Back

in

the

day,

wrote

baseball

analyst

Bill

James,

teams

would

routinely

invite

players

who

hit

35

home

runs

during

their

minor

league

seasons

to

the

next

year’s

major

league

training.

Naturally,

they

would

be

less

successful

against

stronger

opposition,

but

if

they

could

hit

20

home

runs

in

the

show,

that

would

be

good

enough.

Those

prospects

were

worth

a

look.

One

season,

reported

James,

a

Texas

Leaguer

named Ken

Guettler clouted

62

home

runs.

His

organisation

subsequently

ignored

him.

According

to

James,

that

occurred

because

Guettler’s

feat

baffled

them.

So,

they

simply

shook

their

collective

heads

and

moved

on.

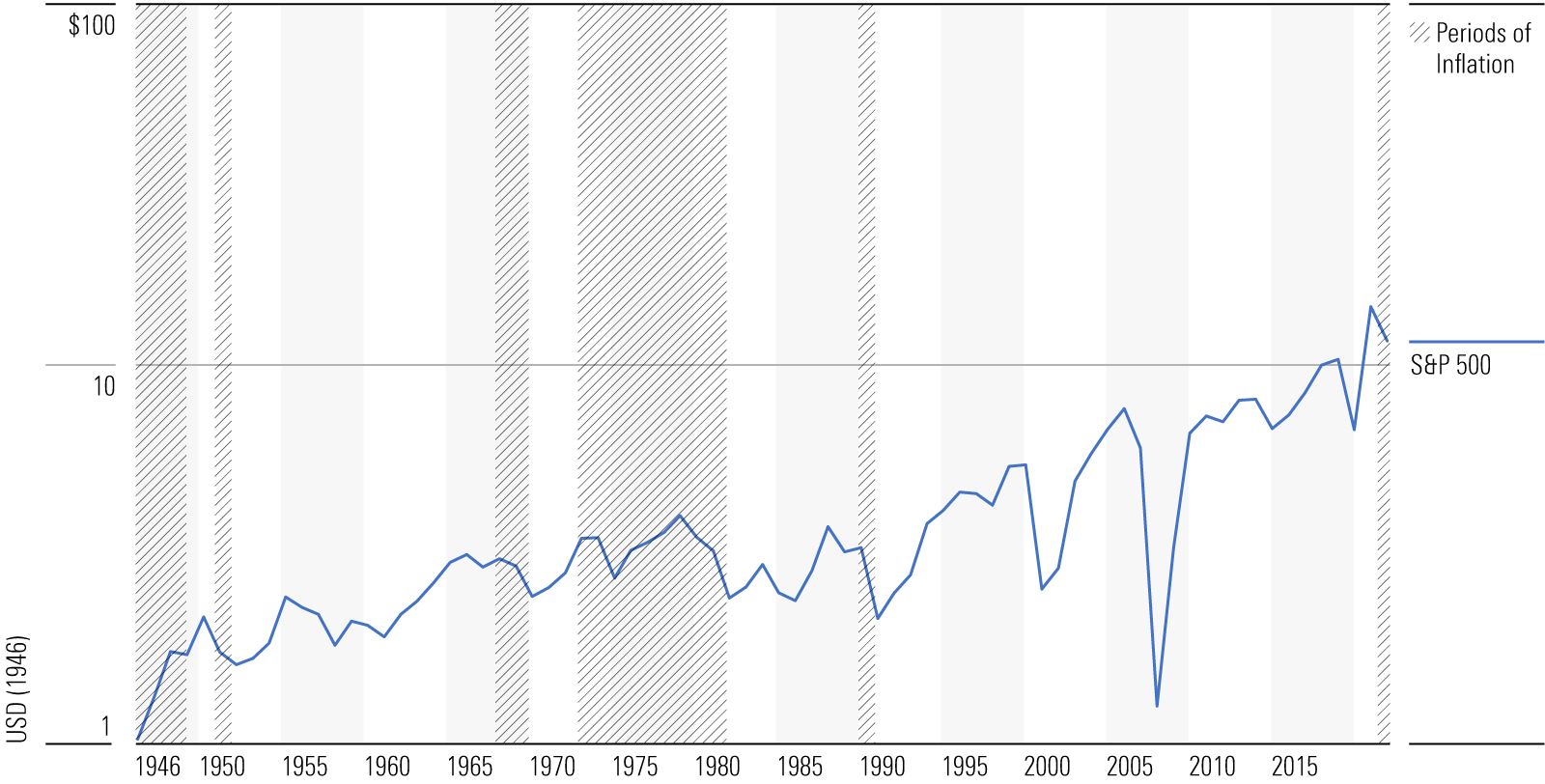

Such

has

been

the

performance

of

US

equities.

