Snowflake

Chairman

Frank

Slootman

attends

the

Snowflake

Summit

2022

in

Las

Vegas

on

June

14,

2022.

Snowflake

|

Via

Reuters

News

of

Snowflake

CEO

Frank

Slootman’s

retirement

sparked

an

18%

plunge

in

the

company’s

stock

price

on

Thursday,

its

steepest

selloff

since

the

data

analytics

software

vendor

debuted

on

the

New

York

Stock

Exchange

in

2020.

Slootman’s

departure

was

announced

late

Wednesday

as

part

of

Snowflake’s

quarterly

earnings

report,

which

included

disappointing

guidance.

Analysts

at

Mizuho

Securities

wrote

in

a

note

that

the

stock

is

getting

hammered

“as

investors

digest

the

resignation”

of

Slootman,

who

joined

in

2019

and

led

the

company

through

its

blockbuster

IPO

the

following

year.

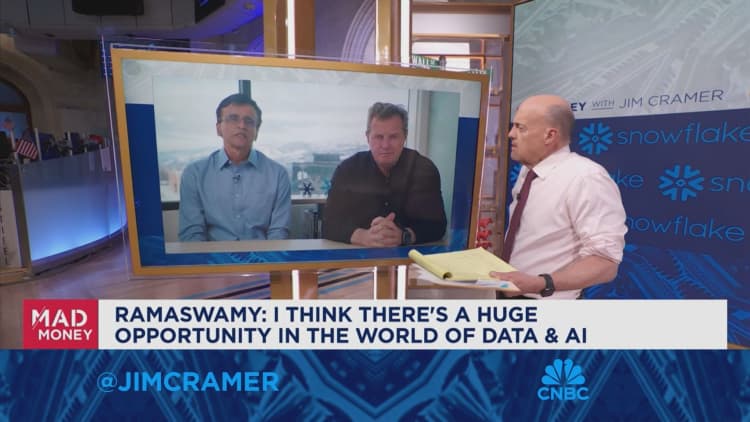

While

the

announcement

caused

consternation

on

Wall

Street,

Slootman

told

CNBC

that

he’s

not

worried

about

a

wave

of

Snowflake

employees

following

him

out

the

door.

“This

is

not

a

personal

cult,

OK?”

Slootman

said.

Slootman,

65,

is

being

succeeded

by

former Google ad

chief

Sridhar

Ramaswamy,

who

joined

Snowflake

in

June

via

the

company’s

$185

million

purchase

of

Neeva,

a

startup

Ramaswamy

co-founded

in

2019.

Snowflake

was

the

third

enterprise

technology

company

that

Slootman

shepherded

through

the

IPO

process,

following

Data

Domain

in

2007

and

ServiceNow

in

2012.

Snowflake

marked

his

biggest

financial

windfall.

He

controlled

roughly

6%

of

the

company’s

stock

at

the

time

of

the

IPO,

and

owned

10.6

million

shares

as

of

Feb.

9,

a

stake

that’s

currently

worth

about

$2

billion.

Additionally,

Slootman’s

total

compensation

in

2023

amounted

to

$23.7

million,

almost

entirely

from

stock

and

option

awards.

Before

joining

Snowflake,

Slootman

spent

about

six

years

as

CEO

of

ServiceNow.

He

told

CNBC

that

ServiceNow

has

continued

to

flourish

since

his

departure.

Annualized

revenue

has

grown

from

$1.5

billion

to

almost

$10

billion.

“Some

people

are

still

there

that

I

hired

—

quite

a

few

of

them,

actually,”

Slootman

said.

“There’s

also

new

ones,

obviously.”

ServiceNow’s

workforce

stood

at

23,668

by

the

end

of

2023,

compared

with

603

in

December

2011,

months

after

Slootman

had

joined,

according

to

regulatory

filings.

“We

put

ServiceNow

on

the

rails.

We’ve

done

that

with

Snowflake

as

well,”

said

Slootman,

who’s

sticking

around

as

chairman.

Taking

three

companies

through

big

and

successful

exits

is

a

rare

feat

in

technology,

and

has

gained

Slootman

plenty

of

acclaim.

But

he’s

also

attracted

attention

for

stepping

into

controversy

on

issues

like

the

tech

industry’s

focus

on

diversity.

In

2021,

as

corporate

America

was

wading

through

the

fallout

of

the

George

Floyd

murder,

Slootman

noted

that

diversity

shouldn’t

trump

merit.

He

later

apologized.

In

his

2022

book

“Amp

It

Up,”

Slootman

offered

advice

leaders

on

how

to

raise

standards

inside

companies,

citing

Steve

Jobs’

insistence

on

greatness

at

Apple.

“Don’t

let

malaise

set

in,”

he

wrote.

watch

now

Founded

in

2012,

Snowflake

built

a

cloud-based

data

warehouse

for

storing

and

analyzing

corporate

information.

Now

the

company

wants

to

help

clients

build

artificial

intelligence

models

and

applications

on

top

of

the

data.

Ramaswamy

said

Snowflake

has

a

clear

vision,

with

the

data

cloud

at

the

center

and

apps

around

it.

“Just

delivering

on

that

at

scale

with

speed

is

what

I’m

going

to

do,”

he

said.

The

challenge

will

be

to

maintain

the

company’s

momentum.

Snowflake

generates

about

$3

billion

in

annualized

revenue,

growing

at

about

32%

a

year,

compared

with

under

$200

million

before

Slootman

replaced

former

Microsoft

executive

Bob

Muglia

as

CEO

in

2019.

As

it

tries

to

continue

its

rapid

expansion,

Snowflake

faces

competition

from

Databricks,

valued

at

$43

billion

last

year

in

an

investment

round

that

included

Capital

One,

which

previously

backed

Snowflake.

After

Snowflake

bought

Neeva,

Slootman

said

he

made

an

effort

to

get

to

know

Ramaswamy.

The

company

put

Ramaswamy

in

the

most

critical

role

at

the

time,

leading

its

AI

efforts.

Slootman

had

a

realization.

“Holy

s—,

this

is

the

opportunity

we’ve

been

waiting

for,”

he

said.

Ramaswamy

said

he’s

been

spending

a

lot

of

time

with

Slootman.

They’ve

traveled

together

to

London

and

Berlin,

along

with

domestic

trips

to

Arizona

and

Las

Vegas.

Ramaswamy

said

he’s

held

conversations

with

over

100

clients,

including

many

with

Slootman.

Now

that

he’s

at

the

helm,

Ramaswamy

has

to

deal

with

the

naysayers.

“It

is

no

doubt

concerning

to

see

Mr.

Slootman,

who

has

a

strong

track

record

and

is

well

regarded

by

investors,

step

down

after

five

years

in

the

role,”

Deutsche

Bank

analysts

wrote

in

a

note

on

Thursday,

though

they

maintained

their

buy

recommendation

on

the

stock.

But

nobody

has

more

at

stake

in

Ramaswamy’s

success

than

Slootman,

who

remains

one

of

the

company’s

biggest

investors.

“Snowflake

is

in

an

extremely

good

place,

having

Sridhar

at

the

helm,”

he

said.

WATCH:

Part

of

Snowflake’s

downfall

is

related

to

CEO

Slootman’s

retirement

watch

now