Well,

that

was

a

surprise.

From

the

economy

avoiding

a

recession

to

the

massive

stock

market

rally,

2023

defied

expectations.

Heading

into

the

year,

investors

expected

more

difficulty

for

the

stock

and

bond

markets

after

the

2022

bloodletting.

The

stock

market’s

outlook

certainly

seemed

dicey;

the

Federal

Reserve

was

continuing

its

unprecedented

series

of

interest

rate

increases,

and

most

investors

felt

“the

most-advertised

recession

in

history”

was

just

months

away.

Even

those

in

the

more

optimistic

camp

felt

we

would

see

mid-single-digit

gains

at

best

by

year-end.

Instead,

2023

turned

into

one

of

the

biggest

years

for

stock

market

performance

in

the

past

decade,

with

the Morningstar

US

Market

Index up

26.4%.

It

was

especially

good

for

the

kinds

of

mega-cap

technology

stocks

and

other

growth

companies

that

suffered

the

biggest

losses

in

the

2022

bear

market.

The

poster

child

for

the

2023

rally

is

semiconductor

chip

designer

Nvidia

(NVDA),

whose

stock

rallied

a

massive

239%

during

the

year,

as

the

emergence

of

artificial

intelligence

(AI)

technologies

looked

to

reshape

the

tech-stock

landscape.

In

2022,

Nvidia’s

value

had

been

cut

in

half.

Bonds

also

managed

a

noteworthy

comeback,

even

if

the

gains

were

small

for

most

investors.

The

catalyst

behind

the

reversal

of

fortune

was

the

shift

in

Fed

policy

from

interest

rate

increases

to

cuts

for

2024.

While

markets

wrongly

priced

in

such

a

pivot

several

times

over

the

past

year

and

a

half,

by

year-end,

inflation

pressures

had

turned

strongly

enough

toward

disinflation

to

make

it

a

reality.

Here

are

some

of

the

highlights

of

2023’s

markets.

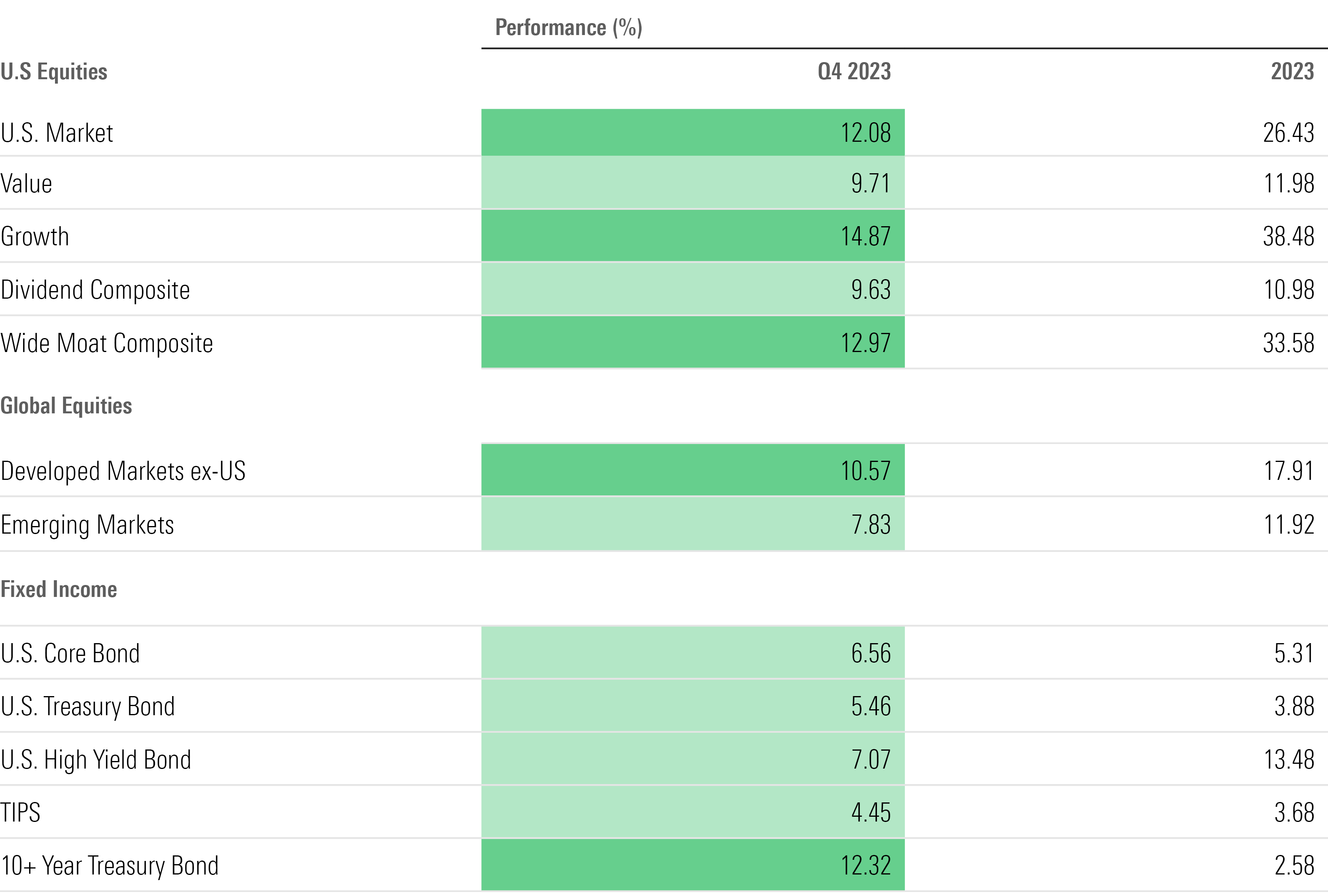

Key

Stats:

2023

Stock

and

Bond

Market

Performance

-

US

Stocks

rose

26.4%

(including

dividends),

the

biggest

rally

in

the

US

Market

Index

since

2019; -

Stocks

were

up

12.1%

in

the

fourth

quarter,

the

index’s

best

quarterly

performance

since

late

2020; -

Since

hitting

their

bear-market

low

in

October

2022,

stocks

have

rallied

36%; -

Technology

stocks

posted

a

huge

year,

surging

59.1%

for

their

best

performance

since

2009.

