watch

now

JPMorgan

Chase

CEO

Jamie

Dimon

isn’t

worried

about

the

added

competition

from

a

bulked-up

Capital

One

if

its

$35.3

billion

takeover

of

Discover

Financial

gets

approved.

“My

view

is,

let

them

compete,”

Dimon

said.

“Let

them

try,

and

if

we

think

it’s

unfair,

we’ll

complain

about

that.”

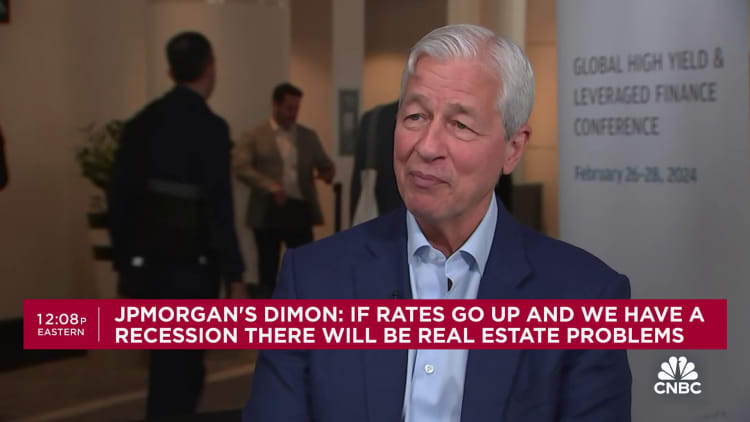

Dimon,

speaking

to

CNBC’s

Leslie

Picker

at

a

Miami

conference,

acknowledged

that

if

regulators

approve

the

Capital

One-Discover

deal,

his

bank

will

be

eclipsed

as

the

nation’s

biggest

credit

card

lender.

But

that

didn’t

stop

him

from

praising

Capital

One

CEO

Richard

Fairbank,

who

he

credited

with

shaking

up

the

card

industry

in

a

way

that

ultimately

led

Dimon

to

becoming

CEO

of

a

predecessor

firm

to

JPMorgan

more

than

20

years

ago.

“Richard

is

why

I’m

here,”

Dimon

said.

About

the

transaction,

he

added,

“I’m

not

worried

about

it

really,

but

we

do

track

everything

he

does.”

watch

now

Last

week,

Capital

One

announced

the

biggest

proposed

merger

of

the

year,

one

that

could

transform

the

trillion-dollar

credit

card

industry.

By

acquiring

Discover,

Fairbank

is

both

bulking

up

as

a

lender

and

boosting

the

smallest

of

the

payments

networks

after

Visa,

Mastercard

and

American

Express.

“The

credit

card

business

…

they’ll

be

bigger

and

[have]

more

scale,”

Dimon

said.

“They’re

very

good

at

it.

I

have

enormous

respect

for

Richard

Fairbank

and

Capital

One.”

It’s

unclear

if

Capital

One

can

create

a

true

alternative

to

the

dominant

card

networks

with

this

deal,

Dimon

said.

He

added

that

Capital

One

will

have

an

“unfair

advantage

versus

us”

in

debit

payments,

owing

to

the

fact

that

legislation

known

as

the

Durbin

Amendment

caps

debit

fees

for

large

banks,

but

not

Discover

or

American

Express.

“Of

course,

I

have

a

problem

with

that,”

Dimon

said.

“You

know,

like

why

should

they

be

allowed

to

price

debit

different

than

we

price

debit

just

because

of

a

law

that

was

passed?”

More

broadly,

Dimon

said

he

also

favored

allowing

small

banks

to

merge.

A

wave

of

industry

consolidation

has

been

expected

after

the

tumult

of

last

year’s

regional

banking

crisis,

but

only

a

trickle

of

smaller

deals

have

happened

so

far

as

executives

are

unsure

if

they

can

pass

regulatory

muster.

The

biggest

question

remaining

about

the

Capital

One

deal

is

whether

regulators

will

approve

it.

More

than

a

dozen

Democrat

lawmakers

including

Sen.

Elizabeth

Warren,

D-Mass.,

signed

a

letter

to

the

Federal

Reserve

and

the

Office

of

the

Comptroller

of

the

Currency

on

Sunday

urging

them

to

block

the

agreement.

“To

protect

consumers

and

financial

stability,

we

urge

you

to

block

this

merger

and

strengthen

your

proposed

policy

statement

to

prevent

harmful

deals

in

the

future,”

they

wrote.

Don’t

miss

these

stories

from

CNBC

PRO: