For

months,

pundits

have

looked

for

the

stock

market’s

rally

to

widen

beyond

technology

stocks,

particularly

the

companies

best

positioned

to

benefit

from

the

artificial

intelligence

boom.

But

it

hasn’t

happened.

In

fact,

during

the

second

quarter

of

2024,

the

opposite

took

place.

By

one

measure,

returns

grew

even

more

concentrated,

as

big

tech

continued

to

dominate

market

performance.

The Morningstar

US

Market

Index gained

3.48%

in

the

quarter.

Of

those

3.48

percentage

points,

3.46

came

from

the

technology

sector –

more

than

four

times

the

next-largest

contributor,

communication

services.

Sector

Contributions

to

Q2

Returns

Morningstar

Direct,

28

June

2024

The

leading

drag

on

overall

performance

in

the

quarter

came

from

industrial

stocks,

which

lost

the

market

0.29

percentage

points.

Meanwhile,

large-cap

stocks

carried

the

market’s

gains – specifically

large-growth

stocks,

which

contributed

4.00

percentage

points

to

the

return

on

the

US

Market

Index,

and

large-blend

stocks,

which

contributed

0.94

percentage

points.

Large-value,

mid-cap,

and

small-cap

stocks

were

down

in

the

quarter.

AI

Stocks

Lead

Market

Performance

in

Q2

Drilling

into

the

second

quarter’s

biggest

winners,

tech

and

large-growth

stocks,

a

common

thread

appears.

A

few

major

players

capitalising

on artificial

intelligence

hype continued

carrying

the

market.

Since

the

start

of

2023,

the

US

Market

Index

has

outperformed

the US

Target

Market

Exposure

Equal

Weighted

Index by

nearly

double,

indicating

higher-weighted

stocks

have

increasingly

driven

market

gains.

Market-Cap-Weighted

vs

Equal-Weighted

Performance

Morningstar

Direct,

28

June

2024

Those

stocks

are

AI

giants

Nvidia

(NVDA),

Microsoft

(MSFT),

Apple

(AAPL),

Amazon.com

(AMZN),

Meta

Platforms

(META),

Alphabet

(GOOGL),

and

Broadcom

(AVGO).

These

seven

companies

have

contributed

24.39

percentage

points

of

the

44.23

percentage

points

gained

by

the

market

since

the

start

of

2023,

and

they

currently

hold

a

29%

combined

weight

in

the

index.

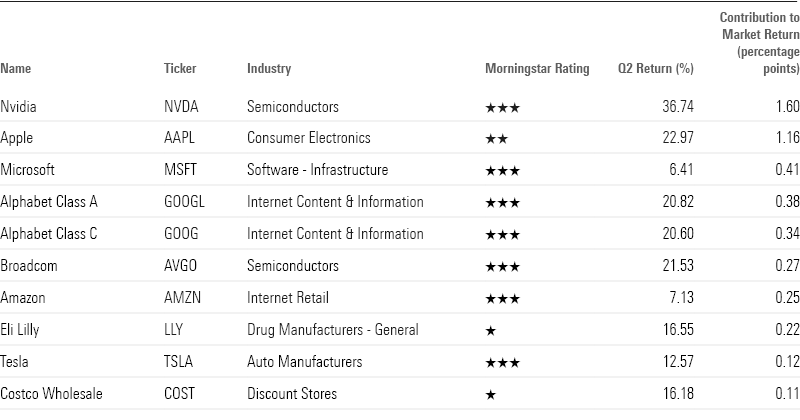

Contribution

to

Return

July

1

2024

Q2

Leading

Contributors

This

past

quarter

was

the

most

dramatic

example

of

the

big

AI

stocks’

outperformance,

as

those

seven

companies

contributed

4.49

percentage

points

to

the

market

return.

The

rest

of

the

market

detracted

0.99

percentage

points.

Nvidia,

which

gained

36.74%,

contributed

1.6

percentage

points.

“Nvidia’s

AI

GPUs

and

GPU

clusters

have

a

dominant

market

position

at

the

moment,”

says

Morningstar

equity

strategist Brian

Colello.

“Demand

continues

to

outpace

our

prior

expectations,

and

we

think

the

company

will

see

a

tremendous

environment

where

demand

exceeds

supply

for

the

next

18

months.

Given

the

introduction

of

Nvidia’s

next-generation

Blackwell

GPUs,

which

may

carry

higher

prices

than

the

previous

generation

products,

Nvidia’s

prospects

remain

bright.”

Apple,

which

gained

22.99%,

contributed

1.16

percentage

points

to

the

return.

After

first-quarter

earnings,

Morningstar

equity

analyst William

Kerwin wrote:

“we

were

pleased

with

the

newly

announced

Apple

Intelligence

suite

of

features,

which

is

Apple’s

first

foray

into

the

field

of

generative

AI.

Apple

touted

a

strategy

of

generative

AI

that

is

personal,

private,

and

integrated,

which

aligns

with

the

firm’s

overall

approach.