Along

with

Nvidia,

chip

manufacturer

Advanced

Micro

Devices

(AMD) jumped

128%; -

Communications

Services

ranked

second

among

stock

sectors,

gaining

54.5%,

led

by

rallies

in

Alphabet

(GOOGL),

Meta

Platforms

(META),

and

Netflix

(NFLX); -

The

so-called

“Magnificent

Seven”

stocks

contributed

nearly

half

of

the

stock

market’s

overall

gain; -

Large-growth

stocks

gained

47.3%,

blowing

away

large-value

stocks

by

36

percentage

points –

the

second-biggest

advantage

for

growth

in

25

years; -

Utilities

stocks

stumbled,

losing

7% –

their

worst

year

since

2008—dragged

down

by

higher

interest

rates; -

Dividend

stocks

lagged

the

broader

market.

The Morningstar

US

Dividend

Composite

Index rose

11%; -

Volatility

remained

very

high

in

bonds,

with

some

parts

of

the

bond

market

staging

a

round

trip

over

the

year.

The

yield

on

the

U.S.

Treasury

10-year

note

started

and

finished

2023

near

3.8%,

but

during

the

year

rose

to

a

17-year

high

near

5%; -

Credit-sensitive

corners

of

the

bond

market

performed

strongly

as

the

economy

avoided

recession.

High-yield

bonds

gained

13.5%,

making

for

their

best

year

since

2019.

2023

Stock

Market

Performance

Heading

into

2023,

there

was

budding

optimism

the

worst

was

over

for

the

stock

market

after

it

hit

what

appeared

to

be

bear-market

lows

in

October

2022.

However,

with

inflation

still

at

lofty

levels

and

the

Fed

still

actively

raising

interest

rates,

caution

continued

to

dominate.

For

stock

investors

in

particular,

there

were

widespread

concerns

that

the

economy

would

slide

into

a

recession

in

2023.

Those

fears

took

on

new

life

in

March

following

the

collapses

of

Silicon

Valley

Bank,

Signature

Bank,

and

First

Republic

Bank.

These

failures,

which

stemmed

from

huge

losses

the

banks

suffered

in

holdings

of

government

bonds,

sparked

fears

of

a

full-blown

regional

banking

crisis

and

the

potential

for

a

credit

crunch

that

could

tip

the

economy

into

a

decline.

But

with

the

Fed

stepping

in

quickly

to

ease

the

pressure

on

regional

banks

holding

troubled

bond

portfolios,

confidence

quickly

returned

to

the

stock

market.

At

the

same

time,

enthusiasm

bubbled

over

around

technology

stocks

in

the

wake

of

Nvidia’s

blowout

first-quarter

earnings

report

in

May.

The

key

driver

was

the

booming

business

of

supplying

chips

for

AI

development.

Bolstering

the

outlook

for

equities

was

surprisingly

strong

job

growth.

As

the

year

wore

on,

concerns

about

a

recession

dwindled.

Meanwhile,

corporate

earnings,

which

started

2023

in

a

slump,

also

showed

signs

of

health.

However,

many

investors

remained

wary

of

the

market’s

rally,

in

part

because

it

was

so

heavily

concentrated

in

just

a

handful

of

names,

specifically

the

so-called

“Magnificent

Seven.”

As

of

the

end

of

May,

nearly

all

the

market’s

gains

came

from

the

10

largest

stocks.

Still,

in

June

stocks

crossed

into

new

bull

market

territory,

gaining

20%

from

the

bear

market

low.

By

the

end

of

July,

the

US

Market

Index

was

up

nearly

28%

from

October

2022

and

20%

since

the

start

of

2023.

Stocks

then

ran

into

an

unexpected

air

pocket

in

the

form

of

a

sudden

sharp

sell-off

in

the

bond

market

which

saw

the

yield

on

the

US

Treasury

10-year

note

jump

to

a

17-year

high

near

5%.

Between

July

31

and

Oct.

27,

the

US

Market

Index

fell

just

over

10%,

entering

formal

correction

territory.

But

once

more,

sentiment

reversed,

this

time

as

evidence

accumulated

that

not

only

was

inflation

continuing

to

trend

lower,

but

that

job

growth

was

also

moderating.

Expectations

began

to

build

that

the

Fed

had

raised

interest

rates

for

the

last

time

at

its

July

meeting

and

that

it

would

soon

shift

to

rate

cuts.

By

the

time

the

Fed

signaled

its

pivot

toward

cutting

rates

in

2024,

stocks

were

well

on

their

way

to

a

17%

rally

from

October

lows,

and

the

market

finished

2023

at

its

highs

for

the

year.

