At market close on Friday, Sept. 20, billions of dollars will exchange hands as S&P changes the way it skirts regulatory concentration limits for its 11 Select Sector indexes.

The change is likely to have the greatest effect on the $68 billion The Technology Select Sector SPDR ETF XLK and its largest holdings: Microsoft MSFT, Nvidia NVDA, and Apple AAPL. Here’s what you need to know.

The ‘Magnificent Seven’ Heavily Influence Index Funds

Through August, Microsoft, Nvidia, and Apple have been the engine driving The Technology Select Sector SPDR ETF. Together, these three stocks made up 48% of the exchange-traded fund on average but contributed two thirds (11%) of the ETF’s 16% year-to-date return.

As these stocks grow increasingly large, so does their weight in The Technology Select Sector SPDR ETF and other index funds. The growth of the “Magnificent Seven″ triggered numerous index weighting caps designed to prevent overconcentration of index funds. Notably, Nasdaq conducted a special rebalance of its flagship Nasdaq 100 index in 2023 to address overconcentration. Now, it’s S&P’s turn.

Qualifying for treatment as a regulated investment company is what’s at stake. RICs can pass through profits to shareholders. Failing to qualify as an RIC means being taxed like a normal corporation—taxing both the fund and its shareholders on capital gains and income. Investors would be rightfully upset if their ETF failed to qualify.

The requirements are simple for RICs (although they require some mental gymnastics):

1. No more than 25% of assets may be invested in a single issuer.

2. The sum of the weights of all issuers representing more than 5% of the fund should not exceed 50% of the fund’s assets.

Index providers build these limits into their indexes to avoid running afoul of the IRS.

S&P Select Sector indexes have a few safeguards in place. First, they cap the weight of individual names at 23% of assets. Second, they allow only 50% to be allocated to companies with weights greater than 4.8%. For indexes over that limit, S&P previously clipped the weight of the “smallest company whose weight is greater than 4.8%” until concentration among those names was back below 50%. That also built a buffer before the capped stock would breach 5% and trigger RIC rules.

S&P’s Technology Select Sector Index is testing these limits. The recent outperformance of Microsoft, Nvidia, and Apple has brought all three over 5% individually and over 50% of the portfolio collectively, causing index constraints to push the smallest of the three down to an unexpectedly low weight. Here’s The Technology Select Sector SPDR ETF XLK‘s top three holdings as of Friday, Sept. 13 (the index reference date):

• Microsoft MSFT (21.95% weight in The Technology Select Sector SPDR ETF)

• Nvidia NVDA (20.09%)

• Apple AAPL (4.86%)

Despite roughly equivalent market capitalizations at the index’s last rebalance (June), Apple’s weight was depressed to satisfy the diversification rule, replacing Nvidia as the third-largest stock in the index, and the world. Here’s The Technology Select Sector SPDR ETF’s top three holdings as of Friday, June 14 (the reference date for its June rebalance):

• Microsoft MSFT (22.13%)

• Apple AAPL (21.94%)

• Nvidia NVDA (6.02%)

At its June rebalance, The Technology Select Sector SPDR ETF was forced to sell roughly $10 billion of Apple and buy nearly as much of Nvidia after the former’s market cap was supplanted by the latter.

Index fund investors have grown increasingly skeptical of the sector index’s weighting scheme as Apple regained second place shortly after the rebalance, setting up the potential for another massive rebalance to meet index rules. A monthlong consultation with market participants led to the eventual shakeup of S&P’s Select Sector indexes and, by effect, State Street’s suite of Select Sector SPDR ETFs.

The rule change, which will be reflected in portfolios on Monday, Sept. 23, will keep the same diversification requirement in place: “the sum of the companies with greater than 4.8% cannot exceed 50% of the total index weight.” The change comes in how that requirement will be implemented. Instead of clipping only the weight of the smallest big holding, the weights of all stocks above that 4.8% threshold will be lowered proportionate to their market capitalization.

The Technology Select Sector Index and funds that track it will see the biggest impact from this change.

