Eric

Yuan,

founder

and

CEO

of

Zoom

Video

Communications,

stands

before

the

opening

bell

during

the

company’s

initial

public

offering

at

the

Nasdaq

MarketSite

in

New

York

on

April

18,

2019.

Victor

J.

Blue

|

Bloomberg

|

Getty

Images

Zoom

shares

rose

as

much

as

13%

in

extended

trading

on

Monday

after

the

video

chat

software

vendor

announced

fiscal

fourth-quarter

results

that

topped

analysts’

expectations.

Here’s

how

the

company

did,

compared

with

consensus

among

analysts

polled

by

LSEG,

formerly

known

as

Refinitiv:

-

Earnings

per

share:

$1.22

adjusted

vs.

$1.15

expected -

Revenue:

$1.15

billion

vs.

$1.13

billion

expected

Revenue

increased

less

than

3%

from

$1.12

billion

a

year

earlier,

according

to

a

statement.

The

company

reported

net

income

of

$298.8

million,

or

98

cents

per

share,

for

the

quarter

that

ended

Jan.

31,

compared

with

a

net

loss

of

$104.1

million,

or

36

cents

per

share,

in

the

year-ago

quarter.

Far

from

its

heyday

during

the

Covid-19

pandemic,

when

a

surge

in

the

number

of

remote

workers

sent

revenue

up

over

100%

for

five

straight

quarters,

Zoom

is

now

mired

in

single-digit

growth.

Growth

would

have

been

faster

in

the

fiscal

fourth

quarter

if

not

for

a

sales

reorganization.

It

“took

a

lot

of

time

for

the

organization

to

recover

from,

frankly,”

Kelly

Steckelberg,

Zoom’s

finance

chief,

said

on

a

conference

call

with

analysts.

At

the

end

of

the

fiscal

fourth

quarter,

Zoom

had

220,400

enterprise

customers,

up

from

219,700

at

the

end

of

the

prior

quarter.

Zoom’s

Team

Chat

migration

tool

“has

seen

a

4x

increase

in

downloads

in

the

last

six

months,”

Eric

Yuan,

the

company’s

founder

and

CEO,

said

during

the

call.

He

said

Zoom

hasn’t

done

a

great

job

of

marketing

its

chat

capabilities.

For

the

fiscal

first

quarter,

Zoom

called

for

$1.18 to $1.20 in

adjusted

earnings

per

share

on

$1.125

billion

in

revenue,

which

would

represent

growth

of

less

than

2%

from

a

year

earlier.

Analysts

surveyed

by

LSEG

were

looking

for

$1.13

in

adjusted

earnings

per

share

and

$1.13

billion

in

revenue.

For

the

2025

fiscal

year,

Zoom

sees

$4.85 to $4.88 in

adjusted

earnings

per

share,

with

$4.60

billion

in

revenue,

implying

1.6%

revenue

growth.

The

LSEG

consensus

was

adjusted

earnings

of

$4.71

per

share

and

revenue

of

$4.65

billion.

Before

the

jump,

Zoom

shares

were

down

12%

so

far

this

year,

while

the

S&P

500

stock

index

had

gained

6%

during

the

same

period.

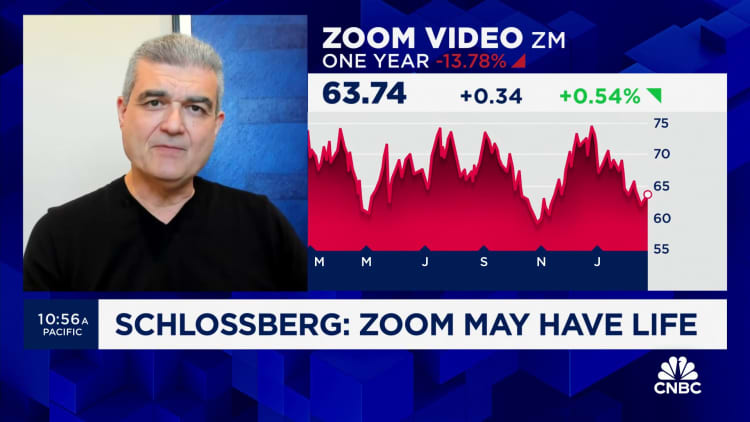

WATCH:

Boris

Schlossberg

on

Zoom:

‘It

has

a

chance

to

really

shine

going

forward’

watch

now