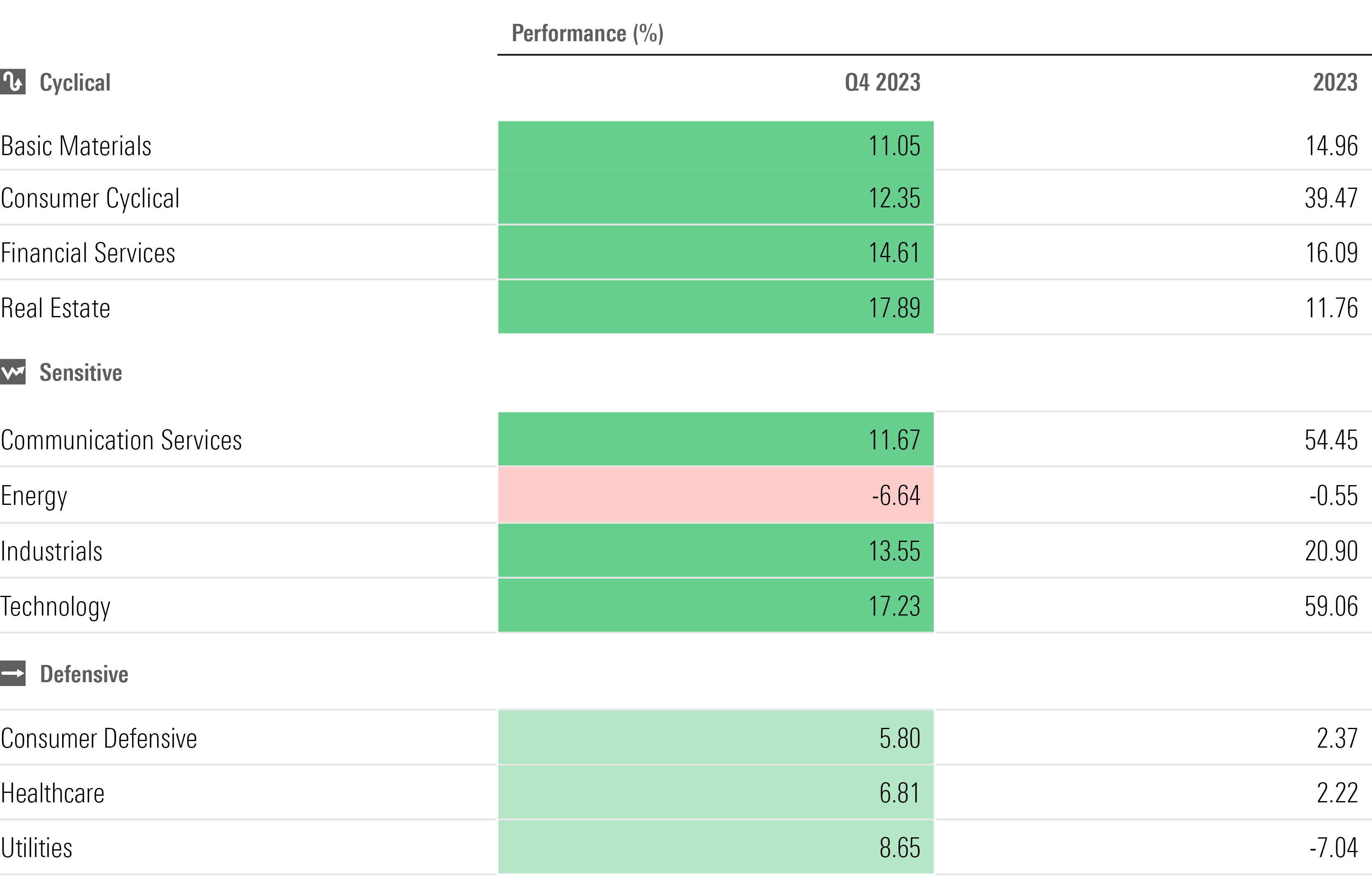

2023

Stock

Sector

Performance

When

it

came

to

the

various

stock

sectors,

the

primary

theme

of

2023

was

“a

reversal

of

fortune.”

Sectors

that

had

been

the

most

buoyant

during

the

bear

market

lagged

significantly

in

2023,

while

those

that

took

the

biggest

beating

in

2022

roared

ahead

with

big

gains.

That

was

especially

the

case

for

technology

stocks

and

the

communications

services

sector,

which

saw

big

rallies

north

of

50%

in

2023.

Contrast

that

with

2022,

when

the Morningstar

US

Communications

Services

Index was

the

worst-performing

sector

benchmark,

losing

40.9%.

The Morningstar

US

Technology

Index had

placed

third

with

a

31.6%

drop,

behind

the

35.5%

loss

in

the Morningstar

US

Consumer

Cyclical

Index.

Powering

the

gains

in

the

tech

and

communications

services

sectors

(along

with

the

jump

in

the

consumer

cyclical

sector)

were

the

Magnificent

Seven.

The

group

comprises

Nvidia,

Tesla

(TSLA),

Meta,

Apple

(AAPL),

Amazon.com

(AMZN),

Microsoft

(MSFT),

and

Alphabet.

Even

Apple,

the

worst

performer

of

the

group,

posted

gains

more

than

20

percentage

points

ahead

of

the

broader

market.

However,

thanks

to

the

big

rally, technology

stocks

are

now

the

most

expensive sector,

based

on

Morningstar

analysts’

fair

value

estimates.

In

the

final

months

of

the

year,

the

market’s

rally

did

broaden

beyond

the

Magnificent

Seven.

However,

this

small

group

of

stocks

was

still

responsible

for

47.8%

of

the

US

Market

Index’s

26.5%

gain.