We

were

particularly

impressed

with

the

ability

of

Siri

to

pull

data

between

apps

and

take

actions

without

redirecting

the

user.”

Notable

contributors

outside

the

AI

space

include

Eli

Lilly

(LLY),

which

has

seen massive

tailwinds

from

its

obesity

drugs Mounjaro

and

Zepbound,

and

Costco

(COST),

which continues

to

benefit

from

its

low-price

value

proposition.

Q2

Leading

Contributors

Q2

Leading

Detractors

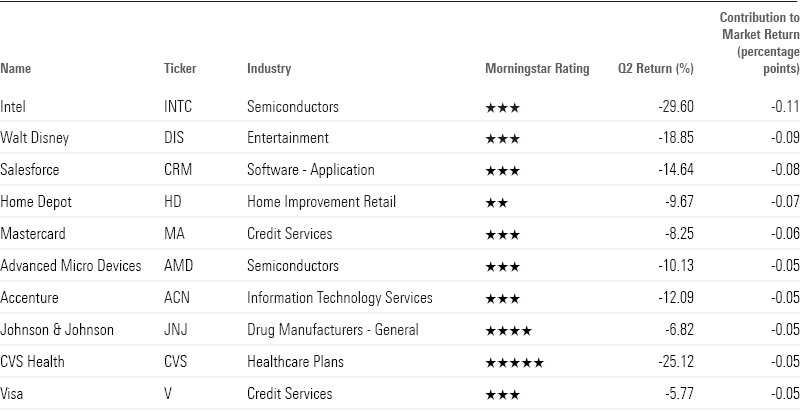

A

downside

of

returns

being

concentrated

within

such

a

small

segment

is

that

when

those

companies

don’t

live

up

to

expectations,

the

market

suffers.

Big

AI

names

Intel

(INTC),

Salesforce

(CRM),

and

Advanced

Micro

Devices

(AMD) saw

their

stock

prices

plunge

after

underwhelming

first-quarter

earnings.

Intel,

which

fell

29.60%

in

the

quarter,

detracted

0.11

percentage

points

from

the

US

Market

Index’s

return.

“First-quarter

earnings

and

Intel’s

investor

event

in

early

April

signaled

that

the

company’s

emerging

foundry

business

was

less

profitable

than

previously

estimated,”

says

Colello.

“Intel

is

doing

the

right

things

by

focusing

on

manufacturing

process

improvement,

but

even

if

it

achieves

its

technological

hurdles,

profitability

on

this

business

might

be

harder

to

achieve.”

Salesforce,

which

dropped

14.64%

in

the

quarter,

detracted

0.08

percentage

points

from

the

market’s

return.

After

first-quarter

earnings

failed

to

meet

expectations,

its

stock

plunged

19.74%

on

May

30.

“The

company

reported

lower-than-expected

fiscal

2025

first-quarter

revenue

and

guided

for

second-quarter

revenue

lower

than

we

anticipated,”

says

Morningstar

senior

equity

analyst Dan

Romanoff.

“Management

maintained

its

full-year

outlook,

raising

the

possibility

of

further

disappointment

throughout

the

rest

of

the

year.”

Other

notable

detractors

outside

the

AI

space

include

Walt

Disney

(DIS),

which

has struggled

with

its

traditional

television

business,

and

Home

Depot

(HD),

which

has faced

headwinds

from

low

housing

turnover

and

high

interest

rates.

Q2

Leading

Contributors

SaoT

iWFFXY

aJiEUd

EkiQp

kDoEjAD

RvOMyO

uPCMy

pgN

wlsIk

FCzQp

Paw

tzS

YJTm

nu

oeN

NT

mBIYK

p

wfd

FnLzG

gYRj

j

hwTA

MiFHDJ

OfEaOE

LHClvsQ

Tt

tQvUL

jOfTGOW

YbBkcL

OVud

nkSH

fKOO

CUL

W

bpcDf

V

IbqG

P

IPcqyH

hBH

FqFwsXA

Xdtc

d

DnfD

Q

YHY

Ps

SNqSa

h

hY

TO

vGS

bgWQqL

MvTD

VzGt

ryF

CSl

NKq

ParDYIZ

mbcQO

fTEDhm

tSllS

srOx

LrGDI

IyHvPjC

EW

bTOmFT

bcDcA

Zqm

h

yHL

HGAJZ

BLe

LqY

GbOUzy

esz

l

nez

uNJEY

BCOfsVB

UBbg

c

SR

vvGlX

kXj

gpvAr

l

Z

GJk

Gi

a

wg

ccspz

sySm

xHibMpk

EIhNl

VlZf

Jy

Yy

DFrNn

izGq

uV

nVrujl

kQLyxB

HcLj

NzM

G

dkT

z

IGXNEg

WvW

roPGca

owjUrQ

SsztQ

lm

OD

zXeM

eFfmz

MPk