Ripple Effects

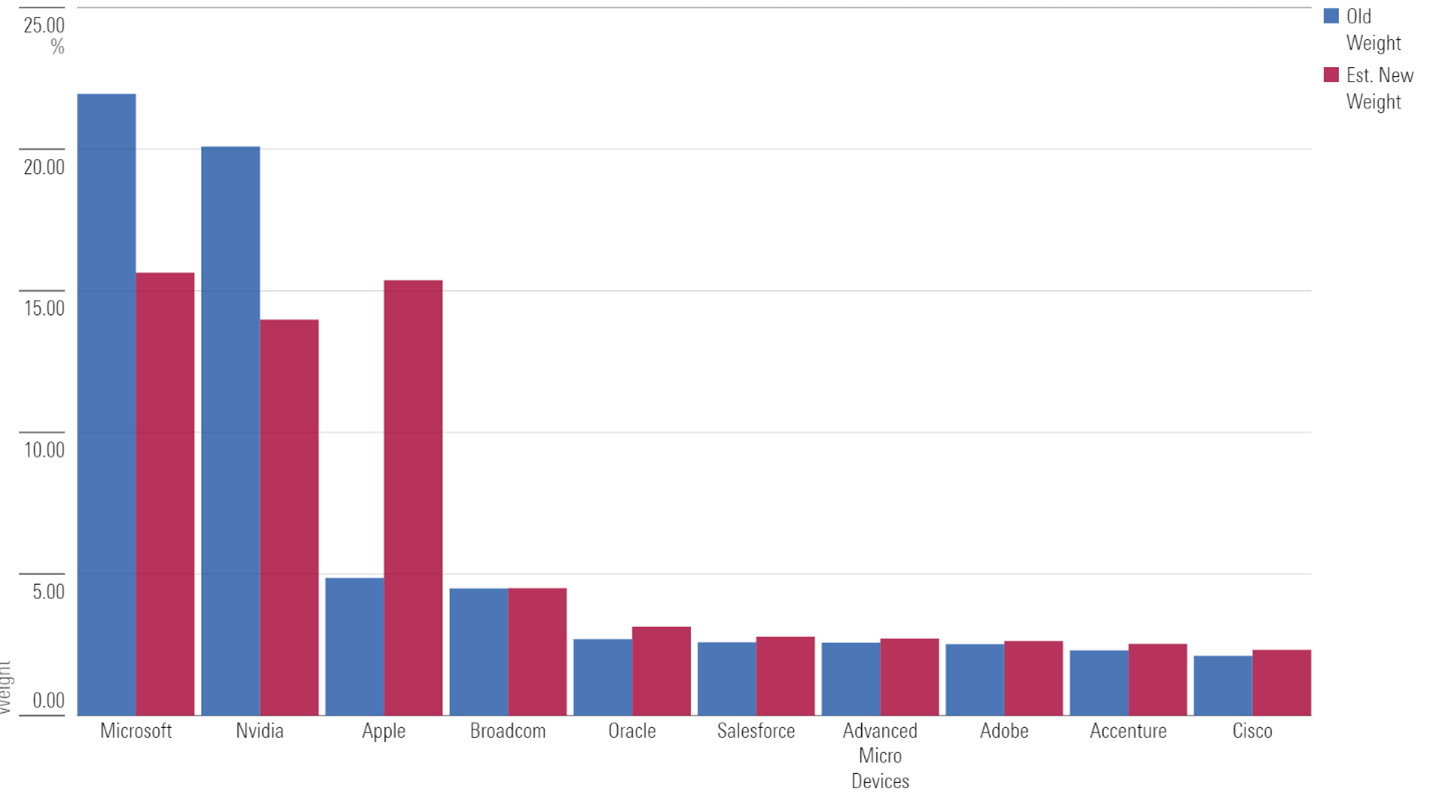

Funds tracking S&P Select Sector indexes claim $300 billion in assets, with The Technology Select Sector SPDR ETF the largest. The ETF will reset its weights alongside the index at market close on Sept. 20. Illustrated below, The Technology Select Sector SPDR ETF will increase its stake in Apple while reducing its stake in Microsoft and Nvidia. Net changes among the top three will be distributed to the rest of the portfolio, which should receive a slight boost.

Microsoft and Nvidia Down, Apple and the Rest Up in The Technology Select Sector SPDR ETF’s Next Rebalance

Source: Morningstar Direct. Author’s calculations. Old weight as of Sept 13, 2024. New weight as of Sept 20, 2024 (estimated expected weight).