On

the

other

side

of

the

fence,

2022’s

leaders

were

left

in

the

dust

in

2023.

The

biggest

performance

differential

came

among

energy

stocks.

The Morningstar

US

Energy

Index surged

62.5%

in

2022,

but

in

2023,

the

sector

barely

held

in

positive

territory

as

oil

prices

slid.

While

many

energy

stocks

had

pushed

into

overvalued

territory

as

a

result

of

the

2022

rally,

the sector

is

now

broadly

undervalued.

Utilities

struggled

too,

mainly

because

of

rising

interest

rates,

which

lifts

their

cost

of

capital

and

offers

competition

in

the

form

of

higher

bond

yields.

Before

rallying

off

their

worst

levels,

the

sector

overall

was

at

its

cheapest

level

since

2008,

according

to

Morningstar

analysts.

Now

the

group

is

more

fairly

valued,

but dividend

yields

are

still

seen

as

attractive.

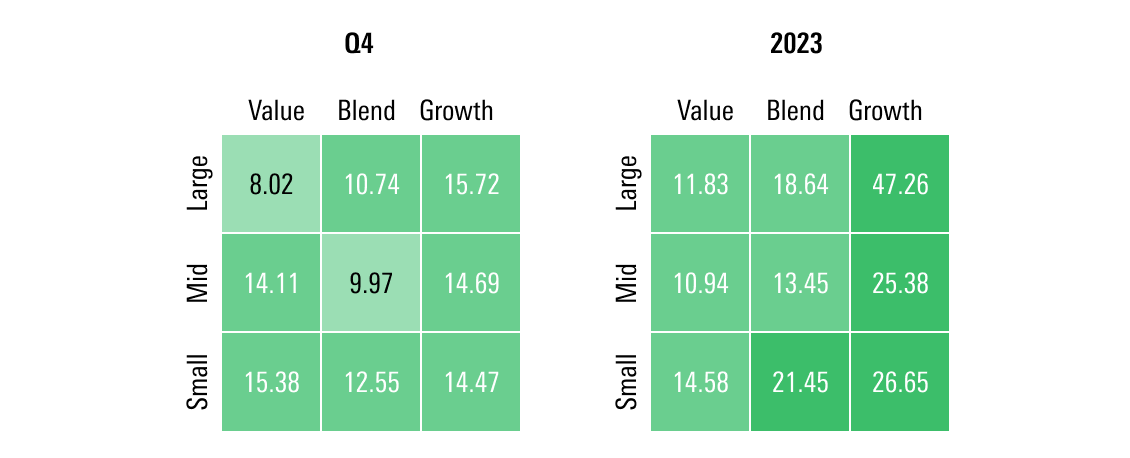

Value

Stocks

vs.

Growth

Stocks

Along

with

the

massive

rally

in

tech

and

communications

services

stocks,

growth

stocks

more

broadly

put

in

their

strongest

performance

in

25

years.

One

catalyst

was

the

shifting

outlook

for

interest

rates.

The

valuations

for

growth

stocks

are

highly

dependent

on

the

value

investors

attach

to

future

earnings.

As

a

result,

rising

rates

drag

on

growth

stocks

because

they

make

those

future

earnings

less

valuable.

But

with

the

Fed

now

expected

to

cut

rates

in

2024,

that

headwind

has

been

reduced.

The

resulting

rally

led

the Morningstar

US

Large

Growth

Index to

its

biggest

gain

since

1998, one

which

outperformed

the Morningstar

US

Large

Value

Index by

35

parentage

points,

which

is

the

second-largest

margin

of

the

past

decade, coming

in

just

behind

2020’s

returns.

For

most

of

2023,

the

stock

market’s

rally

was

dominated

by

large-cap

stocks,

as

smaller

stocks

were

held

back

by

fears

of

recession

and

higher

interest

rates.

Small

value

in

particular

lagged

for

the

first

three

quarters

of

the

year.

However,

with

the

economy

holding

strong,

as

the

Fed

signaled

its

shift

toward

expecting

cut

rates,

small-company

stocks

staged

big

gains

in

the

final

two

months

of

the

year.

During

the

fourth

quarter,

the

Morningstar

Small

Value

Index

posted

its

best

quarterly

gains

since

the

first

three

months

of

2021.

