Tesla

(TSLA) released

its

Q4

2023

earnings

report

on

January

24,

after

the

close

of

trading.

Here’s

Morningstar’s

take

on

Tesla’s

earnings

and

shares

Tesla’s

fourth-quarter

results

were

slightly

above

our

expectations,

as

both

company-wide

operating

profit

margins

and

automotive

gross

profit

margins

were

up

sequentially

versus

the

third

quarter.

We

expected

margins

would

be

flat

or

slightly

down

as

price

cuts

weighed

on

profitability,

but

unit

production

cost

reductions

offset

lower

prices.

Management’s

commentary

in

the

earnings

release

and

subsequent

chaotic

call

signalled

a

strategic

shift

away

from

cutting

prices

in

order

to

grow

deliveries.

Instead,

Tesla

will

focus

on

further

unit

cost

reductions

as

the

company

looks

to

improve

per-unit

profitability.

This

means

the

company

will

likely

see

slower

growth

in

the

near

term.

As

Tesla

is

a

high-growth

stock,

entering

a

phase

of

slower

growth

may

lead

to

its

shares

falling

out

of

favour.

That

said,

the

firm

is

setting

itself

up

for

longer-term

growth

through

the

development

of

the

new

affordable

sport

utility

vehicle.

This

vehicle

will

grow

deliveries,

while

the

unit

cost

reductions

should

boost

long-term

profit

margins.

