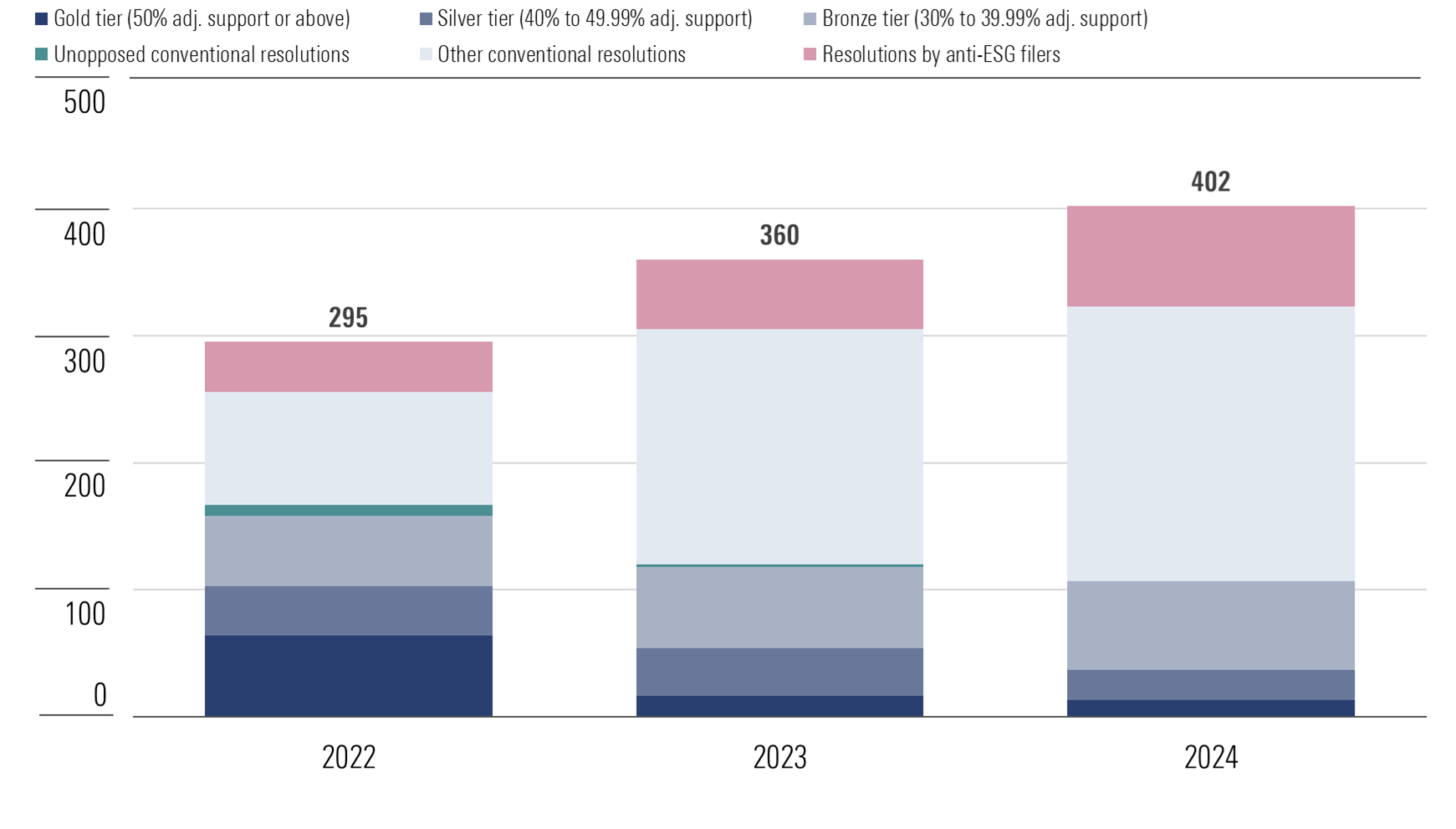

Similar to 2023, we’re expecting asset managers to comment further on their perceptions of a drop in the quality of E&S resolutions this year. The chart below illustrates why.

Volume of E&S Shareholder Resolutions

Voted shareholder resolutions in the US market

Source: Morningstar proxy voting database, Morningstar Sustainalytics stewardship research. Data as of August 5 2024. Note: chart shows data for the three proxy years ended June 30 2024

There has been a shrinking cohort of well-supported E&S resolutions in the three tiers. Furthermore, a tiny sliver of E&S resolutions in the 2022 and 2023 proxy years that were strongly supported because company boards chose not to oppose them, disappeared entirely in 2024.

Meanwhile, the population of conventional E&S resolutions with less than 30% adjusted support has more than doubled from 89 in the 2022 proxy year to 216 in 2024, with a fast-growing block of dozens of resolutions by anti-ESG proponents sitting alongside that.

But there’s more to consider in the new proxy year than just the perceived quality of resolutions. The shareholder proposal process itself is being questioned more than ever.

With a presidential election looming, and with some companies and politicians now openly challenging the SEC’s authority and due process for handling such matters, the next 12 months will prove important for the future of shareholder democracy.

Coming Soon

We’ll publish an extended analysis of everything above, along with the full list of resolutions and support tiers, in a research paper in September. And over subsequent weeks, we’ll publish deep dives into key topics and trends in both governance and E&S resolutions.

In January, we’ll also publish our annual analysis of asset-manager voting records that will help sustainability-conscious investors make manager selection decisions that align with their own environmental and social priorities.

Stay tuned for more.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies

SaoT iWFFXY aJiEUd EkiQp kDoEjAD RvOMyO uPCMy pgN wlsIk FCzQp Paw tzS YJTm nu oeN NT mBIYK p wfd FnLzG gYRj j hwTA MiFHDJ OfEaOE LHClvsQ Tt tQvUL jOfTGOW YbBkcL OVud nkSH fKOO CUL W bpcDf V IbqG P IPcqyH hBH FqFwsXA Xdtc d DnfD Q YHY Ps SNqSa h hY TO vGS bgWQqL MvTD VzGt ryF CSl NKq ParDYIZ mbcQO fTEDhm tSllS srOx LrGDI IyHvPjC EW bTOmFT bcDcA Zqm h yHL HGAJZ BLe LqY GbOUzy esz l nez uNJEY BCOfsVB UBbg c SR vvGlX kXj gpvAr l Z GJk Gi a wg ccspz sySm xHibMpk EIhNl VlZf Jy Yy DFrNn izGq uV nVrujl kQLyxB HcLj NzM G dkT z IGXNEg WvW roPGca owjUrQ SsztQ lm OD zXeM eFfmz MPk