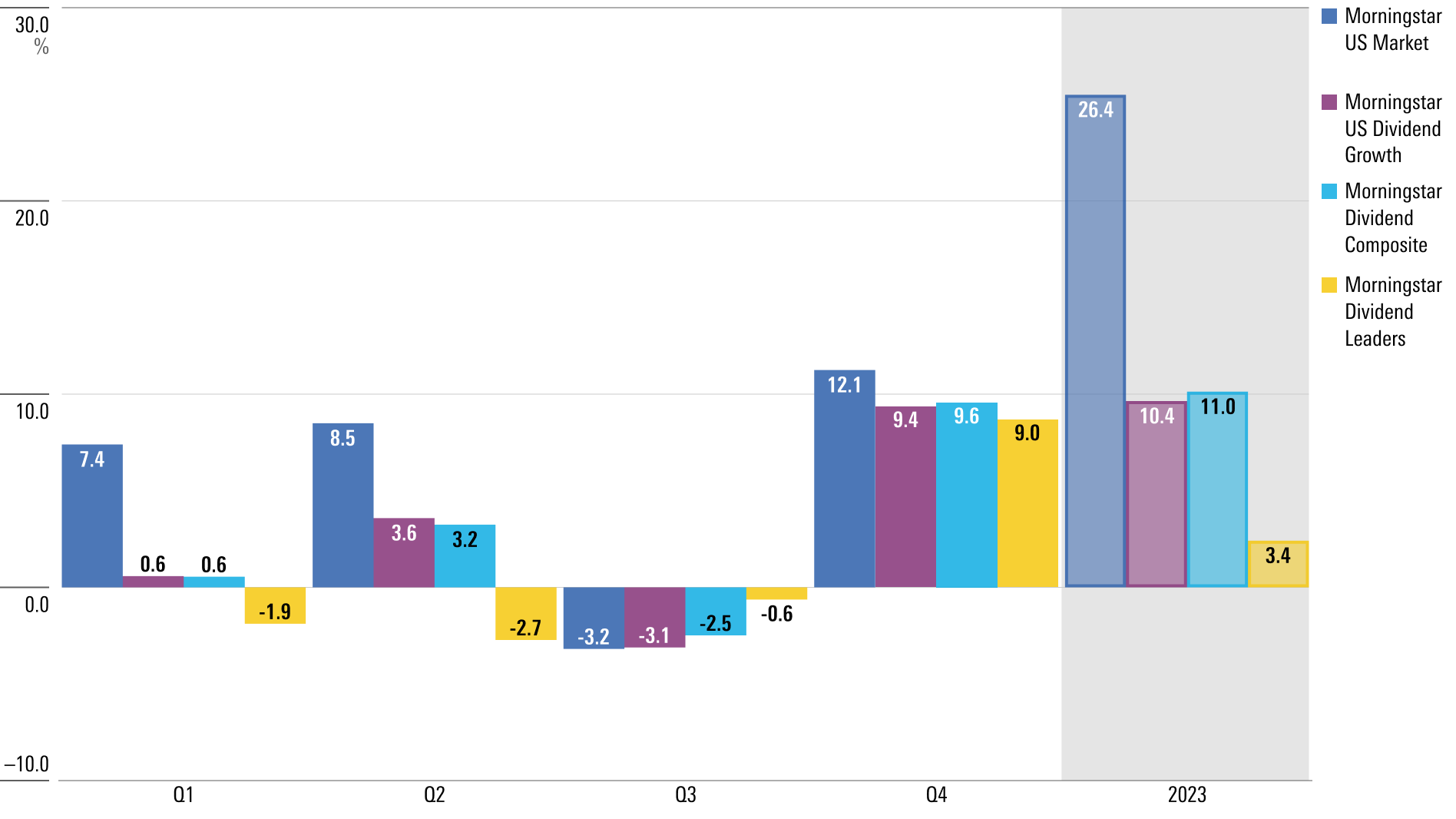

Dividend

Stock

Performance

For

dividend

stocks,

the

story

was

one

of

multiple

headwinds

coming

together

to

depress

performance.

The

regional

banking

crisis

took

its

toll,

thanks

to

heavy

bias

among

dividend

strategies

toward

financials.

Bigger

holdings

of

energy

stocks

and

utilities

also

were

a

drag

on

performance.

The Morningstar

Dividend

Composite

Index – a

broad

measure

of

dividend

stock

performance –

fared

best

among

Morningstar’s

main

dividend

benchmarks,

thanks

to

a

relatively

heavy

weighting

in

technology

stocks,

at

nearly

18%

of

the

portfolio.

(The

Morningstar

US

Market

Index

is

nearly

30%

tech

stocks.)

In

contrast,

the Morningstar

Dividend

Leaders

Index –

a

collection

of

the

100

most

consistently

paying,

highest-yielding

stocks –

has

just

5%

of

its

weight

in

tech

stocks.

That

index

brought

up

the

rear

in

2023,

failing

to crack

even

a

4%

return

for

the

year.

The

Fed

and

Bond

Yields

Far

and

away,

the

biggest

story

for

the

markets

in

2023

was

Fed

policy.

But

as

is

often

the

case,

it

was

more

about

investor

expectations

than

what

the

Fed

actually

did.

As

the

year

got

underway,

the

Fed

shifted

from

its

unprecedented

series

of

three-quarter-of-a-percent

increases

in

its

federal-funds

rate

target

range

during

2022

to

more

traditional

quarter-point

moves.

By

May,

the

Fed

had

raised

three

times

that

year,

taking

that

target

range

to

5.00%-5.25%.

When

officials

met

in

mid-June,

officials

held

policy

steady

for

the

first

time

since

the

hiking

cycle

began

in

March

2022.

However,

Fed

officials

stressed

that

“higher

for

longer”

was

the

likely

course

for

interest

rates.

In

the

background,

inflation

was

still

elevated

and

job

gains

were

strong,

but

with

rates

having

been

raised

aggressively,

officials

signaled

a

desire

to

give

tighter

policy

a

chance

to

work.

The

Fed

raised

rates

again

in

July,

taking

the

funds

rate

target

range

to

5.25%-5.50%.

In

the

bond

market,

yields

followed

an

arc

sharply

higher

and

then

lower

over

the

year,

in

what

turned

out

to

be

a

round

trip

for

some

parts

of

the

US

Treasuries

market.

The

yield

on

the

US

Treasury

10-year

note

(which

serves

as

a

key

benchmark

for

most

home

mortgages

and

other

consumer

and

business

loans)

started

the

year

near

3.8%,

and

for

the

first

seven

months

of

2023,

it

bounced

back

and

forth

within

a

relatively

tight

range.

However,

in

early

August,

Treasury

bond

yields

spiked

in

response

to

news

that

the

federal

government

had

a

larger-than-expected

need

to

borrow

money

through

bond

sales

in

the

third

quarter,

rumblings

of

higher

rates

in

Japan,

and

data

showing

a

red-hot

jobs

market.

