The wait is over: the Fed has cut rates for the first time in over four years.

The Federal Reserve announced on Wednesday that it will lower its benchmark interest rate to a target range between 4.75% and 5.00%—an aggressive half-point cut.

This was a major headline event, but not a surprise. The market knew this was coming and asset prices—stocks, bonds, and everything in between—had already adjusted accordingly. That’s how markets often operate, efficiently pricing in expected outcomes well before they occur.

This likely began in July, when small-cap stocks experienced their best single month of performance in two decades, driven by anticipation of the Fed’s plan to lower rates. Another notable example is the 30-year mortgage rate, which was 7% in July and has since dropped to 6.2%. The same trend is evident in the 10-year Treasury yield, which was at 4.4% in July and now hovers near 3.7%.

In short, the market had already done much of the Fed’s work for it. This is something to keep in mind as you ponder what may come next or work with clients to properly contextualize the situation.

On a recent episode of the Odd Lots podcast, Pimco Chief Investment Officer Dan Ivascyn discussed this topic and was blunt in his assessment of what it means, stating:

“If you have a three-to-five-year time horizon, this is really noise,” while adding, “it’s less important than people think it is.”

Of course, reasonable people can disagree. Stating the obvious: Rates going up versus rates going down is a completely different market environment. As Warren Buffett himself has said, interest rates act like gravity on asset prices, which is to say, this does matter.

Ivascyn further added that his executive team, along with former Fed Chairman Ben Bernanke—now a Pimco advisor—sits in a conference room during Fed press conferences, analyzing subtle changes in tone and language. Any notable developments could influence how they trade and position their portfolios.

But for financial advisors discussing this topic with clients, the most important question might be: What do rate cuts tell us about the future? The answer: For those with a time horizon beyond a few years, it’s often just noise.

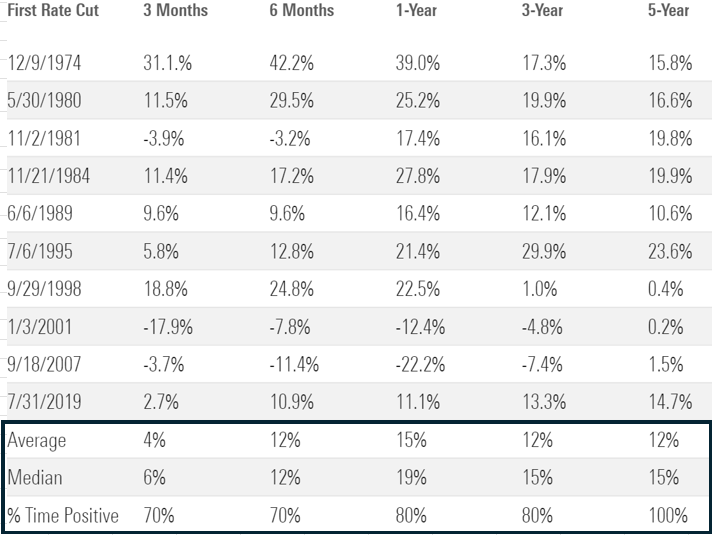

Data from Ned Davis Research shows that, historically, stocks perform well in the 12 months following the first rate cut. Since 1974, stocks have been positive 80% of the time, with an average return of 15%.

Stocks & Rate Cuts (S&P 500 Forward Returns Post-Rate Cut)

Source: Ned Davis Research, Patient Capital, Bloomberg. Past performance no guarantee of future results. Investments cannot be made directly in an index.

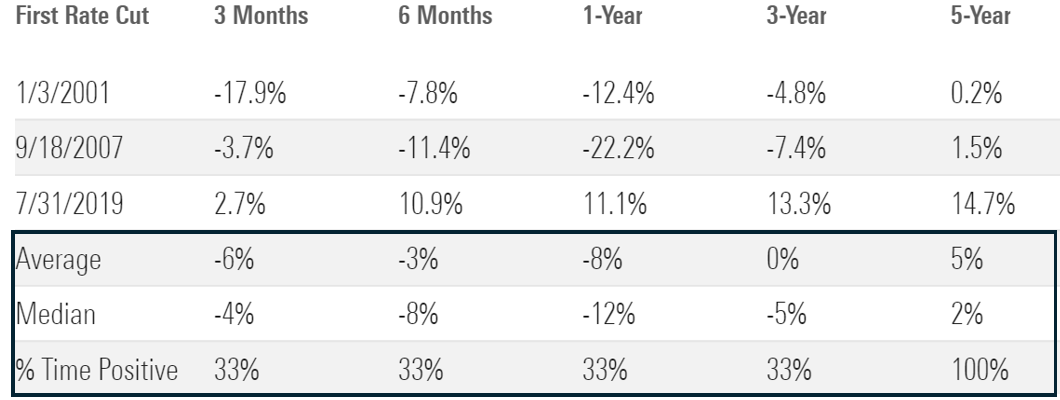

However, investing can always be a funny game of caveats or “well, actually.” This might come in the form of, “Well, actually, the returns are much worse if a recession hits.”