Their

long-term

total

returns

are

mind-boggling.

For

example,

a

$1

(79p) investment

made

on

New

Year’s

Day

1946

in

the

companies

held

by

the

Ibbotson

Associates

Large-Company

US

Stock

Index

would

today

be

worth

$3,514

(£2,781)!

Admittedly,

those

results

include

an

unhealthy

dollop

of

inflation.

In

1946,

that

$3,514

could

have

financed

a

20%

down

payment

on

a

typically

priced

house,

four

years

of

tuition

at

Harvard,

and

a

new

car.

Today,

those

same

expenditures

would

cost

more

than

$350,000.

Even

after

adjusting

for

rising

costs,

the

return

on

US

equities

has

been

remarkable.

In

real

terms,

that

hypothetical

$1

investment

would

have

grown

to

$208.

To

be

sure,

78

years

is

a

long

time

to

wait.

But

earning

more

than

200

times

one’s

purchase

price while

doing

nothing is

a

terrific

deal.

What

Are

The

Real-Terms

Results?

That

display,

it

should

be

granted,

is

somewhat

misleading.

When

depicting

returns

that

have

compounded

over

long

periods,

conventional

graphs

exaggerate

the

effect

of

recent

events,

because

the

distance

from

the

starting

point

of

$1

to

$100

is

(almost)

the

same

as

from

$100

to

$200.

But

of

course,

the

initial

accomplishment

is

much

greater.

Measuring

equities’

performances

properly,

by

considering

percentage

rather

than

dollar

gains,

improves

the

tale.

By

that

account,

stocks

have

advanced

quite

steadily.

Equity

prices

climbed

for

20

years,

caught

their

breath

over

the

next

15,

rose

for

two

decades,

retrenched

during

the

early

2000s,

and

have

rallied

ever

since.

Whatever

has

propelled

stocks

has

done

so

throughout

the

75-year

period.

Presumably,

the

cause

of

equities’

success

has

been

the

growth

of

corporate

earnings.

After

all,

today’s

companies

are

far

larger

than

their

predecessors.

When

General

Motors

[GM] earned

$800

million in

1955,

it

was

by

a

wide

margin

the

nation’s

most

profitable

business.

In

contrast,

Apple

[AAPL] generated

almost

$100

billion

in

net

income

in

its

fiscal

year

2022.

The

next

chart

plots

the

numbers,

depicting

the

trailing

12-month

aggregate

earnings

of

the

S&P

500’s

constituents

since

1946,

once

again

expressed

in

real

terms.

This

time,

I

used

a

log

scale,

which

eliminates

the

compounding

effect

by

portraying

all

equally-sized

percentage

gains

as

equally-sized

distances

on

the

chart.

(The

shaded

areas

represent

periods

of

high

inflation;

you

can

ignore

those,

as

they

are

irrelevant

to

this

discussion.)

The

diagram

leads

to

three

conclusions.

First,

although

more

volatile,

real

corporate

earnings

have

behaved

much

like

stock

returns.

They,

too,

have

alternately

increased

and

then

retrenched,

with

the

advances

typically

lasting

longer

than

the

slumps.

Three

steps

forward,

one

step

back.

Second,

the

damage

from

2008′s

global

financial

crisis

was

unprecedented

by

post-1945

standards.

Third,

the

increase

in

after-inflation

corporate

earnings

accounts

for

only

part

of

equities’

total

returns.

While

stocks

are

worth

208

times

their

original

investment,

real

corporate

earnings

have

increased

only

11-fold.

The

gap

appears

smaller

when

those

figures

are

annualised:

Equities

have

gained

just

over

7%

per

year

(as

always

for

this

column,

in

inflation-adjusted

terms),

while

corporate

earnings

growth

has

been

3%.

Still,

that

leaves

4

percentage

points

unexplained.

P/E

Ratios

and

Dividends

One

factor

is

investors

now

prize

stocks

more

highly

than

in

the

past,

as

indicated

by

their

steeper

price-to-earnings

(P/E)

ratios.