This

sent

the

yield

on

the

10-year

note

to

a

17-year

high

of

roughly

5%

from

just

below

4%

on

July

31.

Then,

just

as

quickly,

that

sell-off

was

reversed

as

data

showed

the

jobs

market

was

finally

moderating

from

the

pace

of

hiring

seen

for

most

of

the

year.

In

addition,

inflation

news

continued

to

be

favorable.

When

the

Fed

confirmed

it

expected

to

pivot

to

rate

cuts

in

2024,

bonds

rallied

strongly.

Treasury

Yield

Curve

Inversion

Another

aspect

of

the

market

that

looks

strikingly

similar

at

year-end

to

the

way

it

did

at

the

start

is

the

inverted

US

Treasury

yield

curve.

When

short-term

Treasury

yields

exceed

long-term

yields,

it’s

known

as

an

inverted

yield

curve,

and

this

is

widely

seen

as

a

precursor

to

a

recession.

(Not

all

yield

curve

inversions

lead

to

recessions,

but,

historically,

all

recessions

have

been

preceded

by

one.)

Many

analysts

say

the

longer

the

yield

curve

remains

inverted,

the

more

likely

a

recession

becomes.

The

yield

curve,

as

measured

by

the

gap

between

yields

on

the

Treasury

2-year

and

10-year

notes,

has

been

steadily

inverted

since

July

2022.

This

was

the

result

of

the

Fed’s

aggressive

effort

to

raise

the

federal-funds

rate,

which

lifted

short-term

yields

well

above

long-term

yields.

Looking

at

recent

history,

this

17-month

inversion

is

second

in

length

only

to

the

period

of

August

1978

through

April

1980,

which

ended

while

the

economy

was

in

recession.

Over

2023,

the

extent

of

the

inversion

has

swung

widely.

To

start

the

year,

2-year

notes

yielded

about

0.5

percentage

points

above

the

10-year

note.

Twice

during

the

year,

that

gap

widened

to

roughly

a

full

percentage

point,

which

by

historical

standards

is

an

extremely

large

difference.

During

the

bond

market

sell-off

in

October,

the

yield

curve

flattened

out

toward

a

0.2-percentage-point

difference

for

2-year

notes

over

10-year

notes.

By

year-end,

the

yield

curve

was

inverted

by

roughly

0.4

percentage

points.

2023

Bond

Market

Performance

While

most

of

the

attention

was

on

the

Fed’s

plans

for

interest

rates

and

the

wild

swings

in

long-term

Treasury

bond

yields,

when

it

came

to

actual

returns,

the

action

was

elsewhere.

By

far,

the

best

returns

came

on

credit-sensitive

portions

of

the

bond

market.

Several

factors

boosted

returns

on

the

credit

markets.

The

first

was

the

unexpected

strength

of

the

economy.

As

the

year

wore

on

and

it

became

clearer

that

we

would

avoid

recession,

that

lessened

the

perceived

risks

of

default

on

bonds

issued

by

riskier

borrowers.

Second,

many

lower-quality

borrowers

had

taken

advantage

of

the

long

period

of

extremely

low

interest

rates

to

issue

longer-maturity

debt.

That

meant

that

even

with

interest

rates

higher

than

they

have

been

in

many

years,

those

borrowers

weren’t

as

likely

to

face

a

cash

crunch

brought

on

by

having

to

issue

debt

at

levels

they

couldn’t

afford.

Meanwhile,

the

strong

gains

in

the

stock

market,

along

with

the

friendly

Fed,

engendered

a

so-called

“risk

on”

mentality,

wherein

investors

were

more

willing

to

venture

into

lower-quality

debt.

As

a

result,

for

the

second

year

running,

leveraged

loans

were

a

top-performing

group

within

the

bond

market.

Leverage

loans

had

the

benefit

of

both

the

favorable

backdrop

for

credit

conditions

and

their

historical

bias

toward

performing

well

in

rising

rate

environments,

thanks

to

the

floating-rate

nature

of

the

underlying

debt.