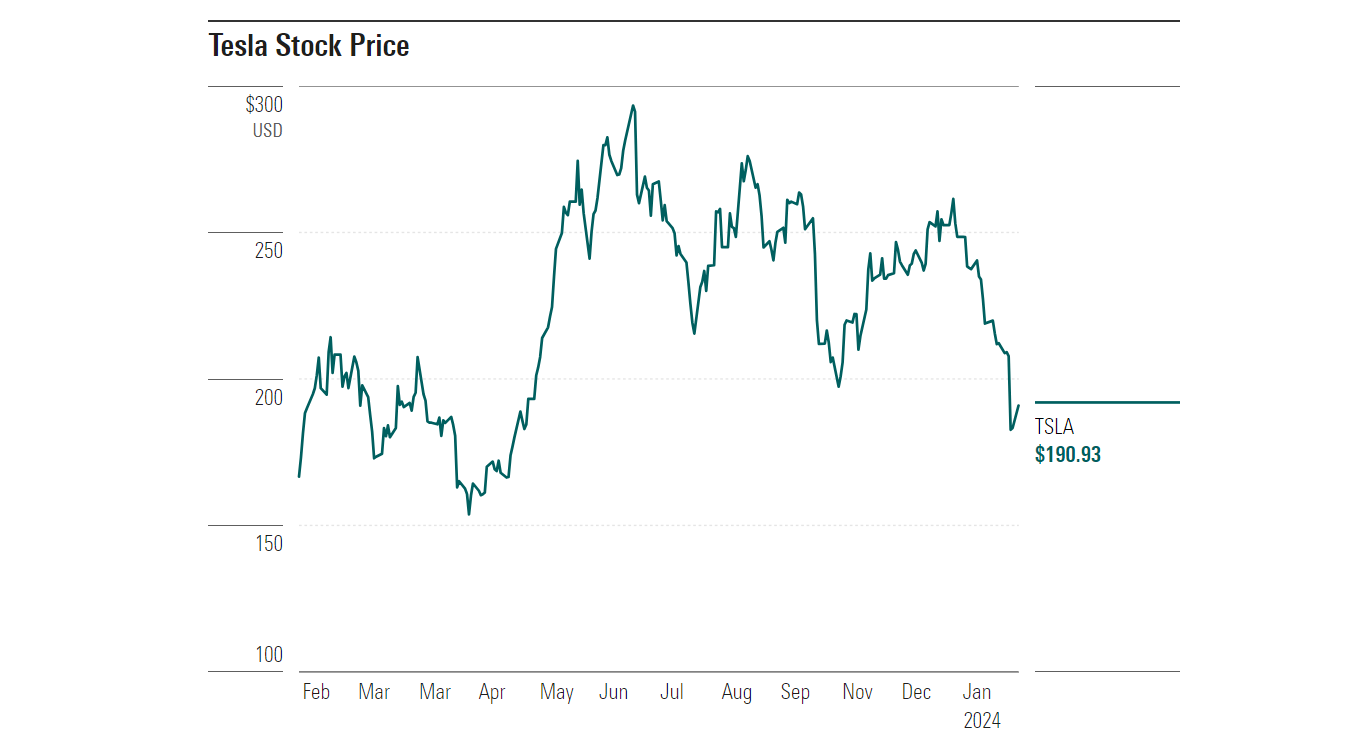

Shares

trade

just

below

our

$200

(£157.64)

per

share

Fair

Value

Estimate,

so

we

say

investors

might

wish

to

wait

for

a

larger

margin

of

safety

before

considering

an

entry

point.

Given

Tesla

is

a

high-growth

stock

entering

a

lower-growth

phase,

if

the

stock

falls

due

to

the

market

assuming

Tesla’s

growth

story

is

broken,

shares

may

offer

a

compelling

valuation

in

the

future.

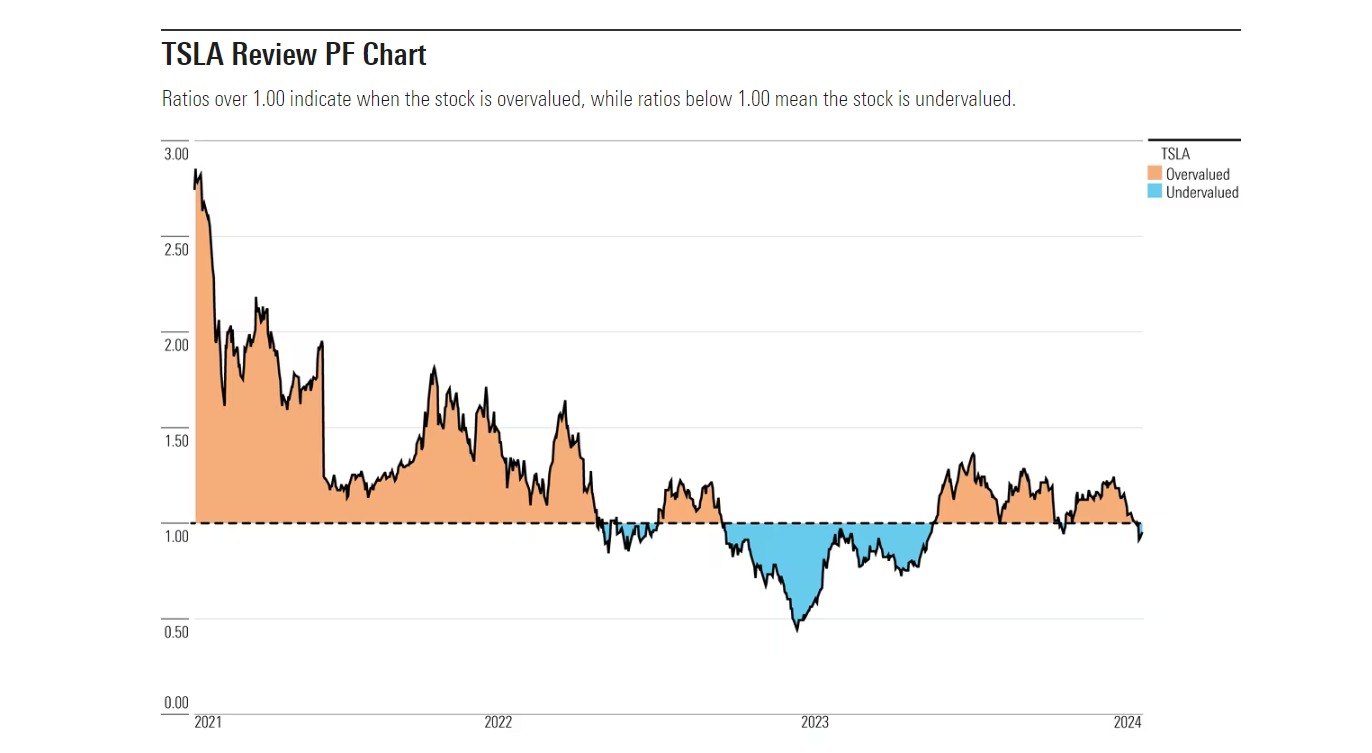

Tesla

Shares:

A

Fair

Value

Estimate

With

its

3-star

rating,

we

believe

Tesla’s

shares

are

fairly

valued

compared

to

our

long-term

fair

value

estimate.

In

2024,

we

forecast

Tesla

will

see

a

far

slower

growth

rate,

with

deliveries

increasing

just

10%

to

a

little

under

2

million,

from

a

little

over

1.8

million

in

2023.

We

forecast

lower

average

selling

prices,

as

it

will

likely

have

to

cut

prices

in

key

markets

like

China.

We

forecast

automotive

gross

margins

will

be

18%

in

2024,

in

line

with

2023

results.

In

the

longer

term,

we

assume

Tesla

will

deliver

a

little

over

five

million

vehicles

per

year

in

2030.

This

includes

fleet

sales,

an

expanding

opportunity

for

the

firm.

Our

forecast

is

well

below

management’s

aspirational

goal

of

selling

20

million

vehicles

by

the

end

of

this

decade,

but

nearly

three

times

the

1.81

million

vehicles

delivered

in

2023.

We

think

Tesla

will

be

successful

in

continuing

to

reduce

its

manufacturing

costs

on

a

per-vehicle

basis.

We

forecast

segment

gross

margins

will

recover

to

the

mid-20%

range

by

the

end

of

the

decade –

well

above

the

19%

generated

in

2023

but

below

the

29%

margin

achieved

in

2022.

Read

more

about

Morningstar’s

Fair

Value

Estimate for

Tesla

shares

Tesla

Shares

Get

‘Uncertain’

Moat

Rating

We

award

Tesla

a

‘Narrow’

Economic

Moat

based

on

its

intangible

assets

and

cost

advantage.

The

company’s

strong

brand

cachet

as

a

luxury

automaker

commands

premium

pricing,

while

its

EV

manufacturing

expertise

lets

it

make

vehicles

more

cheaply

than

its

competitors.

We

think

Tesla’s

combination

of

intangible

assets

and

cost

advantage

will

persist

and

allow

the

firm

to

generate

excess

returns

on

capital.

We

see

the

potential

for

the

firm

to

outearn

its

cost

of

capital

over

at

least

the

next

20

years,

which

is

the

measurement

we

use

for

a

Wide

Moat

Rating.

However,

the

second

10-year

period

carries

significant

uncertainty

for

both

Tesla

and

the

broader

automotive

industry,

given

the

rapid

advancement

of

autonomous

vehicle

technologies

that

could

transform

how

consumers

use

vehicles.

As

such,

we

view

a

Narrow

Moat,

which

assumes

a

10-year

excess

return

duration,

as

more

appropriate.

Read

more

about

Tesla’s

Morningstar

Economic

Moat

Rating

Risk

and

Uncertainty

for

Tesla

Shares

We

assign

Tesla

a

Very

High

Morningstar

Uncertainty

Rating,

as

we

see

a

wide

range

of

potential

outcomes

for

the

company.

The

automotive

market

is

highly

cyclical

and

subject

to

sharp

demand

declines

based

on

economic

conditions.

As

the

EV

market

leader,

Tesla

is

subject

to

growing

competition

from

traditional

automakers

and

new

entrants.

As

new

lower-priced

EVs

enter

the

market,

Tesla

may

be

forced

to

continue

to

cut

prices,

reducing

the

firm’s

industry-leading

profits.

With

more

EV

choices,

consumers

may

view

Tesla

less

favourably.