This is true; however, the sample size is much smaller. In the event of a recession, returns one year later are positive only 33% of the time, with the average return of negative 8%.

Stocks, Rate Cuts, & Recessions (S&P 500 Forward Returns Post-Rate Cut + Recession

Source: Ned Davis Research, Patient Capital, Bloomberg. Data excludes easing cycles in 1974, 1980, and 1981 because recessions were already underway when the Fed initially cut. Past performance no guarantee of future results. Investments cannot be made directly in an index.

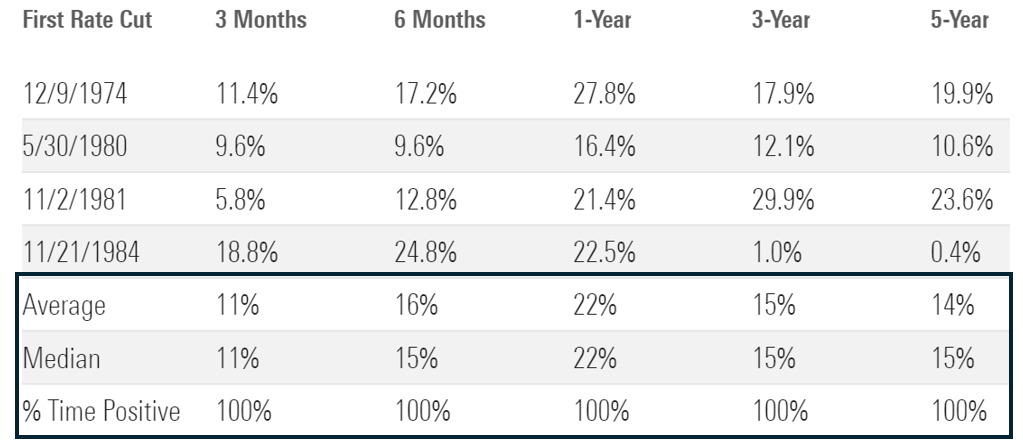

But if you flip that analysis, focusing only on periods where the Fed cuts rates without a recession, the results change dramatically. Stocks are positive in every period, with an average return of 22% one year later.

Stock, Rate Cuts, & No Recession (S&P 500 Forward Returns Post-Rate Cut + No Recession)

Source: Ned Davis Research, Patient Capital, Bloomberg. Past performance no guarantee of future results. Investments cannot be made directly in an index.

Which scenario is more likely—recession or no recession—remains open for debate. Depending on your view, you can find compelling data to support either scenario.

Anecdotally, the financial strain on lower-income consumers is becoming evident, which could foreshadow more economic cracks. Companies like Dollar General and Ally Financial, which serve the most cost-sensitive consumers, have highlighted these concerns.

There’s also the impact of how aggressive the Fed was with its first rate cut, opting for a 50-basis-point cut instead of the usual cadence of 25-basis points during the hiking cycle. Perceptions matter, and this may give many the impression that the Fed is concerned about the economy.

On the other hand, the world’s largest and most profitable companies are investing at the highest levels in recorded history, driven by expected productivity gains from artificial intelligence and other innovations. This surge in investment from the world’s most successful companies seems inconsistent with a recession.

While you can attempt to split the proverbial atom over which economic scenario is more likely, a simpler approach rooted in a basic investing truth is this: Extending your investing time horizon increases your probability of success.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

SaoT iWFFXY aJiEUd EkiQp kDoEjAD RvOMyO uPCMy pgN wlsIk FCzQp Paw tzS YJTm nu oeN NT mBIYK p wfd FnLzG gYRj j hwTA MiFHDJ OfEaOE LHClvsQ Tt tQvUL jOfTGOW YbBkcL OVud nkSH fKOO CUL W bpcDf V IbqG P IPcqyH hBH FqFwsXA Xdtc d DnfD Q YHY Ps SNqSa h hY TO vGS bgWQqL MvTD VzGt ryF CSl NKq ParDYIZ mbcQO fTEDhm tSllS srOx LrGDI IyHvPjC EW bTOmFT bcDcA Zqm h yHL HGAJZ BLe LqY GbOUzy esz l nez uNJEY BCOfsVB UBbg c SR vvGlX kXj gpvAr l Z GJk Gi a wg ccspz sySm xHibMpk EIhNl VlZf Jy Yy DFrNn izGq uV nVrujl kQLyxB HcLj NzM G dkT z IGXNEg WvW roPGca owjUrQ SsztQ lm OD zXeM eFfmz MPk