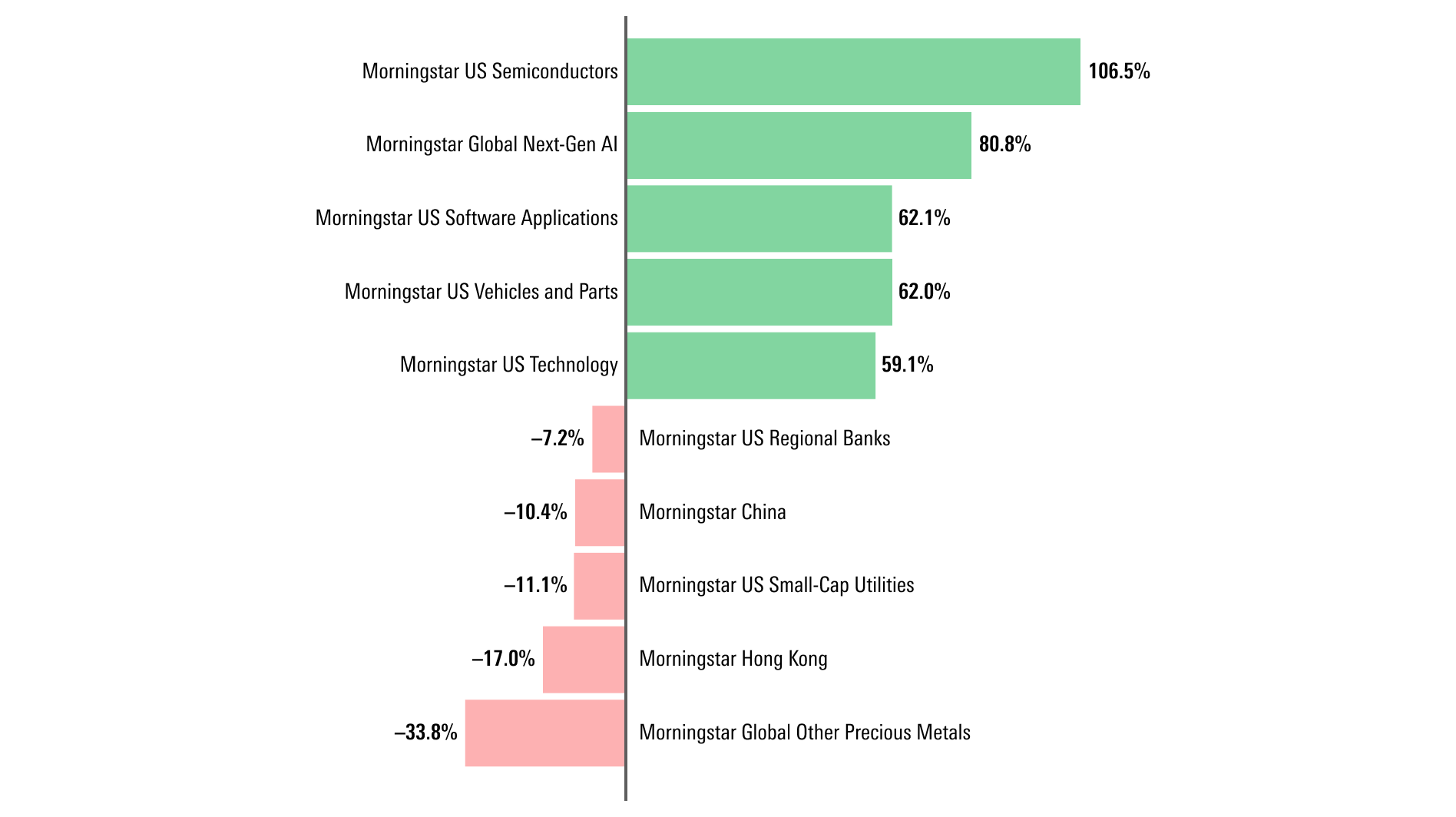

2023’s

Best

and

Worst

Market

Performers

It

was

a

good

year

for

technology

stocks,

no

matter

how

you

sliced

it.

Even

when

pulling

back

the

lens

globally,

across

asset

classes

and

sectors,

technology

names

(semiconductors

in

particular)

dominated

the

performance

charts

in

2023.

Driving

this

rally

was

the

emergence

of

AI

as

a

transformative

technology

requiring

massive

new

computing

power.

Even

as

much

of

the

broader

stock

market

marched

higher

over

the

year,

one

group

was

unable

to

erase

its

early

massive

losses:

regional

banks.

The Morningstar

US

Banks-Regional

Index was

down

as

much

as

36%

in

May

after

the

collapse

of

Silicon

Valley

Bank,

and

even

over

the

summer

it

was

still

posting

double-digit

losses.

It

was

only

with

the

signals

from

the

Fed

that

rate

cuts

could

be

coming

in

2024 –

which

would

relieve

the

pressure

on

these

banks’

balance

sheets –

that

the

index

closed

its

losses

to

single

digits

for

the

year.

Bottom-ranked

performers

also

include

China

stocks,

where

equities

are

posting

their

third

consecutive

year

of

losses.

Sentiment

among

investors

has

been

soured

by

a

combination

of

slowing

economic

growth,

ongoing

financial

strains

in

the

country’s

real

estate

sector,

and

a

heightened

wariness

among

some

investors

about

the

geopolitical

risks

involved

with

owning

China

stocks.