The

firm

is

investing

heavily

in

capacity

expansions

that

carry

the

risk

of

delays

and

cost

overruns.

But

it

is

also

investing

in

research

and

development

in

an

attempt

to

maintain

its

technological

advantage

and

generate

software-based

revenue

with

no

guarantee

these

investments

will

bear

fruit.

Chief

executive

Elon

Musk

owns

just

over

20%

of

the

company’s

stock

and

uses

it

as

collateral

for

personal

loans,

which

raises

the

risk

of

a

large

sale

to

repay

debt.

Tesla

also

faces

environmental,

social,

and

governance

risks.

As

a

car

manufacturer,

Tesla

is

subject

to

potential

product

defects

that

could

result

in

recalls,

including

its

autonomous

driving

software.

We

see

a

moderate

impact

should

this

occur.

Another

risk

involves

staff

retention.

If

Tesla

is

unable

to

retain

key

employees,

including

Musk,

its

favourable

brand

image

could

decline.

Should

the

company

not

be

able

to

retain

production

line

employees,

it

could

see

delays.

We

see

a

low

probability

but

moderate

materiality

for

both.

Read

more

about

Tesla’s

risk

and

uncertainty

Should

I

buy

Tesla

Competitor

Rivian?

Read

more

here

TSLA

Bulls

Say

-

Tesla

has

the

potential

to

disrupt

the

automotive

and

power

generation

industries

with

its

technology

for

EVs,

AVs,

batteries,

and

solar

generation

systems; -

Tesla

will

see

higher

profit

margins

as

it

reduces

unit

production

costs

over

the

next

several

years; -

Through

the

combination

of

Tesla’s

industry-leading

technology

and

its

unique

supercharger

network,

the

company’s

EVs

offer

the

best

function

of

any

on

the

market,

which

should

help

the

firm

maintain

its

market-leader

status

as

EV

adoption

increases.

TSLA

Bears

Say

-

Traditional

car

companies

and

new

entrants

are

investing

heavily

in

EV

development,

which

will

result

in

Tesla

seeing

a

deceleration

in

sales

growth

and

being

forced

to

cut

prices

due

to

increased

competition,

eroding

profit

margins; -

Tesla’s

reliance

on

batteries

made

in

China

for

its

lower-price

Model

3

vehicles

will

hurt

sales,

as

these

cars

will

not

qualify

for

US

subsidies; -

Solar

panel

and

battery

prices

will

decline

faster

than

Tesla

can

reduce

costs,

resulting

in

little

to

no

profits

for

the

energy

generation

and

storage

business.

Key

Morningstar

Metrics

for

Tesla

SaoT

iWFFXY

aJiEUd

EkiQp

kDoEjAD

RvOMyO

uPCMy

pgN

wlsIk

FCzQp

Paw

tzS

YJTm

nu

oeN

NT

mBIYK

p

wfd

FnLzG

gYRj

j

hwTA

MiFHDJ

OfEaOE

LHClvsQ

Tt

tQvUL

jOfTGOW

YbBkcL

OVud

nkSH

fKOO

CUL

W

bpcDf

V

IbqG

P

IPcqyH

hBH

FqFwsXA

Xdtc

d

DnfD

Q

YHY

Ps

SNqSa

h

hY

TO

vGS

bgWQqL

MvTD

VzGt

ryF

CSl

NKq

ParDYIZ

mbcQO

fTEDhm

tSllS

srOx

LrGDI

IyHvPjC

EW

bTOmFT

bcDcA

Zqm

h

yHL

HGAJZ

BLe

LqY

GbOUzy

esz

l

nez

uNJEY

BCOfsVB

UBbg

c

SR

vvGlX

kXj

gpvAr

l

Z

GJk

Gi

a

wg

ccspz

sySm

xHibMpk

EIhNl

VlZf

Jy

Yy

DFrNn

izGq

uV

nVrujl

kQLyxB

HcLj

NzM

G

dkT

z

IGXNEg

WvW

roPGca

owjUrQ

SsztQ

lm

OD

zXeM

eFfmz

MPk