After

a

strong

finish

in

2022,

the

aerospace

and

defense

stock

industries

maintained

momentum

through

the

first

half

of

2023.

Amid

a

recent

dip

in

performance

for

aerospace

and

defense

stocks,

high-quality

names

are

trading

at

significant

discounts.

The Morningstar

US

Aerospace

&

Defense

Index – which

measures

the

stock

performance

of

companies

that

build

and

support

aerospace

and

defense

products –

fell

5.6%

in

2023

through

September

12,

while

the Morningstar

US

Market

Index rose

17.9%.

Over

the

past

12

months

through

September

12,

aerospace

and

defensive

companies

are

up

4.7%

while

the

broader

market

gained

11.4%.

What

Are

Aerospace

and

Defense

Stocks?

The

aerospace

and

defense

industry

is

made

of

industrials

companies

that

manufacture

aerospace

and

defense

products,

including

aircraft

and

aircraft

parts,

tanks,

guided

missiles,

space

vehicles,

ships

and

marine

equipment,

and

other

aerospace

and

defense

components

and

systems,

as

well

as

companies

supporting

these

products

through

repair

and

maintenance

services.

Notable

firms

within

the

Morningstar

Aerospace

and

Defense

Index

include

Boeing

[BA],

and

General

Dynamics

[GD].

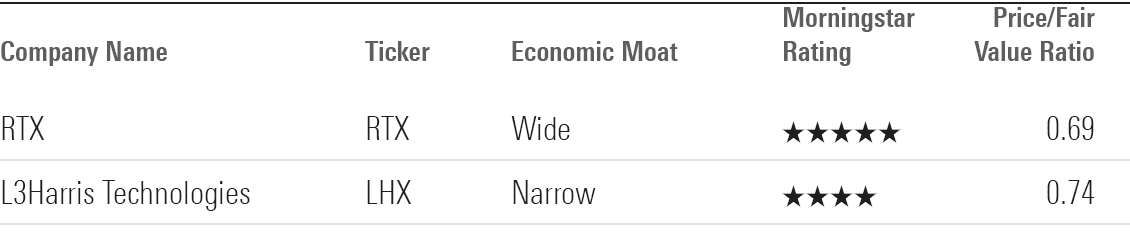

High-Quality

Undervalued

Stocks

For

this

screen,

we

looked

for

the

most

undervalued

stocks

in

the

Aerospace

&

Defense

Index

with

a Morningstar

Rating of

4

or

5

stars.

Next,

we

filtered

that

list

for

stocks

that

have

also

earned

a Morningstar

Economic

Moat

Rating of

wide

or

narrow,

meaning

they

have

durable

competitive

advantages

that

are

expected

to

last

at

least

10

to

20

years.

Stocks

with

moats

and

low

valuations historically

tend

to

outperform

over

the

long

term.

As

of

September

12,

2023,

two

stocks

met

this

criteria.

Here

are

the

two

undervalued

aerospace

and

defensive

stocks

that

made

our

list:

RTX

[RTX],

and

L3Harris

Technologies

[LHX].

RTX

is

trading

at

a

31%

discount

to

its

analyst-assessed

fair

value

estimate

while

L3Harris

Technologies

is

trading

at

a

26%

discount.

Fair

Value

Estimate:

$112.00

“RTX

is

a

diversified

aerospace

and

defense

industrial

company

formed

from

the

merger

of

United

Technologies

and

Raytheon,

with

roughly

equal

exposure

as

a

supplier

to

commercial

aerospace

manufacturers

and

to

the

defense

market.

The

company

operates

in

three

segments:

Collins

Aerospace,

a

diversified

aerospace

supplier;

Pratt

&

Whitney,

an

aircraft

engine

manufacturer;

and

Raytheon,

a

defense

prime

contractor

providing

a

mix

of

missiles,

missile

defense

systems,

sensors,

hardware,

and

communications

technology

to

the

military.

“In

commercial

aerospace,

Collins

is

one

of

the

largest

aircraft

component

and

systems

suppliers.

We

think

its

substantial

scale

gives

it

negotiating

leverage

with

aircraft

manufacturers,

as

it

provides

many

systems

and

can

selectively

bid

on

critical

components.

Meanwhile,

Pratt

&

Whitney

is

in

the

early

innings

of

a

long

ramp-up

of

delivering

thousands

of

jet

engines,

which

power

some

of

the

popular

Airbus

A320neo

and

all

A220

aircraft.

