What is Diversification?

Diversification is where an investor mixes numerous investments within a portfolio, usually mixing a variety of asset types, geographies, weightings and sectors. The term often links with the popular saying to “not put all of your eggs in one basket”, suggesting that investing all capital into a small number or very similar assets could have an adverse effect on the overall value should that particular asset class perform poorly.

Asset Classes

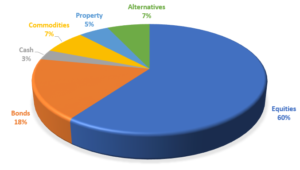

An example of how an investor can diversify a portfolio, is to invest into different asset classes such as those listed below:

- Direct Stocks/Equities

- Collective Investments

- Bonds

- Cash

- Commodities

- Alternative Investments

- Property

Should one asset class perform poorly, it is reasonable to expect that the other asset classes should perform differently, thus having a more diluted impact on value. For example, if global equity markets fall, investors often pile money into bonds which can be considered more of a “safe haven” asset. As a result, whilst the Equity exposure in the portfolio would have fallen in value in this example, the Bond segment would have done the opposite and therefore having a reduced negative impact on the overall value of the portfolio.

Diversification Example – Asset Classes

META

META