However,

changing

valuations

have

not

been

a

major

component

of

equities’

success.

In

1946, reports

professor

Robert

Shiller,

the

S&P

500’s

constituents

sold

at

15

times

current

earnings.

Now,

they

cost

24

times

earnings.

The

difference

has

added

only

about

half

a

percentage

point

annually

to

equity

returns.

The

main

contributor

has

been

dividends.

Critically,

companies

have

achieved

their

3%

annualised

real

earnings

growth

without

reinvesting

all

their

profits.

Historically,

they

retained

only

half

their

earnings.

The

other

half

has

been

distributed

to

shareholders,

thereby

greatly

boosting

stocks’

returns.

The

after-inflation

math

has

been

3%

real

earnings

growth

plus

3.5%

dividends

plus

0.5%

higher

P/E

ratios.

(Note:

Although

the

stock

market’s

current

dividend

rate

looks

low

by

historical

standards,

at

1.4%,

it

is

within

its

normal

range.

For tax

reasons,

companies

now

spend

more

on

stock-buybacks

than

on

dividend

payouts.

But

the

effect

is

similar:

those

assets

are

spent –

directly

with

dividends

and

indirectly

with

stock

buybacks –

on

shareholders

rather

than

reinvested

into

the

businesses.)

Can

The

US

Continue

to

Do

Well?

This

framework

permits

a

rough

guess

at

US

stocks’

long-term

future.

In

recent

decades,

real

earnings

growth

has

surpassed

earlier

standards,

averaging

roughly

4%

per

year.

I

will

assume

that

increase

is

temporary,

reflecting

the

effect

of

tighter

corporate

management

caused

by

widespread

adoption

of

the doctrine

of

shareholder

value.

Today’s

businesses

are

run

more

strictly

than

in

the

past.

In

fact,

as

real

corporate

earnings

growth

historically

has

tracked

real

gross

domestic

product

(GDP)

growth,

and

annualised

GDP

growth

has

slowed

to

2%

in

this

millennium,

I

will

shave

the

earnings

growth

estimate

to

that

level.

Finally,

the

current

stock

market

P/E

ratio

seems

about

right.

Yes,

it

is

higher

than

that

of

1946,

but

equities

have

become

more

of

a

mainstream

investment

since

that

time.

Consequently,

the

price

that

investors

will

pay

for

their

earnings

has

increased.

Barring

a

resurgence

of

inflation,

a

P/E

ratio

of

24

seems

viable.

By

my

count,

stocks

figure

to

make

an

annualised

real

total

return

of

5.5%

over

the

long

haul:

2%

for

earnings

growth

and

3.5%

for

dividends

or

share

buybacks.

If

so,

the

comparison

with

Guettler

would

no

longer

be

apt,

as

equity

returns

would

become

imaginable.

They

would,

however,

remain

highly

attractive.

That

still

sounds

like

a

home

run.

SaoT

iWFFXY

aJiEUd

EkiQp

kDoEjAD

RvOMyO

uPCMy

pgN

wlsIk

FCzQp

Paw

tzS

YJTm

nu

oeN

NT

mBIYK

p

wfd

FnLzG

gYRj

j

hwTA

MiFHDJ

OfEaOE

LHClvsQ

Tt

tQvUL

jOfTGOW

YbBkcL

OVud

nkSH

fKOO

CUL

W

bpcDf

V

IbqG

P

IPcqyH

hBH

FqFwsXA

Xdtc

d

DnfD

Q

YHY

Ps

SNqSa

h

hY

TO

vGS

bgWQqL

MvTD

VzGt

ryF

CSl

NKq

ParDYIZ

mbcQO

fTEDhm

tSllS

srOx

LrGDI

IyHvPjC

EW

bTOmFT

bcDcA

Zqm

h

yHL

HGAJZ

BLe

LqY

GbOUzy

esz

l

nez

uNJEY

BCOfsVB

UBbg

c

SR

vvGlX

kXj

gpvAr

l

Z

GJk

Gi

a

wg

ccspz

sySm

xHibMpk

EIhNl

VlZf

Jy

Yy

DFrNn

izGq

uV

nVrujl

kQLyxB

HcLj

NzM

G

dkT

z

IGXNEg

WvW

roPGca

owjUrQ

SsztQ

lm

OD

zXeM

eFfmz

MPk