Stock

and

Bond

Market

Volatility

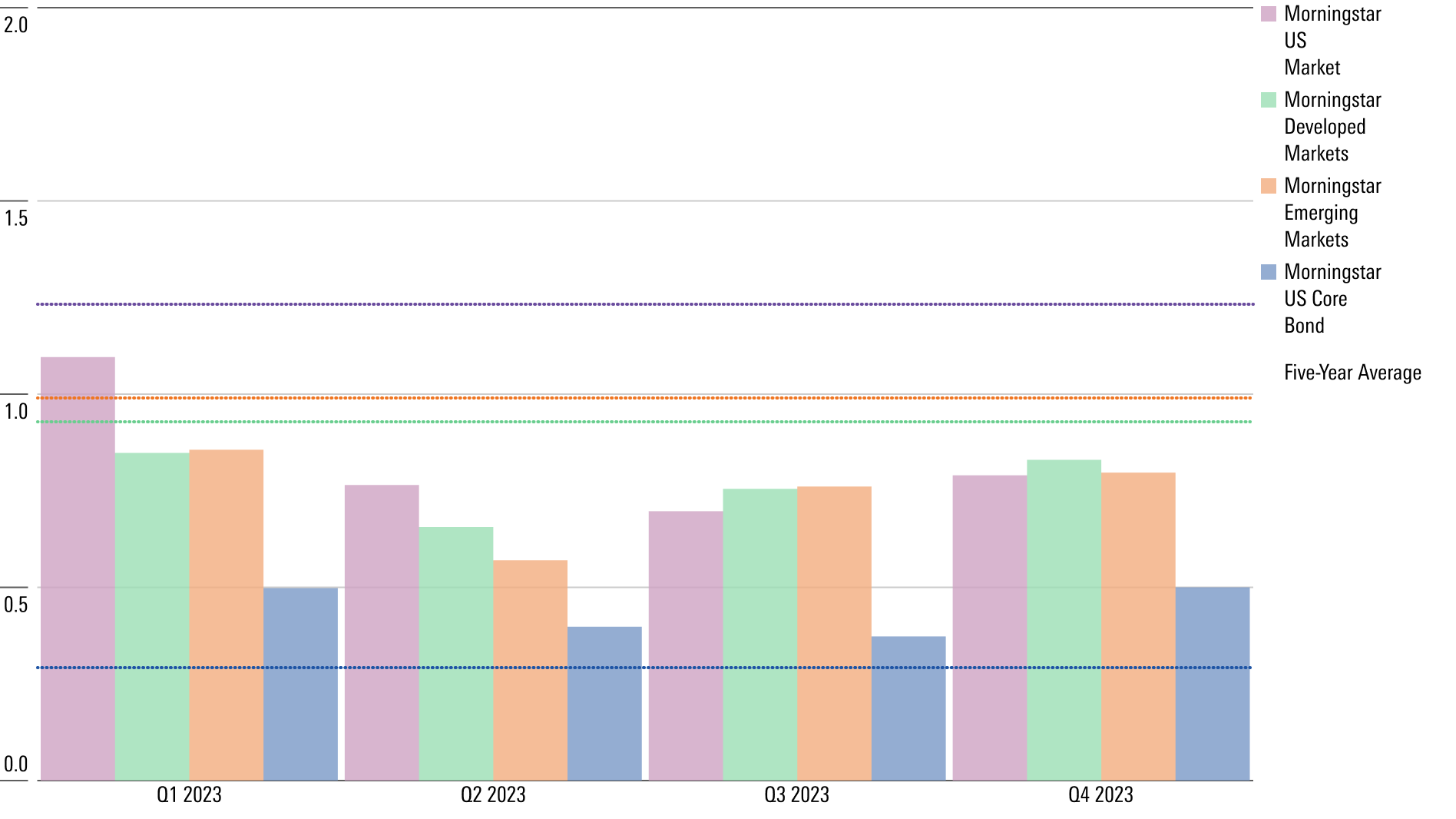

The

past

year

was

a

reminder

that

volatility

captures

both

market

plunges

and

big

market

rallies.

Even

as

stocks

and

bonds

posted

gains

for

the

year,

volatility

was

elevated –

especially

in

the

bond

market,

which

saw

a

tremendous

whipsaw

in

prices

during

the

fourth

quarter.

Driving

the

volatility

was

the

back

and

forth

over

the

outlook

for

the

Fed.

During

the

fourth

quarter,

as

the

Treasury

bond

market

swung

from

a

big

sell-off

into

a

sharp

rally,

volatility

jumped

to

its

highest

level

in

at

least

five

years.

2023

Currency

Market

Performance

For

much

of

the

year,

the

story

in

the

currency

markets

was

the

strength

of

the

dollar,

especially

against

the

Japanese

yen.

With

the

Fed

continuing

to

raise

rates

and

the

Bank

of

Japan

doing

little

more

than

signaling

a

slight

bias

toward

higher

rates,

the

dollar

gained

nearly

16%

against

the

yen

by

the

middle

of

November.

It

was

only

in

the

final

weeks

of

the

year,

after

the

Fed

signaled

its

pivot

to

lower

rates,

that

the

dollar

fell

back

against

the

yen.

Still,

the

dollar

finished

2023

up

nearly

8%

against

the

yen.

The

greenback

also

held

firm

against

the

euro,

with

expectations

that

the

European

Central

Bank

will

need

to

cut

rates

in

2024

largely

offsetting

similar

expectations

for

the

Fed.

2023

Commodity

Markets

Performance

In

commodities,

geopolitical

risks

continued

to

hover

over

the

oil

market,

but

it

was

slowing

demand

that

drove

prices

in

the

end.

Oil

prices

spiked

in

October

in

the

wake

of

the

outbreak

of

war

between

Israel

and

Hamas,

but

quickly

fell

back.

That

slump

came

despite

concerns

over

OPEC

output

cuts

by

Russia

and

Saudi

Arabia.

Gold

prices

ended

2023

near

a

new

record

high

hit

in

early

December.

Driving

prices

higher

have

been

a

combination

of

concerns

about

geopolitical

risks,

such

as

an

expanding

war

in

the

Middle

East,

and

the

prospects

of

lower

interest

rates

in

the

United

States.

Meanwhile,

copper

seesawed

in

2023,

but

it

finished

the

year

slightly

higher.

With

copper

seen

as

a

reflection

of

global

economic

activity,

prices

have

been

capped

by

concerns

about

the

health

of

the

Chinese

economy

and

expectations

for

slower

growth

in

the

U.S.

in

2024.

2023

Cryptocurrency

Performance

Cryptocurrencies

roared

back

to

life

in

2023,

despite

continuing

scandals

in

the

industry.

Both

Bitcoin

and

Ether

lost

more

than

half

their

value

in

2022,

but

their

prospects

revived

on

expectations

that

the

Securities

and

Exchange

Commission

is

drawing

closer

to

approving

exchange-traded

funds

based

on

spot

cryptocurrency

trading.

In

addition,

both

currencies

gained

in

strength

as

investors

viewed

the

Fed’s

expected

rate

cuts

as

a

positive.