Pratt

continues

to

service

older

V2500

engines

that

power

many

A320s

in

service

today.

We

see

long-term

tailwinds

for

the

GTF

as

we

believe

the

A320

family

will

be

the

dominant

narrow-body

aircraft

of

this

generation.

“In

defense,

Raytheon

provides

missiles,

missile

defense

systems,

sensors,

and

secure

communications

almost

exclusively

to

government

agencies.

We

expect

the

military’s

increased

focus

on

modernizing

its

capabilities

to

drive

material

investment

in

each

of

these

areas.

We

expect

a

flattening,

rather

than

declining,

budgetary

environment

as

heightened

geopolitical

tensions

are

likely

to

buoy

spending

despite

the

potential

debt

burden.

For

these

reasons,

in

addition

to

existing

backlogs,

we

think

Raytheon’s

businesses

can

continue

growing

despite

a

potentially

slower

overall

macro

environment.”

Nicolas

Owens,

equity

analyst,

Morningstar

L3Harris

Technologies

[LHX]

Fair

Value

Estimate:

$227.00

“L3Harris

Technologies

provides

products

for

the

command,

control,

communications,

computers,

intelligence,

surveillance,

and

reconnaissance,

or

C4ISR,

market.

The

firm

produces

uncrewed

aerial

vehicles,

sensors,

and

avionics,

as

well

as

provides

military

and

commercial

training

services

and

maintains

the

Federal

Aviation

Administration’s

communications

infrastructure.

In

July

2023,

the

company

acquired

Aerojet

Rocketdyne,

a

key

supplier

of

rocket

motors

to

the

space

and

defense

industry.

“L3Harris

Technologies

is

the

sixth-largest

US

defense

contractor

by

sales

(13th

globally,

according

to

the

Stockholm

International

Peace

Research

Institute).

It

formed

in

2019

from

the

merger

of

L-3

Technologies,

a

sensor

maker

that

operated

a

decentralised

business

focused

on

inorganic

growth,

and

the

Harris

Corporation,

a

sensor

and

radio

manufacturer

that

ran

a

more

unified

business.

Underpinning

the

merger

was

an

assumption

that

additional

scale

would

primarily

generate

cost

synergies

and

eventually,

the

firms

could

produce

meaningful

revenue

synergies.

“With

the

recent

addition

of

ViaSat’s

tactical

data

link

business

and

most

recently

the

acquisition

of

Aerojet

Rocketdyne,

L3Harris

has

opportunistically

vaulted

its

strategy

forward

into

becoming

a

more

well-rounded

defense

prime

contractor,

adding

munitions,

space

exploration,

and

hypersonic

missile

components

and

capabilities

to

its

very

radio-

and

communications-heavy

base.”

Nicolas

Owens,

equity

analyst,

Morningstar

SaoT

iWFFXY

aJiEUd

EkiQp

kDoEjAD

RvOMyO

uPCMy

pgN

wlsIk

FCzQp

Paw

tzS

YJTm

nu

oeN

NT

mBIYK

p

wfd

FnLzG

gYRj

j

hwTA

MiFHDJ

OfEaOE

LHClvsQ

Tt

tQvUL

jOfTGOW

YbBkcL

OVud

nkSH

fKOO

CUL

W

bpcDf

V

IbqG

P

IPcqyH

hBH

FqFwsXA

Xdtc

d

DnfD

Q

YHY

Ps

SNqSa

h

hY

TO

vGS

bgWQqL

MvTD

VzGt

ryF

CSl

NKq

ParDYIZ

mbcQO

fTEDhm

tSllS

srOx

LrGDI

IyHvPjC

EW

bTOmFT

bcDcA

Zqm

h

yHL

HGAJZ

BLe

LqY

GbOUzy

esz

l

nez

uNJEY

BCOfsVB

UBbg

c

SR

vvGlX

kXj

gpvAr

l

Z

GJk

Gi

a

wg

ccspz

sySm

xHibMpk

EIhNl

VlZf

Jy

Yy

DFrNn

izGq

uV

nVrujl

kQLyxB

HcLj

NzM

G

dkT

z

IGXNEg

WvW

roPGca

owjUrQ

SsztQ

lm

OD

zXeM

eFfmz

MPk