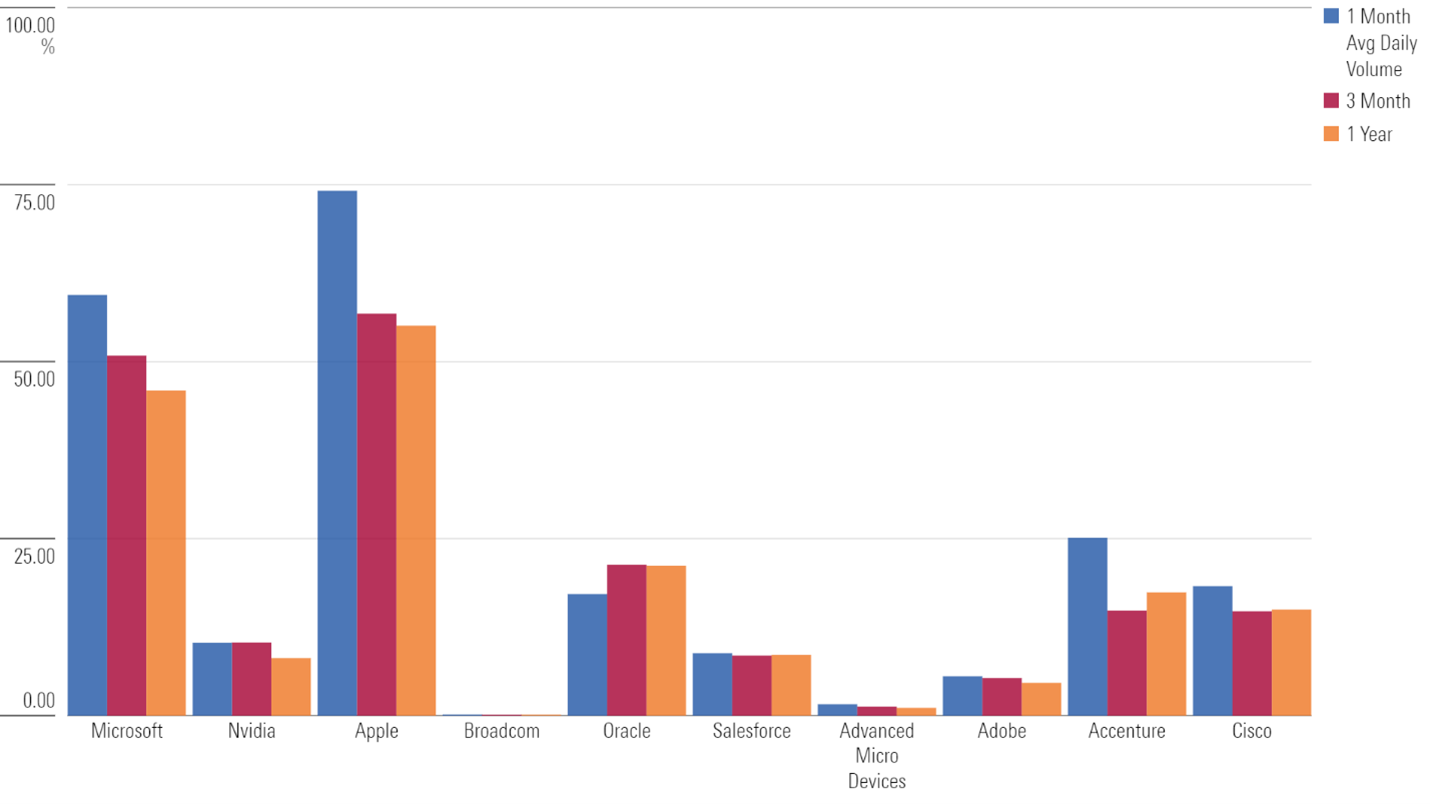

Apple will see its share of The Technology Select Sector SPDR ETF triple when changes go into effect, causing the ETF to buy more than $7 billion of its stock on Sept. 20. The ETF’s trading of Apple stock is likely to make up more than half the stock’s average daily volume over the last one-month, three-month, and one-year periods. Microsoft is also likely to see a major jump in activity that day.

The Technology Select Sector SPDR ETF Trades as a Percentage of Historical Average Daily Volume

Source: Morningstar Direct. Author’s calculations. Values are estimated for Sept. 20, 2024.

High volume is not unexpected around The Technology Select Sector SPDR ETF’s scheduled rebalances. Its June 2024 rebalance saw trading volume in its top 10 holdings measure around 250% of their one-year daily average, on average, far outstripping the ETF’s rebalance alone. Past rebalances look much the same.

The Technology Select Sector SPDR ETF is not the only market mover on the third Friday in March, June, September, and December. Other S&P index funds, including the widely tracked S&P 500, rebalance on the same day. While many of those indexes are not expected to significantly change holding weights like the Technology Select Sector Index, the more than $1 trillion tracking those indexes have the power to move markets.

The index effect—a phenomenon where stocks added to an index see a price boost—is hotly disputed. There’s little conclusive evidence either way, but the forced buying and selling of large index funds is something that fund and stock investors should be aware of. In stocks, high volume is usually associated with high volatility, and high expected volume among The Technology Select Sector SPDR ETF’s constituents may lead to extra volatility surrounding Sept. 20.

Long-term investors should look away, but short-term traders should understand the risks and opportunities of trading around index rebalances.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

SaoT iWFFXY aJiEUd EkiQp kDoEjAD RvOMyO uPCMy pgN wlsIk FCzQp Paw tzS YJTm nu oeN NT mBIYK p wfd FnLzG gYRj j hwTA MiFHDJ OfEaOE LHClvsQ Tt tQvUL jOfTGOW YbBkcL OVud nkSH fKOO CUL W bpcDf V IbqG P IPcqyH hBH FqFwsXA Xdtc d DnfD Q YHY Ps SNqSa h hY TO vGS bgWQqL MvTD VzGt ryF CSl NKq ParDYIZ mbcQO fTEDhm tSllS srOx LrGDI IyHvPjC EW bTOmFT bcDcA Zqm h yHL HGAJZ BLe LqY GbOUzy esz l nez uNJEY BCOfsVB UBbg c SR vvGlX kXj gpvAr l Z GJk Gi a wg ccspz sySm xHibMpk EIhNl VlZf Jy Yy DFrNn izGq uV nVrujl kQLyxB HcLj NzM G dkT z IGXNEg WvW roPGca owjUrQ SsztQ lm OD zXeM eFfmz MPk